EMX Royalty Corporation (EMX): Price and Financial Metrics

EMX Price/Volume Stats

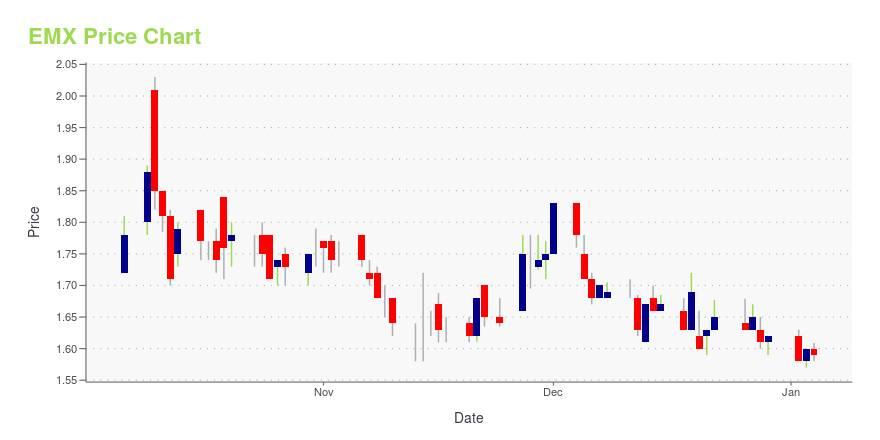

| Current price | $1.79 | 52-week high | $2.15 |

| Prev. close | $1.82 | 52-week low | $1.41 |

| Day low | $1.78 | Volume | 213,201 |

| Day high | $1.84 | Avg. volume | 290,276 |

| 50-day MA | $1.89 | Dividend yield | N/A |

| 200-day MA | $1.75 | Market Cap | 203.21M |

EMX Stock Price Chart Interactive Chart >

EMX Royalty Corporation (EMX) Company Bio

EMX Royalty Corporation, a precious and base metals royalty company, engages in the acquisition, exploration, and evaluation of metals and mineral properties. It explores for gold, silver, copper, molybdenum, lead, zinc, nickel, cobalt, volcanogenic massive sulfide, and iron deposits. The company's royalty and exploration portfolio primarily consist of properties in North America, Turkey, Europe, Haiti, Australia, and New Zealand, as well as in Norway. The company was formerly known as Eurasian Minerals Inc. and changed its name to EMX Royalty Corporation in July 2017. EMX Royalty Corporation is headquartered in Vancouver, Canada.

Latest EMX News From Around the Web

Below are the latest news stories about EMX ROYALTY CORP that investors may wish to consider to help them evaluate EMX as an investment opportunity.

EMX Royalty Announces Third Quarter 2023 ResultsVancouver, British Columbia--(Newsfile Corp. - November 13, 2023) - EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (FSE: 6E9) (the "Company" or "EMX") is pleased to report results for the quarter ended September 30, 2023 ("Q3-2023"). The Company's filings for the quarter are available on SEDAR at www.sedarplus.ca, on the U.S. Securities and Exchange Commission's website at www.sec.gov, and on EMX's website at www.EMXroyalty.com. Financial results were prepared in accordance with Intern |

EMX Receives Q3 Royalty Payment from EsanVancouver, British Columbia--(Newsfile Corp. - November 9, 2023) - EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (FSE: 6E9) (the "Company" or "EMX") is pleased to announce the receipt of US$356,718 in Q3 royalty proceeds from its Balya North royalty property in Türkiye, which is operated by Esan Eczacibaşi Endüstriyel Hammaddeler San. ve Tic. A.Ş. ("Esan"), a private Turkish company. EMX holds an uncapped 4% net smelter return ("NSR") royalty on metals production from Balya ... |

EMX Provides an Update for the Hardshell Royalty Property Included Within the Hermosa Project in ArizonaVancouver, British Columbia--(Newsfile Corp. - October 2, 2023) - EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (FSE: 6E9) (the "Company" or "EMX") is pleased to provide an update for EMX's Hardshell royalty property, which is part of South32 Limited's ("South32") Hermosa Project in southeast Arizona. Recent drill results from the Peake prospect, which is partially covered by the Hardshell royalty, include the best intercept to date in hole HDS-813 reported as 139 meters ... |

EMX Options Its Copperhole Creek Polymetallic Project in Australia to Lumira Energy Ltd.Vancouver, British Columbia--(Newsfile Corp. - September 13, 2023) - EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (FSE: 6E9) (the "Company" or "EMX") is pleased to announce the execution of an option agreement for EMX's Copperhole Creek polymetallic project in Queensland, Australia (the "Project") (see Figure 1) to Lumira Energy Ltd. ("Lumira"), a private Australian Company. The agreement provides EMX with a 2.5% Net Smelter Return ("NSR") royalty interest, cash and equity payments, |

EMX Receives Initial Royalty Payment from ZijinVancouver, British Columbia--(Newsfile Corp. - September 12, 2023) - EMX Royalty Corporation (NYSE American: EMX) (TSXV: EMX) (FSE: 6E9) (the "Company" or "EMX") is pleased to announce the receipt of $6,675,947 in royalty proceeds from its Timok royalty property with Zijin (Europe) International Mining Company Ltd., a wholly owned subsidiary of Zijin Mining Group Ltd ("Zijin"). EMX and Zijin recently agreed to an amended and restated royalty agreement that covers Zijin's Brestovac exploration pe |

EMX Price Returns

| 1-mo | 0.28% |

| 3-mo | -6.77% |

| 6-mo | 18.54% |

| 1-year | -2.19% |

| 3-year | -34.43% |

| 5-year | 29.71% |

| YTD | 10.49% |

| 2023 | -14.29% |

| 2022 | -16.74% |

| 2021 | -32.24% |

| 2020 | 104.07% |

| 2019 | 45.27% |

Continue Researching EMX

Want to see what other sources are saying about EMX Royalty Corp's financials and stock price? Try the links below:EMX Royalty Corp (EMX) Stock Price | Nasdaq

EMX Royalty Corp (EMX) Stock Quote, History and News - Yahoo Finance

EMX Royalty Corp (EMX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...