FANGDD NETWORK GROUP LTD. (DUO): Price and Financial Metrics

DUO Price/Volume Stats

| Current price | $0.45 | 52-week high | $3.75 |

| Prev. close | $0.46 | 52-week low | $0.35 |

| Day low | $0.44 | Volume | 72,777 |

| Day high | $0.47 | Avg. volume | 1,833,034 |

| 50-day MA | $0.67 | Dividend yield | N/A |

| 200-day MA | $0.64 | Market Cap | 2.08M |

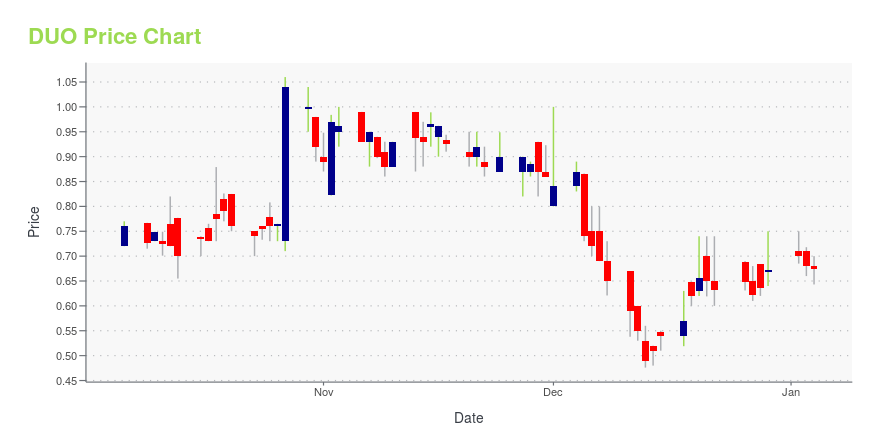

DUO Stock Price Chart Interactive Chart >

FANGDD NETWORK GROUP LTD. (DUO) Company Bio

Fangdd Network Group Ltd. is a proptech company. It engages in the operation and provision of an online real estate marketplace. The company was founded by Yi Duan, Xi Zeng and Jiancheng Li in October 2011 and is headquartered in Shenzhen, China.

Latest DUO News From Around the Web

Below are the latest news stories about FANGDD NETWORK GROUP LTD that investors may wish to consider to help them evaluate DUO as an investment opportunity.

FangDD Announces Management and Board ChangesSHENZHEN, China, Nov. 02, 2023 (GLOBE NEWSWIRE) -- Fangdd Network Group Ltd. (Nasdaq: DUO) (“FangDD” or the “Company”), a customer-oriented property technology company in China, today announced the resignation of Ms. Li Xiao as a member of the Company’s board of directors (the “Board”) and Vice President of the Company, effective November 2, 2023. Ms. Xiao’s resignation was for personal reasons and was not due to any disagreement with the Board, the Company or any of its affiliates on any matter |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on MondayIt's time to dive into the biggest pre-market stock movers as we start the trading week on Monday with the hottest coverage! |

FangDD Reports First Half 2023 Unaudited Financial ResultsSHENZHEN, China, Aug. 25, 2023 (GLOBE NEWSWIRE) -- Fangdd Network Group Ltd. (NASDAQ: DUO) (“FangDD” or “the Company”), a customer-oriented property technology company in China, today announced its unaudited financial results for the six months ended June 30, 2023. First Half 2023 Financial Highlights Revenue for the six months ended June 30, 2023 slightly increased by 6.0% to RMB153.5 million (US$21.2 million) from RMB144.8 million for the same period of 2022.Net income for the six months ended |

FangDD Regains Compliance with Nasdaq Minimum Bid Price RequirementSHENZHEN, China, Aug. 21, 2023 (GLOBE NEWSWIRE) -- Fangdd Network Group Ltd. (“FangDD” or the “Company”) (Nasdaq: DUO) today announced that the Company had received a notification letter (“Compliance Notice”) from the Nasdaq Stock Market LLC (“Nasdaq”), dated August 18, 2023, indicating that the Company has regained compliance with the minimum bid price requirement set forth under the Nasdaq Listing Rule 5450(a)(1) (the “Minimum Bid Price Requirement”). As previously announced, the Company was n |

Why Is Aravive (ARAV) Stock Down 58% Today?Aravive (ARAV) stock is plummeting on Thursday morning following the release of negative results from a Phase 3 clinical trial. |

DUO Price Returns

| 1-mo | -18.18% |

| 3-mo | 12.61% |

| 6-mo | -22.63% |

| 1-year | -81.24% |

| 3-year | -99.89% |

| 5-year | N/A |

| YTD | -33.14% |

| 2023 | -94.17% |

| 2022 | -88.97% |

| 2021 | -93.83% |

| 2020 | -51.42% |

| 2019 | N/A |

Loading social stream, please wait...