Harbor Custom Development Inc. (HCDI): Price and Financial Metrics

HCDI Price/Volume Stats

| Current price | $0.20 | 52-week high | $15.85 |

| Prev. close | $0.32 | 52-week low | $0.18 |

| Day low | $0.18 | Volume | 1,245,600 |

| Day high | $0.25 | Avg. volume | 621,198 |

| 50-day MA | $0.86 | Dividend yield | N/A |

| 200-day MA | $2.74 | Market Cap | 463.47K |

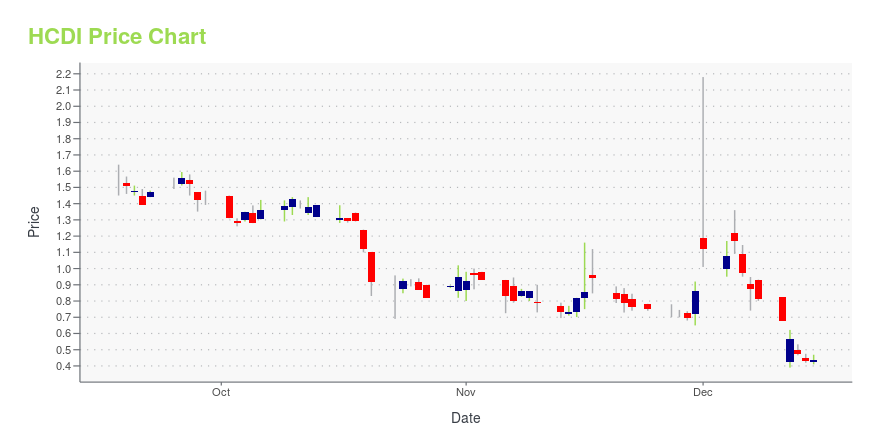

HCDI Stock Price Chart Interactive Chart >

Harbor Custom Development Inc. (HCDI) Company Bio

Harbor Custom Development, Inc. engages in the real estate development business in Western Washington's Puget Sound region. The company undertakes projects, such as residential lots, home communities, and single family and multi-family properties. It is involved in the land development cycle activities, including land acquisition, entitlements, construction of project infrastructure, home building, marketing, sales, and management of various residential projects. The company was formerly known as Harbor Custom Homes, Inc. and changed its name to Harbor Custom Development, Inc. in August 2019. Harbor Custom Development, Inc. was founded in 2014 and is headquartered in Gig Harbor, Washington.

Latest HCDI News From Around the Web

Below are the latest news stories about HARBOR CUSTOM DEVELOPMENT INC that investors may wish to consider to help them evaluate HCDI as an investment opportunity.

Harbor Custom Development, Inc., Announces Board of Directors’ ResignationTACOMA, Wash, Sept. 22, 2023 (GLOBE NEWSWIRE) -- Harbor Custom Development, Inc. (Nasdaq: HCDI, HCDIP, HCDIW, HCDIZ) (“Harbor,” “Harbor Custom Homes®,” or the “Company”), a real estate company involved in all aspects of the land development cycle, today announced Wally Walker has accepted a position with the University of Virginia as the Deputy Athletics Director and will be relocating to Virginia. As a result, Mr. Walker will be stepping down from his role on the Company’s Board of Directors ef |

HCDI: Harbor Custom Development reports 2nd quarter 2023 results and updates investor community on project status and the current real estate market environment.By Thomas Kerr, CFA NASDAQ:HCDI READ THE FULL HCDI RESEARCH REPORT Harbor Custom Development (NASDAQ:HCDI) reported 2nd quarter financial results which showed substantial revenue growth due to the sale of a multi-family property. Sales increased 92.9% to $19.8 million compared to sales of $10.3 million in the prior year period. The increase was primarily attributed to the sale of the Mills |

Harbor Custom Development, Inc., Announces 17 Luxury Homes Coming to the Horseshoe Bay and Austin MSAs1111 Cimarron Hills, Georgetown, TX is 4,836 square feet and listed for $2,055,300 1111 Cimarron Hills, Georgetown, TX is 4,836 square feet and listed for $2,055,300 TACOMA, Wash, Aug. 16, 2023 (GLOBE NEWSWIRE) -- Harbor Custom Development, Inc. (Nasdaq: HCDI, HCDIP, HCDIW, HCDIZ) (“Harbor,” “Harbor Custom Homes®,” or the “Company”), a real estate company involved in all aspects of the land development cycle, announced 17 new construction homes are available to purchase now and into the fall in |

Harbor Custom Development, Inc., Now Leasing Meadowscape Apartments in Olympia, WAMeadowscape Apartments offers studios to two-bedroom rental units starting at $1,550 monthly Meadowscape Apartments offers studios to two-bedroom rental units starting at $1,550 monthly TACOMA, Wash., Aug. 15, 2023 (GLOBE NEWSWIRE) -- Harbor Custom Development, Inc. (Nasdaq: HCDI, HCDIP, HCDIW, HCDIZ) (“Harbor,” “Harbor Custom Homes®,” or the “Company”), a real estate company involved in all aspects of the land development cycle, announced it is now leasing its Meadowscape apartments in Olympia, |

Harbor Custom Development, Inc. Reports 2023 Second Quarter and Year to Date Financial ResultsTACOMA, Wash., Aug. 14, 2023 (GLOBE NEWSWIRE) -- Harbor Custom Development, Inc. (Nasdaq: HCDI, HCDIP, HCDIW, HCDIZ) (“Harbor,” “Harbor Custom Homes®,” or the “Company”), a real estate company involved in all aspects of the land development cycle, today announced its financial results for the second quarter and six months ended June 30, 2023. Second Quarter 2023 Financial Highlights Compared to Second Quarter 2022 Sales of $19.8 million compared to $10.3 millionGross loss of $(2.9) million compa |

HCDI Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -92.31% |

| 3-year | -99.65% |

| 5-year | N/A |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -85.90% |

| 2021 | -39.68% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...