Global-e Online Ltd. (GLBE): Price and Financial Metrics

GLBE Price/Volume Stats

| Current price | $34.82 | 52-week high | $45.28 |

| Prev. close | $34.51 | 52-week low | $27.30 |

| Day low | $34.46 | Volume | 589,385 |

| Day high | $35.35 | Avg. volume | 1,148,183 |

| 50-day MA | $32.99 | Dividend yield | N/A |

| 200-day MA | $35.07 | Market Cap | 5.72B |

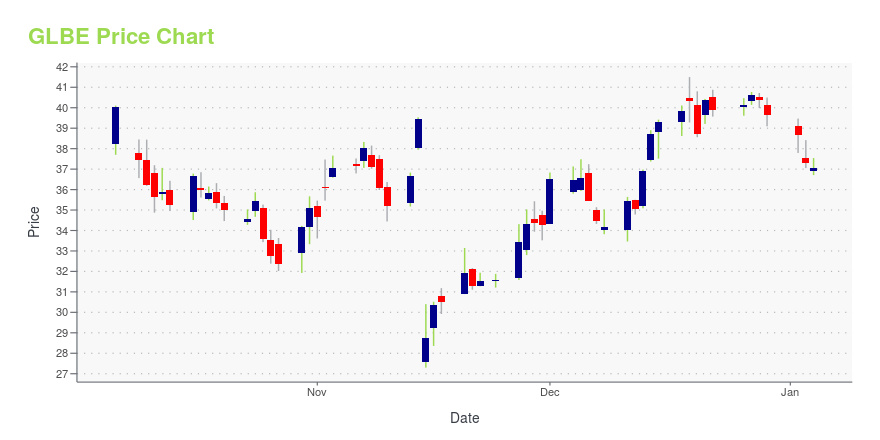

GLBE Stock Price Chart Interactive Chart >

Global-e Online Ltd. (GLBE) Company Bio

Global-e Online Ltd. operates an e-commerce platform that connects online retailers and brands with customers worldwide. The company was incorporated in 2013 and is headquartered in London, United Kingdom. It has additional offices in New York, New York; Paris, France; Petah Tikva, Israel; Beverly Hills, California; Atlanta, Georgia.

Latest GLBE News From Around the Web

Below are the latest news stories about GLOBAL-E ONLINE LTD that investors may wish to consider to help them evaluate GLBE as an investment opportunity.

3 Stocks That Could Supercharge Your Portfolio in 2024These stocks offer incredible growth prospects in a bull market. |

2 Ultra-Growth Stocks That Are Leading the Market RecoveryCheck out two market-beating winners in Wall Street's recent rally. These high-octane growth companies have massive prospects. |

5 Incredible Growth Stocks to Buy for 2024Get ready for the new year with a strong stock portfolio. |

Never Mind the FAANG Stocks; Buy the GHOST Stocks Before 2024Now is the time to invest in the next generation of industry leaders. |

1 Growth Stock Down 56% to Buy Right NowSelling directly to overseas online shoppers has never been easy -- until now. |

GLBE Price Returns

| 1-mo | 4.28% |

| 3-mo | 3.60% |

| 6-mo | -10.14% |

| 1-year | -16.78% |

| 3-year | -44.91% |

| 5-year | N/A |

| YTD | -12.14% |

| 2023 | 92.01% |

| 2022 | -67.44% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...