eXp World Holdings, Inc. (EXPI): Price and Financial Metrics

EXPI Price/Volume Stats

| Current price | $10.94 | 52-week high | $15.39 |

| Prev. close | $11.23 | 52-week low | $6.90 |

| Day low | $10.92 | Volume | 839,300 |

| Day high | $11.33 | Avg. volume | 1,168,768 |

| 50-day MA | $9.10 | Dividend yield | 1.79% |

| 200-day MA | $0.00 | Market Cap | 1.71B |

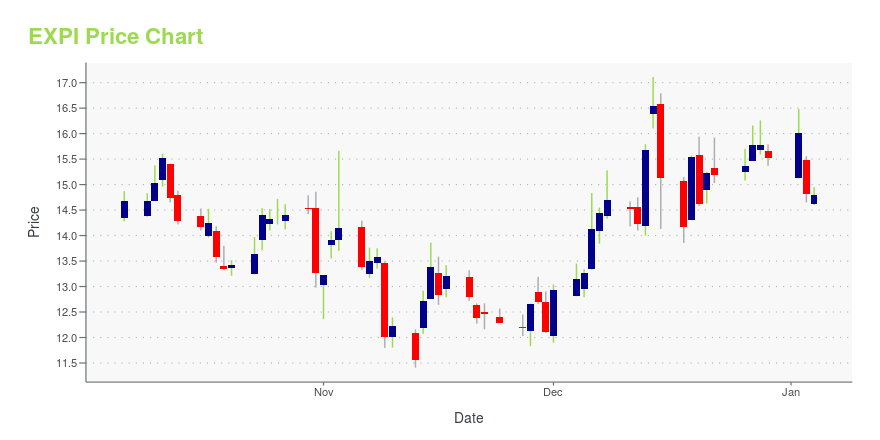

EXPI Stock Price Chart Interactive Chart >

eXp World Holdings, Inc. (EXPI) Company Bio

eXp World Holdings, Inc. provides cloud-based real estate brokerage services for residential real estate market in the United states and Canada. The company facilitates buyers to search real-time property listings and sellers to list their properties through its Website; and provides buyers and sellers access to a network of professional, consumer-centric agents, and brokers. It also offers access to collaborative tools and training services for real estate brokers and agents. In addition, the company provides marketing, training, and other support services to its brokers and agents through a proprietary technology enabled services, and technology and support services contracted to third parties. The company was formerly known as eXp Realty International Corporation and changed its name to eXp World Holdings, Inc. in May 2016. eXp World Holdings, Inc. was founded in 2008 and is based in Bellingham, Washington.

EXPI Price Returns

| 1-mo | 17.51% |

| 3-mo | 23.28% |

| 6-mo | -0.31% |

| 1-year | -18.41% |

| 3-year | -18.56% |

| 5-year | 24.23% |

| YTD | -3.86% |

| 2024 | -24.64% |

| 2023 | 42.00% |

| 2022 | -66.74% |

| 2021 | 6.93% |

| 2020 | 457.10% |

EXPI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching EXPI

Want to do more research on EXP World Holdings Inc's stock and its price? Try the links below:EXP World Holdings Inc (EXPI) Stock Price | Nasdaq

EXP World Holdings Inc (EXPI) Stock Quote, History and News - Yahoo Finance

EXP World Holdings Inc (EXPI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...