Ero Copper Corp. (ERO): Price and Financial Metrics

ERO Price/Volume Stats

| Current price | $14.21 | 52-week high | $23.40 |

| Prev. close | $14.41 | 52-week low | $9.30 |

| Day low | $14.18 | Volume | 649,200 |

| Day high | $14.59 | Avg. volume | 549,166 |

| 50-day MA | $14.96 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 1.47B |

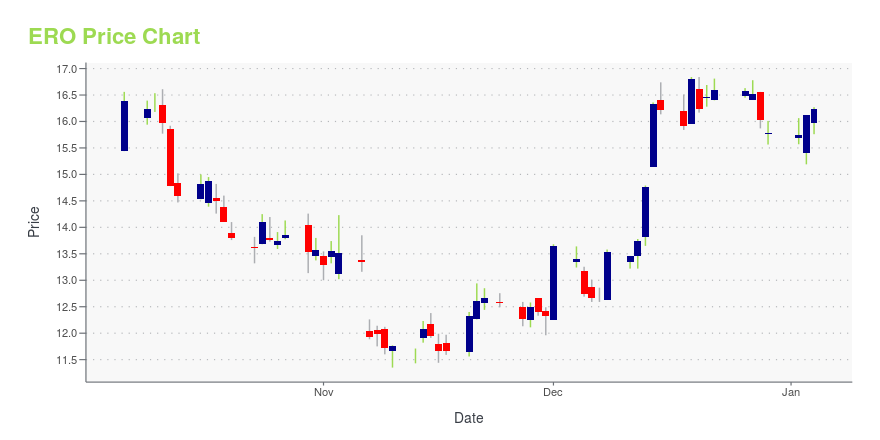

ERO Stock Price Chart Interactive Chart >

Ero Copper Corp. (ERO) Company Bio

Ero Copper Corp. engages in the exploration, development, and mining of mineral properties in Brazil. It also produces and sells copper, gold, silver products. The company was founded on May 16, 2016 and is headquartered in Vancouver, Canada.

ERO Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -27.54% |

| 3-year | 60.38% |

| 5-year | 12.24% |

| YTD | 5.42% |

| 2024 | -14.63% |

| 2023 | 14.84% |

| 2022 | -10.07% |

| 2021 | -5.73% |

| 2020 | N/A |

Loading social stream, please wait...