Granite Construction Incorporated (GVA): Price and Financial Metrics

GVA Price/Volume Stats

| Current price | $68.83 | 52-week high | $68.91 |

| Prev. close | $66.38 | 52-week low | $33.74 |

| Day low | $66.42 | Volume | 1,152,624 |

| Day high | $68.91 | Avg. volume | 490,120 |

| 50-day MA | $62.43 | Dividend yield | 0.77% |

| 200-day MA | $52.51 | Market Cap | 3.04B |

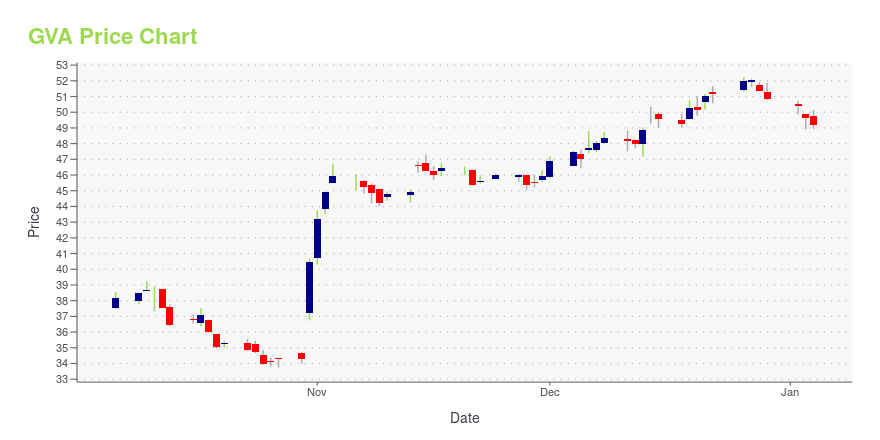

GVA Stock Price Chart Interactive Chart >

Granite Construction Incorporated (GVA) Company Bio

Granite Construction operates as a heavy civil contractor and a construction materials producer in the United States. The company operates through Construction, Large Project Construction, and Construction Materials segments. The company was founded in 1922 and is based in Watsonville, California.

Latest GVA News From Around the Web

Below are the latest news stories about GRANITE CONSTRUCTION INC that investors may wish to consider to help them evaluate GVA as an investment opportunity.

Zacks Industry Outlook Highlights EMCOR, Granite Construction and Orion GroupEMCOR, Granite Construction and Orion Group have been highlighted in this Industry Outlook article. |

The Zacks Analyst Blog Highlights Brinker International, Granite Construction, Royal Caribbean Cruises, Eaton and AZZBrinker International, Granite Construction, Royal Caribbean Cruises, Eaton and AZZ are included in this Analyst Blog. |

3 Stocks to Watch From a Prosperous Heavy Construction IndustryGrowth across the telecommunications, transmission, renewable energy and power generation businesses is set to benefit EME, GVA and ORN from the Zacks Building Products - Heavy Construction industry despite macroeconomic headwinds. |

Amazon and RH have been highlighted as Zacks Bull and Bear of the DayAmazon and RH have been highlighted as Zacks Bull and Bear of the Day. |

5 Top Growth Stocks for the Presidential Election Year 2024With things looking up for Wall Street in 2024, placing bets on growth stocks like Brinker International (EAT), Granite Construction (GVA), Royal Caribbean Cruises (RCL), Eaton (ETN) and AZZ seems prudent. |

GVA Price Returns

| 1-mo | 11.90% |

| 3-mo | 24.21% |

| 6-mo | 53.70% |

| 1-year | 67.54% |

| 3-year | 90.68% |

| 5-year | 67.84% |

| YTD | 35.93% |

| 2023 | 46.84% |

| 2022 | -7.82% |

| 2021 | 46.80% |

| 2020 | -0.65% |

| 2019 | -30.28% |

GVA Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching GVA

Here are a few links from around the web to help you further your research on Granite Construction Inc's stock as an investment opportunity:Granite Construction Inc (GVA) Stock Price | Nasdaq

Granite Construction Inc (GVA) Stock Quote, History and News - Yahoo Finance

Granite Construction Inc (GVA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...