Enviva Inc. (EVA): Price and Financial Metrics

EVA Price/Volume Stats

| Current price | $0.39 | 52-week high | $14.17 |

| Prev. close | $0.39 | 52-week low | $0.25 |

| Day low | $0.39 | Volume | 186,898 |

| Day high | $0.40 | Avg. volume | 2,174,141 |

| 50-day MA | $0.49 | Dividend yield | N/A |

| 200-day MA | $1.03 | Market Cap | 29.33M |

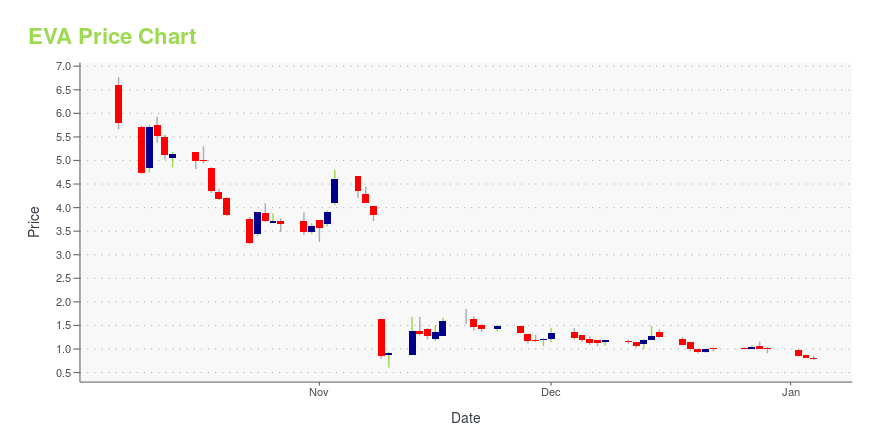

EVA Stock Price Chart Interactive Chart >

Enviva Inc. (EVA) Company Bio

Enviva Partners LP engages in the production, process, and distribution of wood biomass to power generators. It offers wood pellets and wood chips which are used in coal-fired power generation and power plants. The company was founded on November 12, 2013 and is headquartered in Bethesda, MD.

Latest EVA News From Around the Web

Below are the latest news stories about ENVIVA INC that investors may wish to consider to help them evaluate EVA as an investment opportunity.

Implied Volatility Surging for Enviva (EVA) Stock OptionsInvestors need to pay close attention to Enviva (EVA) stock based on the movements in the options market lately. |

The Trade That Backfired for America’s Biggest Wood-Pellet ExporterA wrong-way bet on the price of wood pellets has jeopardized America’s biggest exporter of the fuel, even though demand has never been higher among the European and Asia power plants burning wood instead of coal. Enviva said its gambit to buy pellets from a customer, and resell them for more, backfired when prices fell, and that nine-figure losses could trigger a default with its lenders by year-end. Enviva’s shares are down about 60% since it warned investors earlier this month that the trade risked its ability to remain a going concern. |

Wood Pellet Exporter Enviva's Stock Is Tumbling AgainShares of Enviva, America's largest wood-pellet exporter, are tumbling again, following [Thursday's 78% slide](https://www.wsj.com/livecoverage/stock-market-today-dow-jones-11-09-2023/card/america-s-biggest-wood-pellet-exports-warns-its-future-is-in-jeopardy-stock-crashes-lwtHswJKcJ6zekFG24Ri?mod=finance_lcmarkets_pos1). |

America's Biggest Wood Pellet Exporter Warns Its Future Is in Jeopardy; Stock CrashesU.S. wood pellets have never been more in demand around the world as a replacement for coal. Enviva—which grinds up trees at facilities across the South and [ships the resulting pellets abroad to be burned in power plants](https://www.wsj.com/articles/wood-pellet-exports-boom-amid-ukraine-war-environmental-concerns-11659915622)—gave investors a litany of bad news on Thursday, prompting a 78% drop in its shares to less than $1. Shares plunged in spring after Enviva eliminated its dividend in favor of a strategy to build new plants across the South in hopes of taking advantage of [the glut of pine trees](https://www.wsj.com/articles/thousands-of-southerners-planted-trees-for-retirement-it-didnt-work-1539095250). |

Enviva Inc (EVA) Faces Headwinds as Q3 2023 Results Show Net Loss and Lower Adjusted EBITDALeadership Changes and Strategic Reviews Underway Amidst Financial Challenges |

EVA Price Returns

| 1-mo | -13.91% |

| 3-mo | -27.36% |

| 6-mo | -32.58% |

| 1-year | -96.92% |

| 3-year | -99.21% |

| 5-year | -98.34% |

| YTD | -60.84% |

| 2023 | -98.08% |

| 2022 | -19.37% |

| 2021 | 64.30% |

| 2020 | 31.22% |

| 2019 | 46.06% |

Continue Researching EVA

Want to do more research on Enviva Partners LP's stock and its price? Try the links below:Enviva Partners LP (EVA) Stock Price | Nasdaq

Enviva Partners LP (EVA) Stock Quote, History and News - Yahoo Finance

Enviva Partners LP (EVA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...