Forestar Group Inc. (FOR): Price and Financial Metrics

FOR Price/Volume Stats

| Current price | $22.09 | 52-week high | $37.07 |

| Prev. close | $22.14 | 52-week low | $18.00 |

| Day low | $21.54 | Volume | 207,220 |

| Day high | $22.44 | Avg. volume | 193,798 |

| 50-day MA | $20.23 | Dividend yield | N/A |

| 200-day MA | $24.37 | Market Cap | 1.12B |

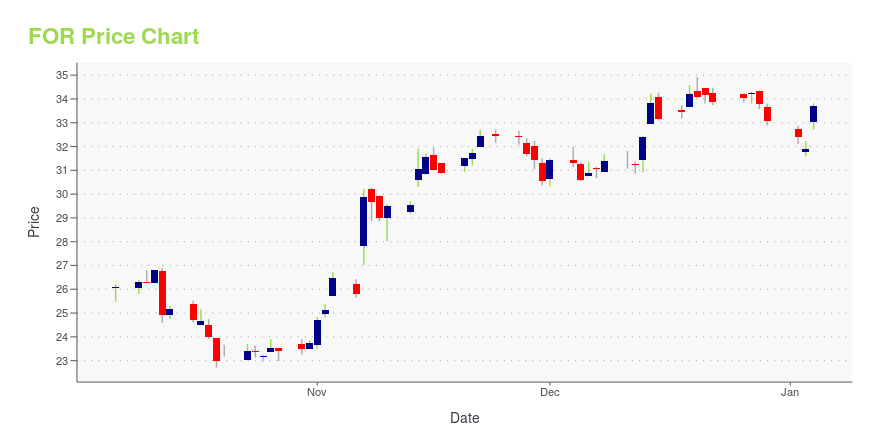

FOR Stock Price Chart Interactive Chart >

Forestar Group Inc. (FOR) Company Bio

Forestar Group Inc. engages in the provision of real estate business. It acquires land and develops infrastructure for single-family residential communities, and its revenues generally come from sales of residential single-family finished lots to local, regional, and national homebuilders. The company was founded in 2007 and is headquartered in Arlington, TX.

FOR Price Returns

| 1-mo | 11.34% |

| 3-mo | 16.69% |

| 6-mo | -17.54% |

| 1-year | -40.15% |

| 3-year | 44.57% |

| 5-year | 34.45% |

| YTD | -14.78% |

| 2024 | -21.62% |

| 2023 | 114.60% |

| 2022 | -29.15% |

| 2021 | 7.78% |

| 2020 | -3.21% |

Continue Researching FOR

Here are a few links from around the web to help you further your research on Forestar Group Inc's stock as an investment opportunity:Forestar Group Inc (FOR) Stock Price | Nasdaq

Forestar Group Inc (FOR) Stock Quote, History and News - Yahoo Finance

Forestar Group Inc (FOR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...