EverCommerce Inc. (EVCM): Price and Financial Metrics

EVCM Price/Volume Stats

| Current price | $12.14 | 52-week high | $12.15 |

| Prev. close | $11.86 | 52-week low | $6.22 |

| Day low | $11.94 | Volume | 187,500 |

| Day high | $12.15 | Avg. volume | 158,857 |

| 50-day MA | $10.62 | Dividend yield | N/A |

| 200-day MA | $9.85 | Market Cap | 2.25B |

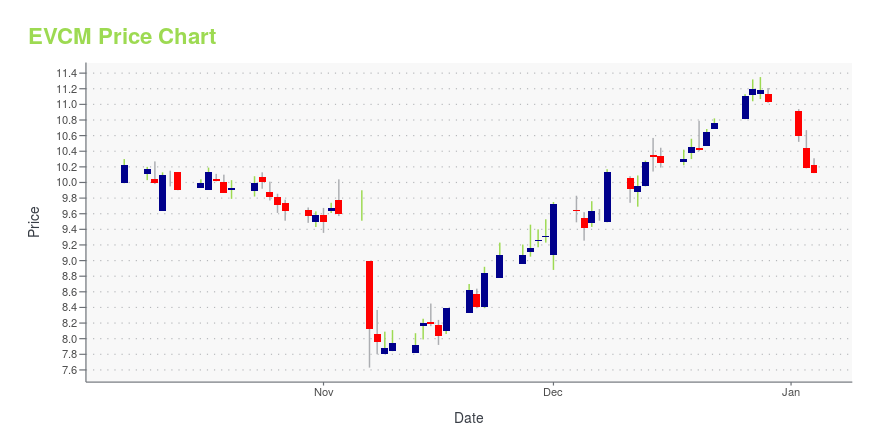

EVCM Stock Price Chart Interactive Chart >

EverCommerce Inc. (EVCM) Company Bio

EverCommerce Inc. provides integrated software-as-a-service solutions for service-based small- and medium-sized businesses. The company offers business management software, such as route-based dispatching, medical practice management, and gym member management; billing and payment solutions, including e-invoicing, mobile payments, and integrated payment processing; customer engagement applications comprising reputation management and messaging solutions; and marketing technology solutions consisting of websites, hosting, and digital lead generation. It provides EverPro suite of solutions in home services; EverHealth suite of solutions within health services; and EverWell suite of solutions in fitness and wellness services. In addition, the company offers professional services, including implementation, configuration, installation, or training services. It serves home service professionals, such as construction contractors and home maintenance technicians; physician practices and therapists in the health services industry; and personal trainers and salon owners in the fitness and wellness sectors. The company was formerly known as PaySimple Holdings, Inc. and changed its name to EverCommerce Inc. in December 2020. The company was incorporated in 2016 and is headquartered in Denver, Colorado.

Latest EVCM News From Around the Web

Below are the latest news stories about EVERCOMMERCE INC that investors may wish to consider to help them evaluate EVCM as an investment opportunity.

Is There Now An Opportunity In EverCommerce Inc. (NASDAQ:EVCM)?While EverCommerce Inc. ( NASDAQ:EVCM ) might not have the largest market cap around , it led the NASDAQGS gainers with... |

This Low-Priced Tech Stock Is Making a Bottom PatternEverCommerce , a leading service commerce platform, provides integrated software-as-a-service solutions for small and medium-sized businesses. In this daily bar chart of EVCM, below, I see a mixed picture. The On-Balance-Volume (OBV) line shows weakness since late May. Trading volume has increased since the beginning of November. |

New EverCommerce Report Reveals Service-Based Small Businesses are Resilient2023 State of Service Economy Report states 69% of North American service-based small businesses reported moderate to healthy recoveries from COVID-related anomaliesDENVER, Dec. 05, 2023 (GLOBE NEWSWIRE) -- EverCommerce Inc. (NASDAQ: EVCM), a leading service commerce platform, today released the 2023 State of the Service Economy Report, providing a look at the post-pandemic health outlook and consumer demand trends for North American service-based small businesses. The company’s first annual rep |

EverCommerce to Present at Fourth Quarter Investor ConferencesDENVER, Nov. 13, 2023 (GLOBE NEWSWIRE) -- EverCommerce Inc. (NASDAQ: EVCM), a leading service commerce platform, today announced that management will participate in the following upcoming investor conferences: Chief Executive Officer Eric Remer will present at the RBC 2023 Technology, Internet, Media and Telecommunications Conference in New York, NY. The presentation is scheduled for Tuesday, November 14, 2023 at 10:40 a.m. ET.Senior Vice President and Head of Investor Relations Brad Korch will |

EverCommerce Inc. (NASDAQ:EVCM) Q3 2023 Earnings Call TranscriptEverCommerce Inc. (NASDAQ:EVCM) Q3 2023 Earnings Call Transcript November 7, 2023 Operator: Thank you for standing by, and welcome to EverCommerce’s Third Quarter 2023 Earnings Conference Call. My name is Norma, and I’ll be your operator today. After the speakers’ presentation, there will be a question-and-answer session. [Operator Instructions] As a reminder, this conference is […] |

EVCM Price Returns

| 1-mo | 14.31% |

| 3-mo | 32.39% |

| 6-mo | 20.44% |

| 1-year | 7.82% |

| 3-year | -31.99% |

| 5-year | N/A |

| YTD | 10.06% |

| 2023 | 48.25% |

| 2022 | -52.76% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...