Guess?, Inc. (GES): Price and Financial Metrics

GES Price/Volume Stats

| Current price | $23.57 | 52-week high | $33.50 |

| Prev. close | $23.00 | 52-week low | $17.92 |

| Day low | $23.18 | Volume | 662,100 |

| Day high | $23.73 | Avg. volume | 1,286,788 |

| 50-day MA | $22.66 | Dividend yield | 5.18% |

| 200-day MA | $24.00 | Market Cap | 1.26B |

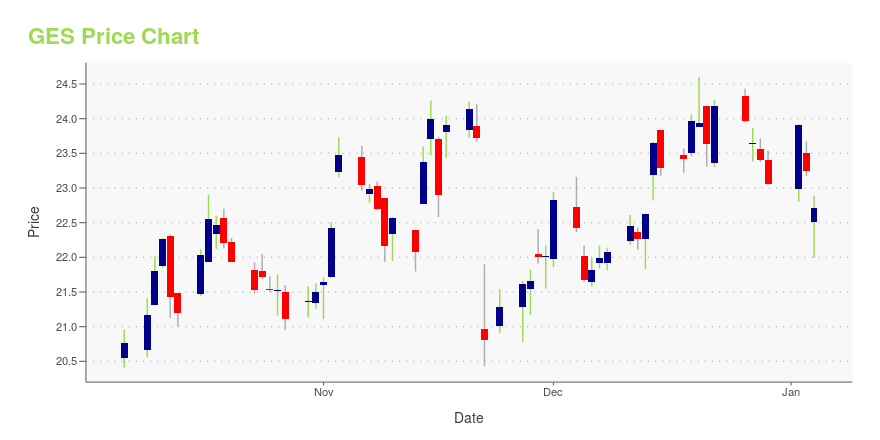

GES Stock Price Chart Interactive Chart >

Guess?, Inc. (GES) Company Bio

Guess Inc. designs, markets, distributes and licenses a lifestyle collection of contemporary apparel, denim, handbags, watches, footwear and other related consumer products. The company was founded in 1981 and is based in Los Angeles, California.

Latest GES News From Around the Web

Below are the latest news stories about GUESS INC that investors may wish to consider to help them evaluate GES as an investment opportunity.

7 Dividend Stocks I Wouldn’t Touch With a 10-Foot PoleAvoid these seven dividend stocks to sell at all costs, as their payouts may not be a sustainable as they seem. |

Are Robust Financials Driving The Recent Rally In Guess?, Inc.'s (NYSE:GES) Stock?Most readers would already be aware that Guess?'s (NYSE:GES) stock increased significantly by 7.5% over the past week... |

Guess? (GES) Hurt by Soft Americas Retail Unit & Cost WoesGuess? (GES) is witnessing weakness across its Americas retail business amid a dynamic macroeconomic environment. Rising operating costs are major concerns. |

Here's What We Like About Guess?'s (NYSE:GES) Upcoming DividendGuess?, Inc. ( NYSE:GES ) is about to trade ex-dividend in the next 3 days. Typically, the ex-dividend date is one... |

4 Stocks to Buy to Benefit from Resilient Consumer SpendingAs we head into 2024, some of the best stocks to buy won't be the Magnificent 7 but will instead be good value names in the retail space. |

GES Price Returns

| 1-mo | 15.48% |

| 3-mo | -8.93% |

| 6-mo | 14.05% |

| 1-year | 31.96% |

| 3-year | 31.91% |

| 5-year | 81.76% |

| YTD | 14.15% |

| 2023 | 17.62% |

| 2022 | -8.51% |

| 2021 | 7.00% |

| 2020 | 2.58% |

| 2019 | 11.17% |

GES Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching GES

Here are a few links from around the web to help you further your research on Guess Inc's stock as an investment opportunity:Guess Inc (GES) Stock Price | Nasdaq

Guess Inc (GES) Stock Quote, History and News - Yahoo Finance

Guess Inc (GES) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...