Greenlight Reinsurance, Ltd. - Class A Ordinary Shares (GLRE): Price and Financial Metrics

GLRE Price/Volume Stats

| Current price | $13.07 | 52-week high | $15.82 |

| Prev. close | $13.40 | 52-week low | $11.95 |

| Day low | $13.07 | Volume | 213,822 |

| Day high | $13.45 | Avg. volume | 106,827 |

| 50-day MA | $14.01 | Dividend yield | N/A |

| 200-day MA | $13.85 | Market Cap | 451.63M |

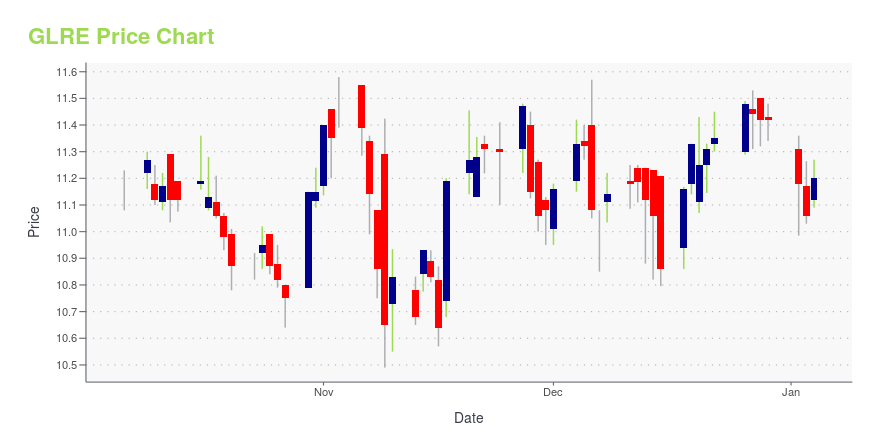

GLRE Stock Price Chart Interactive Chart >

Greenlight Reinsurance, Ltd. - Class A Ordinary Shares (GLRE) Company Bio

Greenlight Capital Re, Ltd., through its subsidiaries, provides property and casualty reinsurance products and services worldwide. Its frequency business comprises contracts containing smaller losses emanating from multiple events and enables the clients to increase their underwriting capacity; and severity business includes contracts with the potential for significant losses emanating from one event or multiple events. The company was founded in 2004 and is based in Grand Cayman, the Cayman Islands.

GLRE Price Returns

| 1-mo | -10.05% |

| 3-mo | -1.36% |

| 6-mo | -7.17% |

| 1-year | -0.23% |

| 3-year | 84.08% |

| 5-year | 86.05% |

| YTD | -6.64% |

| 2024 | 22.59% |

| 2023 | 40.12% |

| 2022 | 3.95% |

| 2021 | 7.25% |

| 2020 | -27.70% |

Continue Researching GLRE

Want to do more research on Greenlight Capital Re Ltd's stock and its price? Try the links below:Greenlight Capital Re Ltd (GLRE) Stock Price | Nasdaq

Greenlight Capital Re Ltd (GLRE) Stock Quote, History and News - Yahoo Finance

Greenlight Capital Re Ltd (GLRE) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...