Evogene Ltd. - Ordinary Shares (EVGN): Price and Financial Metrics

EVGN Price/Volume Stats

| Current price | $5.14 | 52-week high | $11.00 |

| Prev. close | $4.84 | 52-week low | $4.50 |

| Day low | $4.79 | Volume | 55,215 |

| Day high | $5.14 | Avg. volume | 14,997 |

| 50-day MA | $6.60 | Dividend yield | N/A |

| 200-day MA | $7.13 | Market Cap | 211.85M |

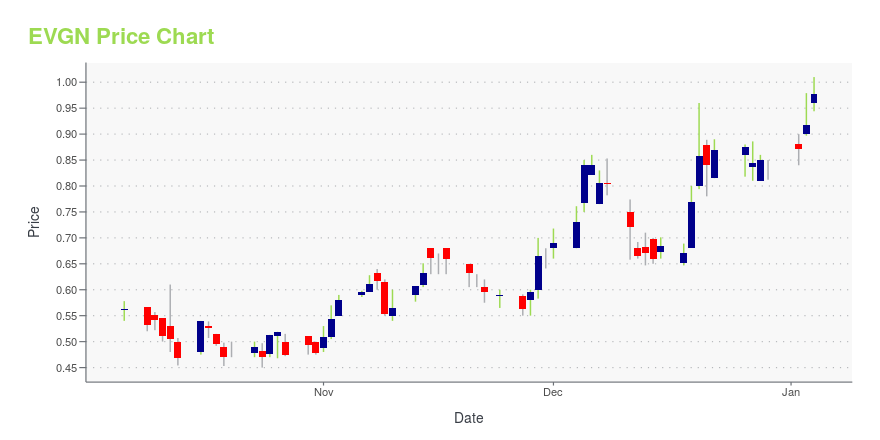

EVGN Stock Price Chart Interactive Chart >

Evogene Ltd. - Ordinary Shares (EVGN) Company Bio

Evogene Ltd. operates as a plant genomics company that uses a technology infrastructure to enhance seed traits underlying crop productivity. The company was founded in 1999 and is based in Rehovot, Israel.

Latest EVGN News From Around the Web

Below are the latest news stories about EVOGENE LTD that investors may wish to consider to help them evaluate EVGN as an investment opportunity.

Biomica CEO Set to Attend JP Morgan Healthcare Week in San Francisco, January 8-11, 2024Biomica Ltd., a clinical-stage biopharmaceutical company developing innovative microbiome-based therapeutics and a subsidiary of Evogene Ltd. (Nasdaq: EVGN) (TASE: EVGN), is gearing up for participation in the JP Morgan 42nd Annual Healthcare Week, scheduled to run from January 8 to 11, 2024, in San Francisco. Biomica will also be taking part in the Biotech Showcase conference. |

Casterra Appoints New CEO and Expands Team to Drive Growth and InnovationCasterra Ag Ltd., a subsidiary of Evogene Ltd. ("Evogene") (Nasdaq: EVGN) (TASE: EVGN) and an integrated castor cultivation solution company for the bio-based industries (e.g. biofuels, biopolymers), today announced the appointment of Mr. Yoash Zohar as new CEO, as of January 1, 2024, to lead the company's expansion efforts. Considering Casterra's rapid growth and its continued prospects for development, this nomination aims to strengthen its leadership and positioning in the industry. |

Is Compugen (CGEN) Outperforming Other Medical Stocks This Year?Here is how Compugen (CGEN) and Evogene (EVGN) have performed compared to their sector so far this year. |

Lavie Bio Announces a Distribution Agreement with WinField United Canada for its Bio-Inoculant Seed Treatment Yalos™Lavie Bio Ltd., a subsidiary of Evogene Ltd. (Nasdaq: EVGN) (TASE: EVGN), a leading ag-biologicals company that develops microbiome-based, computational-driven bio-stimulant and bio-pesticide novel products, today announced a distribution agreement exclusive to independent retail with WinField United Canada for its bio-inoculant seed treatment Yalos™. This partnership aims to support Lavie Bio's 2024 sales growth strategy in Canada, with a focus on key agricultural regions, including Saskatchewa |

Bears are Losing Control Over Evogene (EVGN), Here's Why It's a 'Buy' NowAfter losing some value lately, a hammer chart pattern has been formed for Evogene (EVGN), indicating that the stock has found support. This, combined with an upward trend in earnings estimate revisions, could lead to a trend reversal for the stock in the near term. |

EVGN Price Returns

| 1-mo | -20.14% |

| 3-mo | -17.77% |

| 6-mo | -26.57% |

| 1-year | -51.05% |

| 3-year | -81.77% |

| 5-year | -64.55% |

| YTD | -38.81% |

| 2023 | 20.00% |

| 2022 | -57.32% |

| 2021 | -65.11% |

| 2020 | 209.21% |

| 2019 | -23.23% |

Continue Researching EVGN

Want to see what other sources are saying about Evogene Ltd's financials and stock price? Try the links below:Evogene Ltd (EVGN) Stock Price | Nasdaq

Evogene Ltd (EVGN) Stock Quote, History and News - Yahoo Finance

Evogene Ltd (EVGN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...