Greenlane Holdings, Inc. - (GNLN): Price and Financial Metrics

GNLN Price/Volume Stats

| Current price | $0.27 | 52-week high | $1.03 |

| Prev. close | $0.27 | 52-week low | $0.24 |

| Day low | $0.27 | Volume | 36,137 |

| Day high | $0.28 | Avg. volume | 300,637 |

| 50-day MA | $0.41 | Dividend yield | N/A |

| 200-day MA | $0.50 | Market Cap | 1.02M |

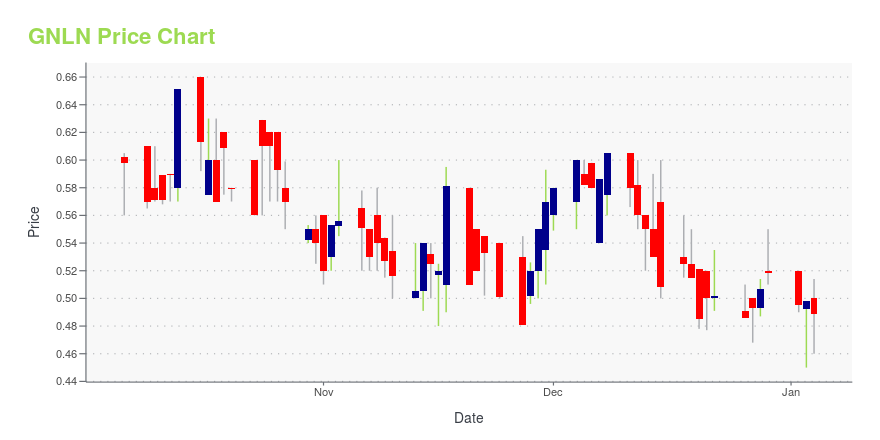

GNLN Stock Price Chart Interactive Chart >

Greenlane Holdings, Inc. - (GNLN) Company Bio

Greenlane Holdings Inc. Greenlane Holdings, Inc. is a distributor of vaporization products and consumption accessories in the United States. The Company owns and operates direct-to-consumer e-commerce websites in the vaporization products and consumption accessories industry, http://vapornation.com/ and https://www.vapor.com/, which offers shopping solutions directly to consumers. The Company markets and sells its products in both the business to business (B2B) and business to consumer (B2C) sectors of the marketplace. The Company offers a comprehensive selection of over 5,000 stock keeping units (SKUs), including vaporizers and parts, cleaning products, grinders and storage containers, pipes, rolling papers and customized lines of specialty packaging. It offers varieties of vaporization products from various brands, which includes Volcano vaporizers by Storz and Bickel; PAX 3 vaporizers by PAX Labs; and JUUL vaporizers by JUUL Labs, a nicotine vaporizer brand.

Latest GNLN News From Around the Web

Below are the latest news stories about GREENLANE HOLDINGS INC that investors may wish to consider to help them evaluate GNLN as an investment opportunity.

Greenlane Announces Receipt of Nasdaq Listing Deficiency NoticeBOCA RATON, FL / ACCESSWIRE / November 27, 2023 / Greenlane Holdings, Inc. ("Greenlane" or the "Company") (NASDAQ:GNLN), one of the largest global sellers of premium cannabis accessories, child-resistant packaging, and specialty vaporization products, ... |

Greenlane Announces Launch of New Dry Herb Vaporizer From EYCEBOCA RATON, FL / ACCESSWIRE / October 25, 2023 / Greenlane Holdings, Inc. ("Greenlane" or the "Company") (NASDAQ:GNLN), one of the largest global sellers of premium accessories, child-resistant packaging, and specialty vaporization products, today ... |

Greenlane Announces Changes to Its Board of DirectorsBOCA RATON, FL / ACCESSWIRE / October 18, 2023 / Greenlane Holdings, Inc. ("Greenlane" or the "Company") (NASDAQ:GNLN), one of the largest global sellers of premium accessories, child-resistant packaging, and specialty vaporization products, today ... |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on WednesdayIt's time for another dive into the biggest pre-market stock movers as we check out all the shares worth watching on Wednesday! |

Greenlane Renewables (TSE:GRN) Is In A Good Position To Deliver On Growth PlansJust because a business does not make any money, does not mean that the stock will go down. For example, biotech and... |

GNLN Price Returns

| 1-mo | -26.81% |

| 3-mo | -57.55% |

| 6-mo | -43.42% |

| 1-year | -69.70% |

| 3-year | -99.96% |

| 5-year | -99.98% |

| YTD | -47.88% |

| 2023 | -81.98% |

| 2022 | -98.51% |

| 2021 | -75.65% |

| 2020 | 21.66% |

| 2019 | N/A |

Loading social stream, please wait...