Empire State Realty OP, L.P. Series ES Operating Partnership Limited Partnership Interests (ESBA): Price and Financial Metrics

ESBA Price/Volume Stats

| Current price | $10.49 | 52-week high | $11.24 |

| Prev. close | $10.40 | 52-week low | $6.80 |

| Day low | $10.26 | Volume | 1,900 |

| Day high | $10.66 | Avg. volume | 9,911 |

| 50-day MA | $9.47 | Dividend yield | N/A |

| 200-day MA | $9.09 | Market Cap | N/A |

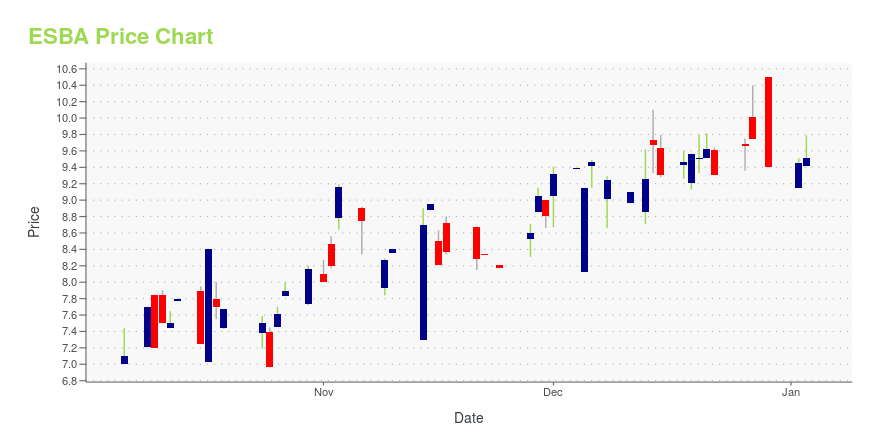

ESBA Stock Price Chart Interactive Chart >

Empire State Realty OP, L.P. Series ES Operating Partnership Limited Partnership Interests (ESBA) Company Bio

Empire State Realty OP, L.P. operates as a subsidiary of Empire State Realty Trust, Inc.

Latest ESBA News From Around the Web

Below are the latest news stories about EMPIRE STATE REALTY OP LP that investors may wish to consider to help them evaluate ESBA as an investment opportunity.

Empire State Realty Trust Announces Stock Repurchase AuthorizationNEW YORK, December 22, 2023--Empire State Realty Trust, Inc. (NYSE: ESRT) (the "Company"), today announced that its Board of Directors has authorized the repurchase of up to $500 million of the Company’s Class A common stock and Empire State Realty OP, L.P.’s Series ES, Series 250 and Series 60 operating partnership units (NYSE Arca: ESBA, FISK and OGCP, respectively) for the period from January 1, 2024 through December 31, 2025. This will replace the existing $500 million repurchase authorizati |

Empire State Realty OP, L.P. declares $0.035 dividendMore on Empire State Realty OP, L.P.... |

Empire State Realty Trust Inc (ESRT) Raises 2023 Guidance Following Q3 ResultsESRT reports Q3 net income per fully diluted share of $0.07 and core FFO per fully diluted share of $0.25 |

Unveiling Empire State Realty OP LP (ESBA)'s Value: Is It Really Priced Right? A Comprehensive GuideA deep dive into the valuation of Empire State Realty OP LP (ESBA), providing a detailed analysis of its intrinsic value and market performance. |

Empire State Realty OP LP (ESBA)'s True Worth: A Comprehensive Analysis of Its Market ValueUnveiling the intrinsic value of Empire State Realty OP LP |

ESBA Price Returns

| 1-mo | 18.73% |

| 3-mo | 16.87% |

| 6-mo | 5.69% |

| 1-year | 30.86% |

| 3-year | -5.20% |

| 5-year | -18.36% |

| YTD | 12.43% |

| 2023 | 46.51% |

| 2022 | -25.01% |

| 2021 | -1.99% |

| 2020 | -32.61% |

| 2019 | 1.12% |

Continue Researching ESBA

Want to do more research on Empire State Realty OP LP's stock and its price? Try the links below:Empire State Realty OP LP (ESBA) Stock Price | Nasdaq

Empire State Realty OP LP (ESBA) Stock Quote, History and News - Yahoo Finance

Empire State Realty OP LP (ESBA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...