ESAB Corporation (ESAB): Price and Financial Metrics

ESAB Price/Volume Stats

| Current price | $99.97 | 52-week high | $114.77 |

| Prev. close | $99.42 | 52-week low | $61.43 |

| Day low | $99.30 | Volume | 279,737 |

| Day high | $101.15 | Avg. volume | 254,485 |

| 50-day MA | $98.26 | Dividend yield | 0.32% |

| 200-day MA | $92.19 | Market Cap | 6.04B |

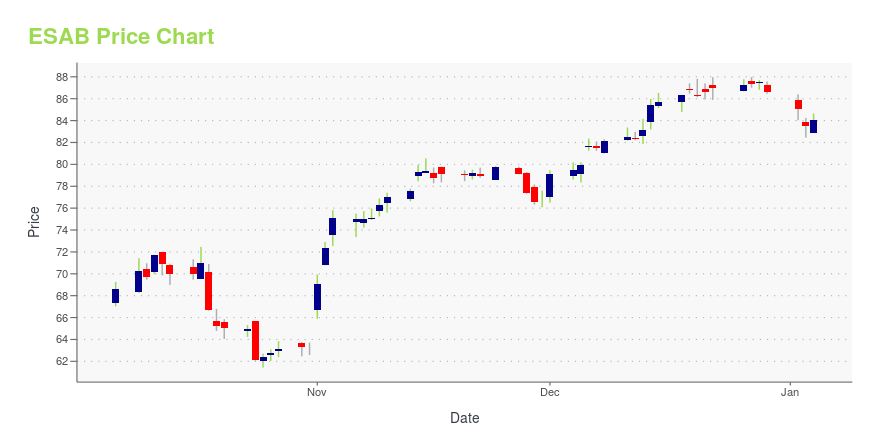

ESAB Stock Price Chart Interactive Chart >

ESAB Corporation (ESAB) Company Bio

ESAB Corporation formulates, develops, manufactures, and supplies consumable products and equipment for use in cutting, joining, and automated welding, as well as gas control equipment. Its comprehensive range of welding consumables includes electrodes, cored and solid wires, and fluxes using a range of specialty and other materials; and cutting consumables, including electrodes, nozzles, shields, and tips. The company's fabrication technology equipment ranges from portable welding machines to large customized automated cutting and welding systems. It also offers a range of digital software and solutions to help its customers increase their productivity, remotely monitor their welding operations, and digitize their documentation. The company sells its products under the ESAB brand to various end markets, including general industry, construction, infrastructure, transportation, energy, renewable energy, and medical and life sciences. It offers its products through independent distributors and direct salespeople. ESAB Corporation was incorporated in 2021 and is based in Wilmington, Delaware.

Latest ESAB News From Around the Web

Below are the latest news stories about ESAB CORP that investors may wish to consider to help them evaluate ESAB as an investment opportunity.

Zacks Industry Outlook Highlights Norsk Hydro ASA, AB SKF, ESAB, Century Aluminum and TriMasZacks Industry Outlook Highlights Norsk Hydro ASA, AB SKF, ESAB, Century Aluminum and TriMas |

5 Metal Fabrication Stocks to Watch in a Challenging IndustryLow order levels cloud the near-term prospects of the Zacks Metal Products - Procurement and Fabrication industry. However, the likes of NHYDY, SKFRY, ESAB, CENX and TRS seem well-poised to tide over the hurdles. |

ESAB Corp CEO Shyam Kambeyanda Sells 6,702 Shares: An Analysis of Insider Activity and Stock ...Shyam Kambeyanda, the President and CEO of ESAB Corp, has recently made a significant sale of company shares, according to regulatory filings. |

Insider Sell Alert: ESAB Corp's Michele Campion Unloads SharesIn the realm of stock market movements, insider trading activity is often a significant indicator for investors. |

ESAB Corporation Board Declares DividendNORTH BETHESDA, Md., December 06, 2023--ESAB Corporation Board Declares Dividend |

ESAB Price Returns

| 1-mo | 4.78% |

| 3-mo | -7.24% |

| 6-mo | 15.95% |

| 1-year | 48.47% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | 15.57% |

| 2023 | 85.23% |

| 2022 | N/A |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

ESAB Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...