Guaranty Bancshares, Inc. (GNTY): Price and Financial Metrics

GNTY Price/Volume Stats

| Current price | $35.46 | 52-week high | $35.75 |

| Prev. close | $33.58 | 52-week low | $26.29 |

| Day low | $33.84 | Volume | 60,472 |

| Day high | $35.70 | Avg. volume | 18,552 |

| 50-day MA | $30.47 | Dividend yield | 2.75% |

| 200-day MA | $30.31 | Market Cap | 408.39M |

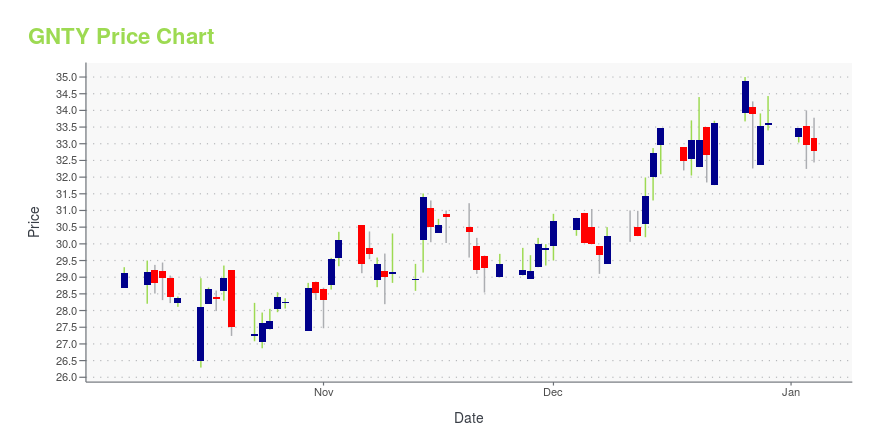

GNTY Stock Price Chart Interactive Chart >

Guaranty Bancshares, Inc. (GNTY) Company Bio

Guaranty Bancshares, Inc. is a bank holding company headquartered in Mount Pleasant, Texas, which is based in Northeast Texas. The company was founded in 1913.

Latest GNTY News From Around the Web

Below are the latest news stories about GUARANTY BANCSHARES INC that investors may wish to consider to help them evaluate GNTY as an investment opportunity.

Guaranty Bancshares, Inc. Declares Quarterly Cash DividendADDISON, Texas, December 20, 2023--The Board of Directors of Guaranty Bancshares, Inc. (NYSE: GNTY), the parent company of Guaranty Bank & Trust, N.A., declared a quarterly cash dividend yesterday in the amount of $0.23 per share of common stock. The dividend will be paid on January 10, 2024, to stockholders of record as of the close of business on December 30, 2023. |

Guaranty Bank & Trust Launches CommunityFirst Mortgage and Development Program, Championing Affordable Homeownership Solutions, Financial Literacy and Community Development, with Initial Targeted Efforts in South DallasADDISON, Texas, December 04, 2023--Guaranty Bank & Trust, N.A., its parent company, Guaranty Bancshares, Inc. (NYSE: GNTY), is proud to announce the launch of our latest initiative, the "Guaranty CommunityFirst Mortgage and Development Program." This innovative program is designed to empower individuals and families within our communities to achieve their dream of homeownership while fostering a stronger, more inclusive neighborhood. |

Payne to Retire After 40 Year Career at GuarantyADDISON, Texas, October 23, 2023--Guaranty Bancshares, Inc., (the ‘Company,’ NYSE: GNTY), the parent company of Guaranty Bank & Trust, N.A. (the ‘Bank’), announced that Clifton A. ‘Cappy’ Payne, Senior Executive Vice President and Chief Financial Officer of the Company plans to retire March 31, 2024, after 40 years with the Company and 35 years as the principal accounting officer. Cappy will step down as CFO effective December 29, 2023 and Shalene Jacobson will become the Company’s next CFO. Sha |

Guaranty Bancshares, Inc. Reports Third Quarter 2023 Financial ResultsADDISON, Texas, October 16, 2023--Guaranty Bancshares, Inc. (NYSE: GNTY) (the "Company"), the parent company of Guaranty Bank & Trust, N.A. (the "Bank"), today reported financial results for the fiscal quarter ended September 30, 2023. The Company's net income available to common shareholders was $6.3 million, or $0.54 per basic share, for the quarter ended September 30, 2023, compared to $9.6 million, or $0.82 per basic share, for the quarter ended June 30, 2023 and $10.9 million, or $0.92 per |

Earnings Preview: Guaranty Bancshares Inc. (GNTY) Q3 Earnings Expected to DeclineGuaranty Bancshares Inc. (GNTY) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations. |

GNTY Price Returns

| 1-mo | 21.36% |

| 3-mo | 20.21% |

| 6-mo | 9.13% |

| 1-year | 17.21% |

| 3-year | 14.08% |

| 5-year | 44.40% |

| YTD | 7.15% |

| 2023 | 0.19% |

| 2022 | -5.50% |

| 2021 | 41.21% |

| 2020 | -6.15% |

| 2019 | 12.84% |

GNTY Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching GNTY

Want to see what other sources are saying about Guaranty Bancshares Inc's financials and stock price? Try the links below:Guaranty Bancshares Inc (GNTY) Stock Price | Nasdaq

Guaranty Bancshares Inc (GNTY) Stock Quote, History and News - Yahoo Finance

Guaranty Bancshares Inc (GNTY) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...