Heritage-Crystal Clean, Inc. (HCCI): Price and Financial Metrics

HCCI Price/Volume Stats

| Current price | $45.51 | 52-week high | $47.98 |

| Prev. close | $45.47 | 52-week low | $25.70 |

| Day low | $45.49 | Volume | 2,520,300 |

| Day high | $45.52 | Avg. volume | 203,823 |

| 50-day MA | $45.29 | Dividend yield | N/A |

| 200-day MA | $38.90 | Market Cap | 1.11B |

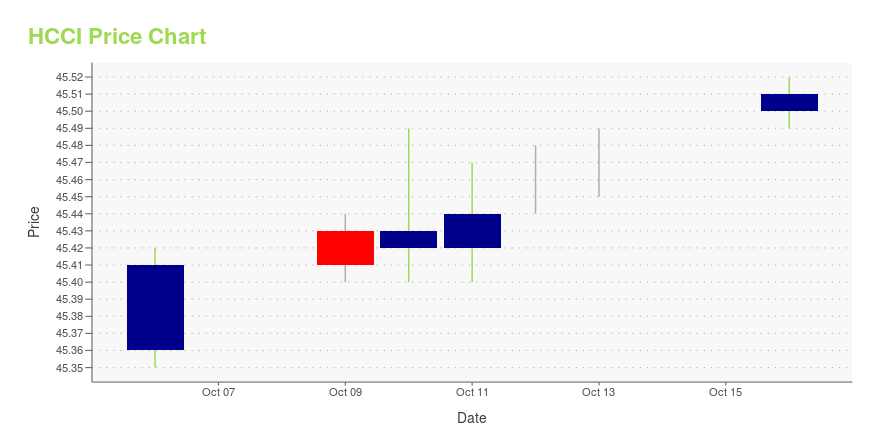

HCCI Stock Price Chart Interactive Chart >

Heritage-Crystal Clean, Inc. (HCCI) Company Bio

Heritage-Crystal Clean, Inc. provides parts cleaning, and hazardous and non-hazardous waste services to small and mid-sized customers in the manufacturing and vehicle maintenance sectors. The company was founded in 2007 and is based in Elgin, Illinois.

Latest HCCI News From Around the Web

Below are the latest news stories about HERITAGE-CRYSTAL CLEAN INC that investors may wish to consider to help them evaluate HCCI as an investment opportunity.

TortoiseEcofin Announces Constituent Changes Due to Corporate ActionLEAWOOD, KS / ACCESSWIRE / October 17, 2023 / TortoiseEcofin today announced that Heritage-Crystal Clean Inc (NASDAQ:HCCI) will be removed from the Tortoise Recycling Decarbonization IndexSM (RCYCL) and the Tortoise Recycling Decarbonization UCITSSM ... |

J.F. Lehman & Company Completes Acquisition of Heritage-Crystal Clean, Inc.HOFFMAN ESTATES, Ill., October 17, 2023--Heritage-Crystal Clean, Inc. ("Crystal Clean" or the "Company"), a leading provider of parts cleaning, used oil re-refining, hazardous and non-hazardous waste disposal, emergency and spill response, and industrial and field services to vehicle maintenance businesses, manufacturers and other industrial businesses, as well as utilities and governmental entities, today announced that an investment affiliate of J.F. Lehman & Company ("JFLCO"), a leading priva |

Earnings Preview: Heritage-Crystal Clean (HCCI) Q3 Earnings Expected to DeclineHeritage-Crystal Clean (HCCI) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations. |

Heritage-Crystal Clean (HCCI) was Sold to a Private Equity in Q3Investment management company Cove Street Capital recently released its “Small Cap Value Fund” third quarter 2023 investor letter. A copy of the same can be downloaded here. During the calendar third quarter of 2023, financial markets were chaotic, causing CSC shareholders to lose some gains from the first half, both relatively and absolutely. In the third quarter, the […] |

Leading Independent Proxy Advisory Firms ISS and Glass Lewis Recommend Heritage-Crystal Clean Shareholders Vote "FOR" the All-Cash Transaction with J.F. Lehman & CompanyHOFFMAN ESTATES, Ill., October 03, 2023--Heritage-Crystal Clean, Inc. (Nasdaq: HCCI) ("Crystal Clean" or the "Company") today announced that leading independent proxy advisory firms Institutional Shareholder Services ("ISS") and Glass Lewis & Co. ("Glass Lewis") recommend that Crystal Clean shareholders vote "FOR" Crystal Clean’s proposed combination with J.F. Lehman & Company ("JFLCO") at the Company’s upcoming Special Meeting of Shareholders (the "Special Meeting") scheduled for October 10, 20 |

HCCI Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -3.42% |

| 3-year | 66.09% |

| 5-year | 58.41% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | 1.44% |

| 2021 | 51.97% |

| 2020 | -32.83% |

| 2019 | 36.33% |

Continue Researching HCCI

Want to see what other sources are saying about Heritage-Crystal Clean Inc's financials and stock price? Try the links below:Heritage-Crystal Clean Inc (HCCI) Stock Price | Nasdaq

Heritage-Crystal Clean Inc (HCCI) Stock Quote, History and News - Yahoo Finance

Heritage-Crystal Clean Inc (HCCI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...