Forward Air Corporation (FWRD): Price and Financial Metrics

FWRD Price/Volume Stats

| Current price | $26.00 | 52-week high | $121.38 |

| Prev. close | $27.67 | 52-week low | $11.21 |

| Day low | $24.94 | Volume | 627,100 |

| Day high | $28.05 | Avg. volume | 1,095,402 |

| 50-day MA | $19.66 | Dividend yield | N/A |

| 200-day MA | $40.52 | Market Cap | 687.39M |

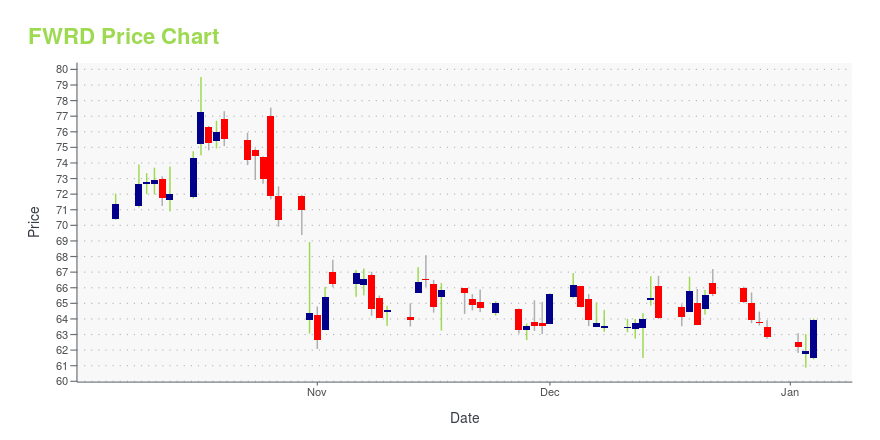

FWRD Stock Price Chart Interactive Chart >

Forward Air Corporation (FWRD) Company Bio

Forward Air Corporation provides surface transportation and related logistics services. The company operates in three segments: Forward Air (Forward Air); Forward Air Solutions (FASI); and Total Quality (TQI). The company was founded in 1981 and is based in Greeneville, Tennessee.

Latest FWRD News From Around the Web

Below are the latest news stories about FORWARD AIR CORP that investors may wish to consider to help them evaluate FWRD as an investment opportunity.

Omni alleges Forward CEO withheld, destroyed requested docsCounsel for Omni Logistics claims Forward Air’s CEO withheld requested notes from board meetings discussing plans to avoid a merger between the companies. The post Omni alleges Forward CEO withheld, destroyed requested docs appeared first on FreightWaves. |

Forward Air sells final-mile unit to Hub Group for $262MForward Air said Wednesday it sold its final-mile business, but it provided no update on the status of a merger with Omni Logistics. The post Forward Air sells final-mile unit to Hub Group for $262M appeared first on FreightWaves. |

Hub Group Expands Its Final Mile Service Offering through the Acquisition of Forward Air Final MileAcquisition of Forward Air Final Mile (“FAFM”) enhances end-to-end solutions for Hub Group’s customers and adds significant scale and service capability in appliance delivery and installation. Transaction Highlights Increases Hub Group’s LTM Final Mile revenue from $192m to $481mDrives continued diversification into non-asset based logistics services; pro forma LTM Logistics revenue now represents 44% of total Hub revenueAdds new capabilities in appliance delivery and installation and increases |

Forward Air Announces Sale of Final Mile BusinessGREENEVILLE, Tenn., December 20, 2023--Forward Air Corporation (NASDAQ: FWRD) (the "Company" or "Forward") is pleased to announce the sale of its Final Mile business to Hub Group, Inc. for an estimated total cash consideration of $262 million. For the twelve months ended September 30, 2023, Final Mile generated approximately $289 million in revenue. Final Mile has approximately 45 locations and more than 640 employees that will transfer to Hub Group, Inc. |

Forward Air Corporation's (NASDAQ:FWRD) Stock Been Rising: Are Strong Financials Guiding The Market?Forward Air's (NASDAQ:FWRD) stock is up by 2.7% over the past week. Since the market usually pay for a company’s... |

FWRD Price Returns

| 1-mo | 30.78% |

| 3-mo | 16.75% |

| 6-mo | -44.30% |

| 1-year | -78.03% |

| 3-year | -69.24% |

| 5-year | -55.87% |

| YTD | -58.64% |

| 2023 | -39.34% |

| 2022 | -12.56% |

| 2021 | 59.02% |

| 2020 | 11.27% |

| 2019 | 29.00% |

Continue Researching FWRD

Want to do more research on Forward Air Corp's stock and its price? Try the links below:Forward Air Corp (FWRD) Stock Price | Nasdaq

Forward Air Corp (FWRD) Stock Quote, History and News - Yahoo Finance

Forward Air Corp (FWRD) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...