Energy Recovery, Inc. (ERII): Price and Financial Metrics

ERII Price/Volume Stats

| Current price | $14.91 | 52-week high | $30.70 |

| Prev. close | $14.84 | 52-week low | $12.26 |

| Day low | $14.70 | Volume | 258,440 |

| Day high | $15.23 | Avg. volume | 425,320 |

| 50-day MA | $13.59 | Dividend yield | N/A |

| 200-day MA | $15.77 | Market Cap | 854.79M |

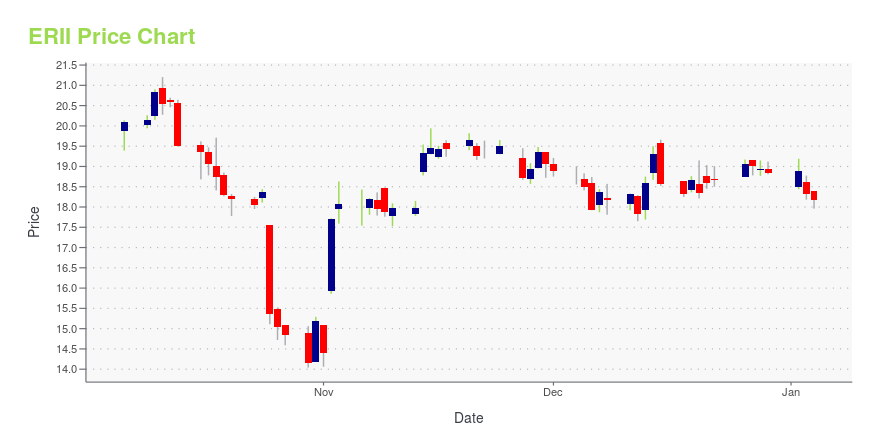

ERII Stock Price Chart Interactive Chart >

Energy Recovery, Inc. (ERII) Company Bio

Energy Recovery, Inc. designs, develops, and manufactures energy recovery devices (ERDs) to transform untapped energy into reusable energy from industrial fluid flows and pressure cycles. The company was founded in 1992 and is based in San Leandro, California.

Latest ERII News From Around the Web

Below are the latest news stories about ENERGY RECOVERY INC that investors may wish to consider to help them evaluate ERII as an investment opportunity.

Are Energy Recovery, Inc.'s (NASDAQ:ERII) Mixed Financials Driving The Negative Sentiment?It is hard to get excited after looking at Energy Recovery's (NASDAQ:ERII) recent performance, when its stock has... |

Estimating The Intrinsic Value Of Energy Recovery, Inc. (NASDAQ:ERII)Key Insights Using the 2 Stage Free Cash Flow to Equity, Energy Recovery fair value estimate is US$18.14 Energy... |

Energy Recovery, Inc. (NASDAQ:ERII) Q3 2023 Earnings Call TranscriptEnergy Recovery, Inc. (NASDAQ:ERII) Q3 2023 Earnings Call Transcript November 1, 2023 Operator: Greetings. Welcome to the Energy Recovery 3Q 2023 Earnings Call. At this time, all participants are in a listen-only mode. A question-and-answer session will follow the formal presentation. [Operator Instructions] Please note this conference is being recorded. I will now turn the […] |

Energy Recovery Inc (ERII) Reports 22% YoY Quarterly Revenue Growth in Q3 2023Company's net income doubles, beating estimates |

Energy Recovery Achieves 22% Year-on-Year Quarterly Revenue Growth, Beating GuidanceSAN LEANDRO, Calif., November 01, 2023--Energy Recovery, Inc. (Nasdaq:ERII) ("Energy Recovery" or the "Company") today announced its financial results for the third quarter and nine months ended September 30, 2023. |

ERII Price Returns

| 1-mo | 15.14% |

| 3-mo | 5.00% |

| 6-mo | -7.74% |

| 1-year | -49.76% |

| 3-year | -27.20% |

| 5-year | 31.71% |

| YTD | -20.86% |

| 2023 | -8.05% |

| 2022 | -4.65% |

| 2021 | 57.55% |

| 2020 | 39.33% |

| 2019 | 45.47% |

Continue Researching ERII

Want to do more research on Energy Recovery Inc's stock and its price? Try the links below:Energy Recovery Inc (ERII) Stock Price | Nasdaq

Energy Recovery Inc (ERII) Stock Quote, History and News - Yahoo Finance

Energy Recovery Inc (ERII) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...