Express, Inc. (EXPR): Price and Financial Metrics

EXPR Price/Volume Stats

| Current price | $0.83 | 52-week high | $17.84 |

| Prev. close | $0.70 | 52-week low | $0.35 |

| Day low | $0.35 | Volume | 444,100 |

| Day high | $0.97 | Avg. volume | 162,673 |

| 50-day MA | $1.68 | Dividend yield | N/A |

| 200-day MA | $7.80 | Market Cap | 3.11M |

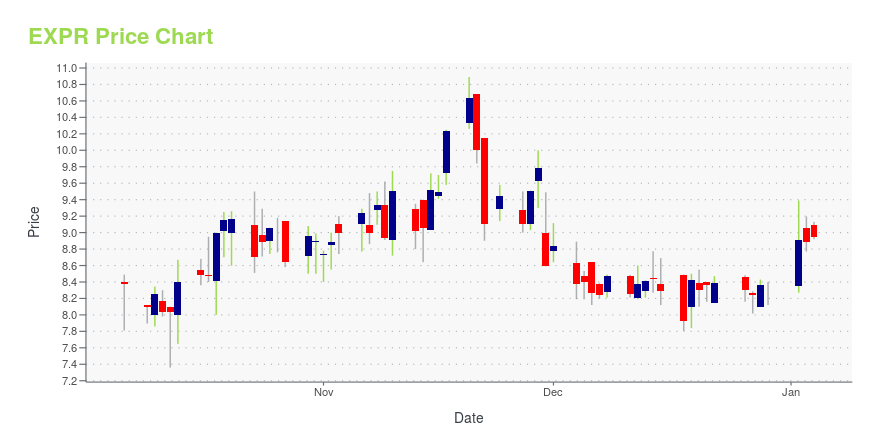

EXPR Stock Price Chart Interactive Chart >

Express, Inc. (EXPR) Company Bio

Express Inc. is a specialty apparel and accessories retailer of women's and men's merchandise, targeting the 20 to 30 year old customer. The company was founded in 1980 and is based in Columbus, Ohio.

Latest EXPR News From Around the Web

Below are the latest news stories about EXPRESS INC that investors may wish to consider to help them evaluate EXPR as an investment opportunity.

Express Expands Collegiate Athlete Style Ambassador ProgramCOLUMBUS, Ohio, December 21, 2023--Fashion apparel retailer Express, Inc. (NYSE: EXPR), announces today the latest partnership in the brand’s collegiate athlete style ambassador program with Ohio-based student athlete Ethan Grunkemeyer. Grunkemeyer, who is considered a top 10 college football quarterback recruit, is the brand’s youngest athlete partner to date. Grunkemeyer celebrates his first Name, Image, and Likeness (NIL) deal on National Signing Day, as he marks his commitment to play at Pen |

Express, Inc. (NYSE:EXPR) Q3 2023 Earnings Call TranscriptExpress, Inc. (NYSE:EXPR) Q3 2023 Earnings Call Transcript November 30, 2023 Express, Inc. beats earnings expectations. Reported EPS is $-7.09, expectations were $-7.18. Operator: Good morning. My name is Krista, and I’ll be your conference operator today. At this time, I would like to welcome everyone to the Express Incorporated Conference Call to discuss our […] |

Abercrombie & Fitch CEO: A leadership master class on saving a retail iconAbercrombie & Fitch CEO Fran Horowitz takes you inside her successful leadership style. |

Abercrombie & Fitch CEO’s turnaround playbook: Lead This Way premiereFran Horowitz took over the top job at Abercrombie & Fitch (ANF) in 2017, following a tumultuous stretch for the retailer. Under Horowitz’s leadership, Abercrombie & Fitch has undergone a revival, not only reclaiming its cultural relevance, but delivering profits for investors in the process. While visiting the company’s new flagship store in New York City, Horowitz tells Yahoo Finance Executive Editor Brian Sozzi what it took to turn around the legacy retail brand. Horowitz describes the qualities that she says make her an effective leader, such as being authentic, having patience and admitting when she’s wrong. “Make a mistake. And when you make a mistake, just fix it and move on,” Horowitz says. Prior to leading Abercrombie & Fitch, Horowitz rose up the retail ranks at Express (EXPR)... |

Express (EXPR) Q3 2023 Earnings Call TranscriptAt this time, I would like to welcome everyone to the Express, Incorporated conference call [Technical difficulty] third-quarter 2023 earnings. Express assumes no obligation to update any forward-looking statements whether as a result of new information, future events, or otherwise, except as required by law. |

EXPR Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | -88.47% |

| 1-year | -94.49% |

| 3-year | -99.17% |

| 5-year | -98.25% |

| YTD | -90.08% |

| 2023 | -58.97% |

| 2022 | -66.88% |

| 2021 | 238.46% |

| 2020 | -81.31% |

| 2019 | -4.70% |

Continue Researching EXPR

Want to do more research on Express Inc's stock and its price? Try the links below:Express Inc (EXPR) Stock Price | Nasdaq

Express Inc (EXPR) Stock Quote, History and News - Yahoo Finance

Express Inc (EXPR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...