Esports Entertainment Group Inc. (GMBL): Price and Financial Metrics

GMBL Price/Volume Stats

| Current price | $0.48 | 52-week high | $201.56 |

| Prev. close | $0.34 | 52-week low | $0.10 |

| Day low | $0.40 | Volume | 1,016 |

| Day high | $0.49 | Avg. volume | 132,422 |

| 50-day MA | $0.58 | Dividend yield | N/A |

| 200-day MA | $5.45 | Market Cap | 149.28K |

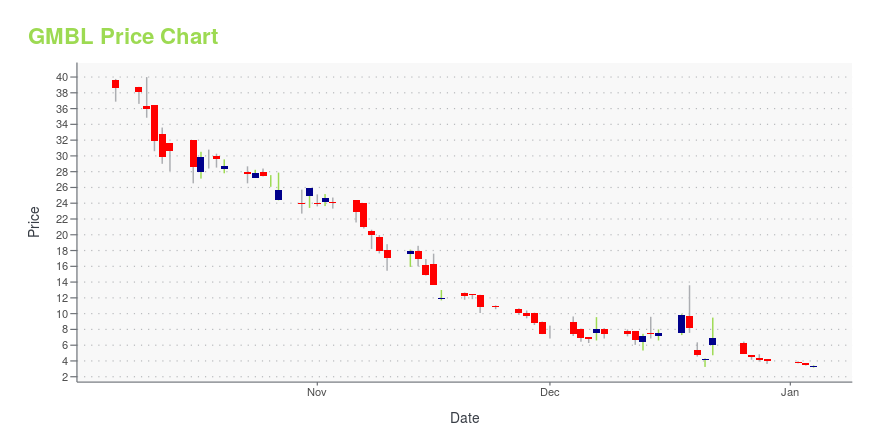

GMBL Stock Price Chart Interactive Chart >

Esports Entertainment Group Inc. (GMBL) Company Bio

Esports Entertainment Group, Inc. operates as an online gambling platform. It offers bet exchange style wagering on esports events in a licensed, regulated and secure platform to the global esports audience. The company was founded on July 22, 2008 and is headquartered in Malta, Antigua and Barbuda.

Latest GMBL News From Around the Web

Below are the latest news stories about ESPORTS ENTERTAINMENT GROUP INC that investors may wish to consider to help them evaluate GMBL as an investment opportunity.

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on ThursdayIt's time to start off Thursday with a breakdown of the biggest pre-market stock movers worth keeping an eye on this morning! |

Esports Entertainment Group Announces Reverse Stock SplitSt. Julian's, Malta--(Newsfile Corp. - December 20, 2023) - Esports Entertainment Group, Inc. (NASDAQ: GMBL) (NASDAQ: GMBLP) (NASDAQ: GMBLW) (NASDAQ: GMBLZ) ("Esports Entertainment", "EEG", or the "Company"), a leading, global iGaming company and business-to-business (B2B) esports content and solutions provider, today announced that its Board of Directors has approved a 1-for-400 reverse stock split of the Company's common stock, par value $0.001 (the "Common Stock"). The reverse stock split wil |

Esports Entertainment Group Temporarily Suspends Series A Preferred Stock DividendJulians, Malta--(Newsfile Corp. - December 8, 2023) - Esports Entertainment Group, Inc. (NASDAQ: GMBL) (NASDAQ: GMBLP) (NASDAQ: GMBLW) (NASDAQ: GMBLZ) ("Esports Entertainment", "EEG", or the "Company"), a leading, global iGaming company and business-to-business (B2B) esports content and solutions provider, today announced that its Board of Directors has suspended payment of the monthly cash dividend on the Company's outstanding 10% Series A Cumulative Redeemable Convertible Preferred Stock (the |

Esports Entertainment Group Provides Fiscal First Quarter Business UpdateInitiatives Expanding Esports and iGaming Offerings, Focusing on End-to-End Betting SolutionsHigh Standards and Regulatory Compliance Remain at the Forefront; Ensuring Solutions Meet State-by-State Standards to Support Expected Rapid Expansion within Sizable U.S. MarketJulians, Malta--(Newsfile Corp. - November 21, 2023) - Esports Entertainment Group, Inc. (NASDAQ: GMBL) (NASDAQ: GMBLP) (NASDAQ: GMBLW) (NASDAQ: GMBLZ) ("Esports Entertainment", "EEG", or the "Company"), a leading, global iGaming |

7 F-Rated Consumer Discretionary Stocks to Sell in NovemberThe holiday season is a great time for consumers. |

GMBL Price Returns

| 1-mo | -31.43% |

| 3-mo | -38.46% |

| 6-mo | -79.66% |

| 1-year | -99.72% |

| 3-year | -100.00% |

| 5-year | -100.00% |

| YTD | -87.85% |

| 2023 | -99.87% |

| 2022 | -97.82% |

| 2021 | -44.72% |

| 2020 | 51.19% |

| 2019 | -62.16% |

Loading social stream, please wait...