Fuel Tech, Inc. (FTEK): Price and Financial Metrics

FTEK Price/Volume Stats

| Current price | $1.04 | 52-week high | $1.34 |

| Prev. close | $1.03 | 52-week low | $0.96 |

| Day low | $1.03 | Volume | 50,100 |

| Day high | $1.07 | Avg. volume | 64,462 |

| 50-day MA | $1.09 | Dividend yield | N/A |

| 200-day MA | $1.10 | Market Cap | 31.60M |

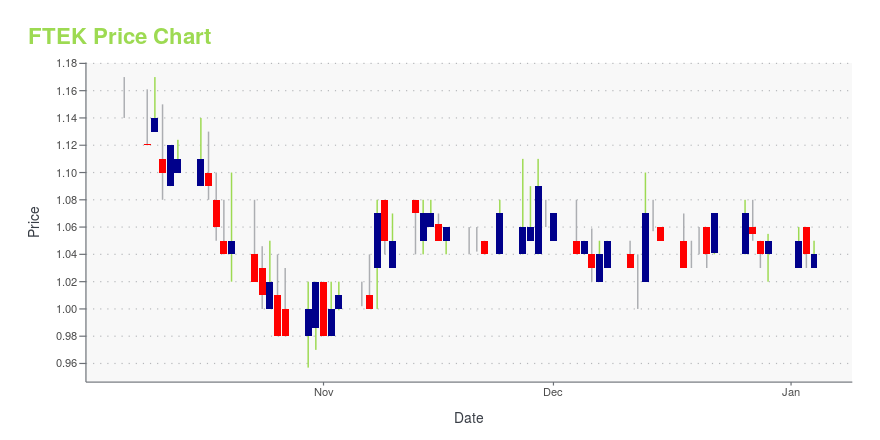

FTEK Stock Price Chart Interactive Chart >

Fuel Tech, Inc. (FTEK) Company Bio

Fuel Tech, Inc. provides boiler optimization, efficiency improvement, and air pollution reduction and control solutions to utility and industrial customers worldwide. It operates through Air Pollution Control Technology and FUEL CHEM Technology segments. The Air Pollution Control Technology segment offers technologies to reduce nitrogen oxide (NOx) emissions in flue gas from boilers, incinerators, furnaces, and other stationary combustion sources, which includes low and ultra-low NOx burners; over-fire air systems; NOxOUT and HERT selective non-catalytic reduction systems; advanced selective catalytic reduction systems comprising ULNB, OFA, and SNCR components, as well as downsized SCR catalyst, Ammonia Injection Grid, and Graduated Straightening Grid systems; NOxOUT CASCADE and NOxOUT-SCR processes; ULTRA technology; and flue gas conditioning systems. The FUEL CHEM Technology segment provides programs to improve the efficiency, reliability, fuel flexibility, boiler heat rate, and environmental status of combustion units by controlling slagging, fouling, corrosion, opacity, and acid plume, as well as the formation of sulfur trioxide, ammonium bisulfate, particulate matter, sulfur dioxide, and carbon dioxide through the addition of chemicals into the furnace using TIFI targeted in-furnace injection technology. This segment offers its FUEL CHEM program for plants operating in the electric utility, industrial, pulp and paper, waste-to-energy, university, and district heating markets, as well as to the owners of boilers, furnaces, and other combustion units. The company was founded in 1987 and is headquartered in Warrenville, Illinois.

Latest FTEK News From Around the Web

Below are the latest news stories about FUEL TECH INC that investors may wish to consider to help them evaluate FTEK as an investment opportunity.

Fuel Tech Awarded Air Pollution Control and Chemical Technologies Orders Totaling $2.5 MillionWARRENVILLE, Ill., December 12, 2023--Fuel Tech, Inc. (NASDAQ: FTEK), a technology company providing advanced engineering for the optimization of combustion systems, emissions control and water treatment in utility and industrial applications, today announced the receipt of air pollution control (APC) and Chemical Technologies orders from existing customers in South Africa and the Caribbean. These awards have an aggregate value of approximately $2.5 million. |

20 Most Oxygen Friendly Cities in the USIn this article, we will be looking at the 20 most oxygen-friendly cities in the US. If you want to skip our detailed analysis, you can go directly to the 5 Most Oxygen Friendly Cities in the US. Clean air is vital for our survival, health and longevity. Air quality has been declining across the […] |

Fuel Tech, Inc. (NASDAQ:FTEK) Q3 2023 Earnings Call TranscriptFuel Tech, Inc. (NASDAQ:FTEK) Q3 2023 Earnings Call Transcript November 8, 2023 Operator: Greetings, and welcome to the Fuel Tech Third Quarter 2023 Financial Results Conference Call. [Operator Instructions]. It is now my pleasure to introduce your host, Devin Sullivan.You may begin. Devin Sullivan: Good morning, everyone. Thank you for joining us today for Fuel […] |

Fuel Tech Reports 2023 Third Quarter Financial ResultsWARRENVILLE, Ill., November 07, 2023--Fuel Tech, Inc. (NASDAQ: FTEK), a technology company providing advanced engineering solutions for the optimization of combustion systems, emissions control, and water treatment in utility and industrial applications, today reported financial results for the third quarter ended September 30, 2023 ("Q3 2023"). |

Fuel Tech Awarded Air Pollution Control Orders Totaling $2.6 MillionWARRENVILLE, Ill., November 06, 2023--Fuel Tech, Inc. (NASDAQ: FTEK), a technology company providing advanced engineering for the optimization of combustion systems, emissions control and water treatment in utility and industrial applications, today announced the receipt of multiple air pollution control (APC) contracts from new and existing customers in the US and South Africa. These awards support projects serving various end markets and have an aggregate value of approximately $2.6 million. |

FTEK Price Returns

| 1-mo | -1.89% |

| 3-mo | -16.13% |

| 6-mo | 0.00% |

| 1-year | -17.46% |

| 3-year | -47.47% |

| 5-year | -3.70% |

| YTD | -0.95% |

| 2023 | -17.65% |

| 2022 | -8.93% |

| 2021 | -63.92% |

| 2020 | 308.42% |

| 2019 | -20.17% |

Continue Researching FTEK

Want to see what other sources are saying about Fuel Tech Inc's financials and stock price? Try the links below:Fuel Tech Inc (FTEK) Stock Price | Nasdaq

Fuel Tech Inc (FTEK) Stock Quote, History and News - Yahoo Finance

Fuel Tech Inc (FTEK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...