Enovix Corporation (ENVX): Price and Financial Metrics

ENVX Price/Volume Stats

| Current price | $14.64 | 52-week high | $23.90 |

| Prev. close | $14.55 | 52-week low | $5.70 |

| Day low | $14.36 | Volume | 3,483,500 |

| Day high | $15.09 | Avg. volume | 5,350,507 |

| 50-day MA | $13.40 | Dividend yield | N/A |

| 200-day MA | $10.80 | Market Cap | 2.49B |

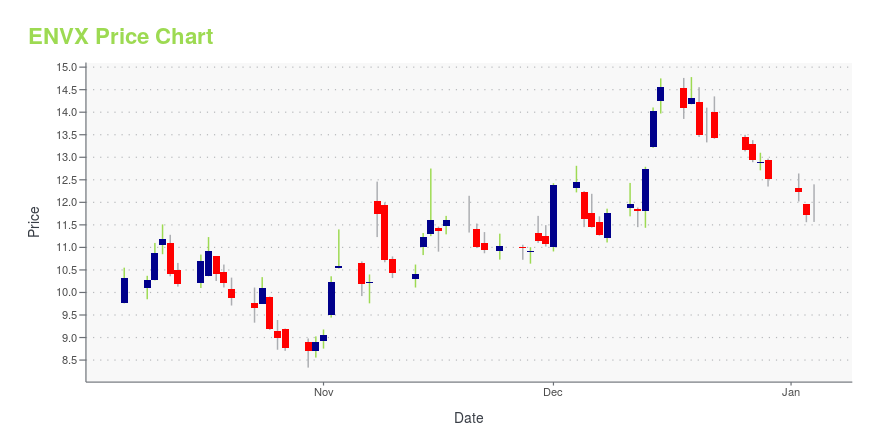

ENVX Stock Price Chart Interactive Chart >

Enovix Corporation (ENVX) Company Bio

Enovix Corporation develops and manufactures 3D silicon lithium-ion batteries. Its lithium-ion battery uses 3D cell architecture and silicon anode to increase energy density and maintain high cycle life. The company has strategic partnerships with Cypress Semiconductor, Intel Corporation, and Qualcomm. Enovix Corporation was formerly known as MicroAzure Corp. The company was founded in 2006 and is based in Fremont, California. It has production plants in Fremont, California; and Manila, the Philippines.

Latest ENVX News From Around the Web

Below are the latest news stories about ENOVIX CORP that investors may wish to consider to help them evaluate ENVX as an investment opportunity.

7 Solid Small-Caps for 2024 and BeyondSmall-cap stocks are positioned to beat the biggest companies in 2024 as risk tolerance climbs and shares remain undervalued |

2024’s Hidden Gems: 7 Small-Caps Set for Explosive GrowthSmall-cap stocks outperform larger companies on an indexed basis, but finding the best among them individually isn't always easy |

Enovix President and CEO Dr. Raj Talluri Receives Executive of the Year BIG Award for BusinessDr. Raj Talluri, President and CEO of Enovix Enovix President and CEO Dr. Raj Talluri Receives Executive of the Year BIG Award for Business FREMONT, Calif., Nov. 22, 2023 (GLOBE NEWSWIRE) -- Enovix Corporation (“Enovix”) (Nasdaq: ENVX), an advanced silicon battery company, today announced that its President and CEO, Dr. Raj Talluri, has received the Business Intelligence Group’s BIG Award for Business in the “Executive of the Year” category. The organization’s annual program rewards companies, p |

Recent uptick might appease Enovix Corporation (NASDAQ:ENVX) institutional owners after losing 5.1% over the past yearKey Insights Significantly high institutional ownership implies Enovix's stock price is sensitive to their trading... |

Enovix Named CES 2024 Innovation Awards HonoreeFREMONT, Calif., Nov. 16, 2023 (GLOBE NEWSWIRE) -- Enovix Corporation (“Enovix”) (Nasdaq: ENVX), an advanced silicon battery company, today announced it has been named a CES® 2024 Innovation Awards Honoree for its pioneering BrakeFlow™ safety technology. The announcement of award winners was made ahead of CES 2024 in Las Vegas, NV, the world’s most powerful technology event. The CES Innovation Awards program, owned and produced by the Consumer Technology Association (CTA)®, is an annual competit |

ENVX Price Returns

| 1-mo | -2.59% |

| 3-mo | 126.63% |

| 6-mo | 51.55% |

| 1-year | -21.46% |

| 3-year | -5.97% |

| 5-year | N/A |

| YTD | 16.93% |

| 2023 | 0.64% |

| 2022 | -54.40% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...