Extra Space Storage Inc. (EXR): Price and Financial Metrics

EXR Price/Volume Stats

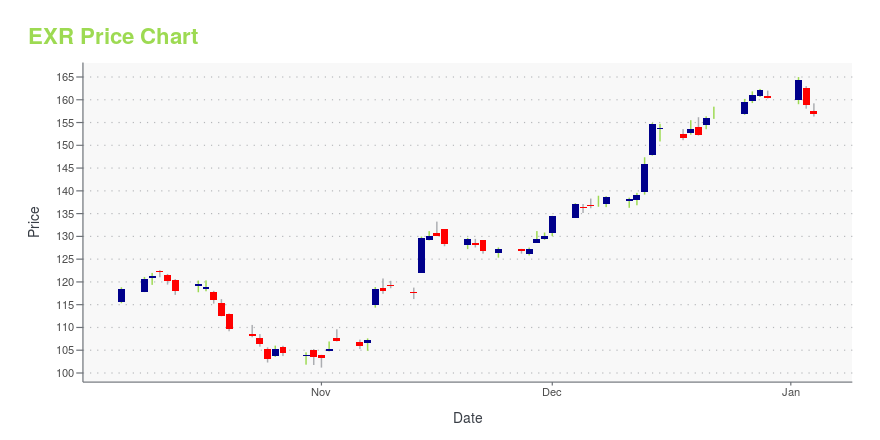

| Current price | $164.61 | 52-week high | $171.46 |

| Prev. close | $160.69 | 52-week low | $101.19 |

| Day low | $160.73 | Volume | 742,322 |

| Day high | $165.93 | Avg. volume | 1,074,203 |

| 50-day MA | $154.36 | Dividend yield | 3.89% |

| 200-day MA | $142.11 | Market Cap | 34.85B |

EXR Stock Price Chart Interactive Chart >

Extra Space Storage Inc. (EXR) Company Bio

Extra Space Storage is a real estate investment trust headquartered in Cottonwood Heights, Utah that invests in self storage units. As of December 31, 2021, the company owned and/or operated 2,096 locations in 41 states, and Washington, D.C. comprising approximately 160.9 million square feet of net rentable space in 1.5 million storage units. It is the 2nd largest owner of self storage units in the United States and the largest self storage property manager. (Source:Wikipedia)

Latest EXR News From Around the Web

Below are the latest news stories about EXTRA SPACE STORAGE INC that investors may wish to consider to help them evaluate EXR as an investment opportunity.

3 Wealth-Creating Dividend Stocks to Boost Your Income in 2024These dividend stocks can supply income and upside potential in 2024. |

Want $1 Million in Retirement? 3 Stocks to Buy Now and Hold for Decades.These REITs are proven wealth creators. |

Insider Sell Alert: Director Joseph Saffire Sells 25,000 Shares of Extra Space Storage Inc (EXR)Extra Space Storage Inc (NYSE:EXR), a leading figure in the self-storage industry, has recently witnessed a significant insider transaction. |

Extra Space Storage Inc's Dividend AnalysisExtra Space Storage Inc (NYSE:EXR) recently announced a dividend of $1.62 per share, payable on 2023-12-29, with the ex-dividend date set for 2023-12-14. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Extra Space Storage Inc's dividend performance and assess its sustainability. |

Boost Your Passive Income with 7 Reliable Dividend StocksAre you looking to grow your dividend portfolio? |

EXR Price Returns

| 1-mo | 4.85% |

| 3-mo | 24.60% |

| 6-mo | 14.02% |

| 1-year | 20.34% |

| 3-year | 7.22% |

| 5-year | 78.45% |

| YTD | 4.88% |

| 2023 | 13.86% |

| 2022 | -32.82% |

| 2021 | 100.98% |

| 2020 | 13.64% |

| 2019 | 20.71% |

EXR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching EXR

Here are a few links from around the web to help you further your research on Extra Space Storage Inc's stock as an investment opportunity:Extra Space Storage Inc (EXR) Stock Price | Nasdaq

Extra Space Storage Inc (EXR) Stock Quote, History and News - Yahoo Finance

Extra Space Storage Inc (EXR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...