Huaneng Power Intl (HNP): Price and Financial Metrics

HNP Price/Volume Stats

| Current price | $21.51 | 52-week high | $28.77 |

| Prev. close | $21.10 | 52-week low | $13.05 |

| Day low | $21.03 | Volume | 97,500 |

| Day high | $21.85 | Avg. volume | 23,754 |

| 50-day MA | $19.25 | Dividend yield | 4.54% |

| 200-day MA | $20.23 | Market Cap | 8.44B |

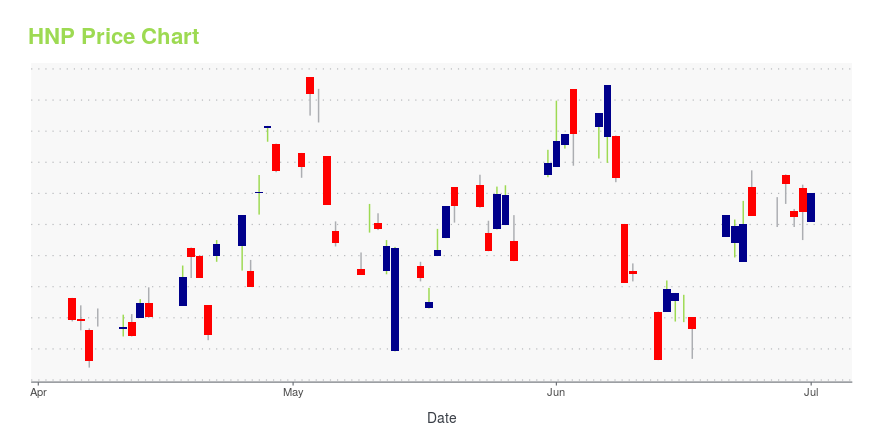

HNP Stock Price Chart Interactive Chart >

Huaneng Power Intl (HNP) Company Bio

Huaneng Power International generates and sells electricity and heat to the regional or provincial grid companies in China and Singapore. The company was founded in 1994 and is based in Beijing, China.

Latest HNP News From Around the Web

Below are the latest news stories about Huaneng Power International Inc that investors may wish to consider to help them evaluate HNP as an investment opportunity.

HUANENG POWER INTERNATIONAL, INC. DOMESTIC ELECTRICITY SOLD INCREASES BY 13.23% FOR THE YEAR OF 2021Huaneng Power International, Inc. ("HPI", the "Company") (NYSE: HNP; HKEx: 902; SSE: 600011) today announced its electricity sales for the whole year of 2021. |

Huaneng Power International (NYSE:HNP) Shares Gap Up to $19.34Huaneng Power International, Inc. (NYSE:HNP)s stock price gapped up prior to trading on Wednesday . The stock had previously closed at $19.34, but opened at $20.76. Huaneng Power International shares last traded at $20.76, with a volume of 433 shares trading hands. Several research analysts have commented on HNP shares. Zacks Investment Research upgraded Huaneng [] |

Huaneng Power International (NYSE:HNP) Shares Gap Up to $16.30Huaneng Power International, Inc. (NYSE:HNP) shares gapped up before the market opened on Monday . The stock had previously closed at $16.30, but opened at $17.45. Huaneng Power International shares last traded at $17.47, with a volume of 29 shares. HNP has been the subject of a number of analyst reports. Zacks Investment Research upgraded [] |

64 Biggest Movers From YesterdayGainers Siyata Mobile Inc. (NASDAQ: SYTA) shares jumped 83.4% to close at $5.30. Siyata Mobile released their Q2 earnings on an October 15th call that included CEO Marc Seelenfreund, VP of Corporate Development Daniel Kim, and VP of Sales Glenn Kennedy. With a heavy reliance on mobile unit sales to fleet services that are still not at full capacity, the numbers were expected to be low. CEO Marc Seelenfreund summed it up best. “While we are disappointed with our financial performance for the quar |

Huaneng Power International, Inc. RMB 0.783 Billion Net Profit Attributable to Shareholders for the Three Quarters of 2021 Decreased by 91.42%Huaneng Power International, Inc. ("HPI", or the "Company") (NYSE: HNP; HKEx: 902; SSE: 600011) today announced its unaudited operating results prepared in accordance with the PRC GAAP for the nine months ended September 30, 2021. |

HNP Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | 59.93% |

| 5-year | 4.79% |

| YTD | N/A |

| 2023 | N/A |

| 2022 | 0.00% |

| 2021 | 95.29% |

| 2020 | -24.90% |

| 2019 | -17.96% |

HNP Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching HNP

Want to do more research on Huaneng Power International Inc's stock and its price? Try the links below:Huaneng Power International Inc (HNP) Stock Price | Nasdaq

Huaneng Power International Inc (HNP) Stock Quote, History and News - Yahoo Finance

Huaneng Power International Inc (HNP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...