Hudson Global, Inc. (HSON): Price and Financial Metrics

HSON Price/Volume Stats

| Current price | $18.01 | 52-week high | $23.32 |

| Prev. close | $18.01 | 52-week low | $13.38 |

| Day low | $17.75 | Volume | 14,700 |

| Day high | $18.30 | Avg. volume | 6,200 |

| 50-day MA | $16.65 | Dividend yield | N/A |

| 200-day MA | $16.30 | Market Cap | 49.62M |

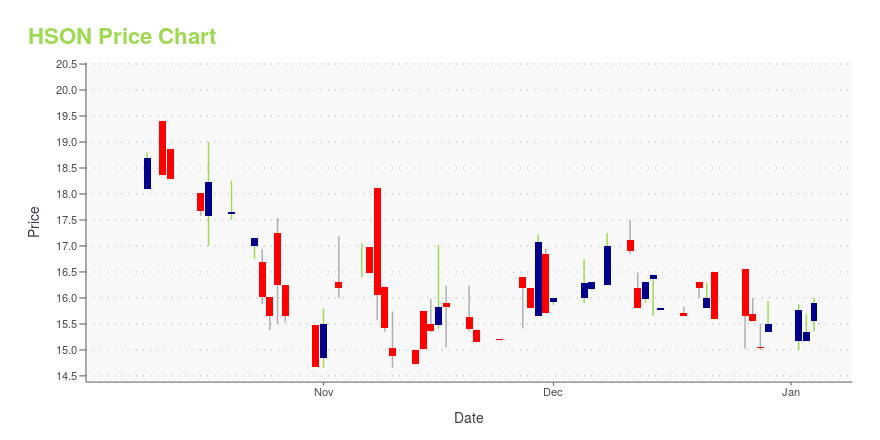

HSON Stock Price Chart Interactive Chart >

Hudson Global, Inc. (HSON) Company Bio

Hudson Global, Inc. provides talent solutions for mid-to-large-cap multinational companies and government agencies under the Hudson RPO brand in the Americas, the Asia Pacific, and Europe. It offers recruitment process outsourcing (RPO) services, such as complete recruitment outsourcing, project-based outsourcing, contingent workforce solutions, and recruitment consulting for clients' permanent staff hires; and RPO contracting services, including outsourced professional contract staffing and managed services. The company was formerly known as Hudson Highland Group, Inc. and changed its name to Hudson Global, Inc. in April 2012. Hudson Global, Inc. was founded in 1999 and is headquartered in Old Greenwich, Connecticut.

Latest HSON News From Around the Web

Below are the latest news stories about HUDSON GLOBAL INC that investors may wish to consider to help them evaluate HSON as an investment opportunity.

Hudson Global, Inc. (NASDAQ:HSON) Stock's Been Sliding But Fundamentals Look Decent: Will The Market Correct The Share Price In The Future?It is hard to get excited after looking at Hudson Global's (NASDAQ:HSON) recent performance, when its stock has... |

Hudson RPO APAC Receives the Prestigious 2023 SEEK SARA RPO of the Year Award in AustraliaOLD GREENWICH, Conn., Nov. 29, 2023 (GLOBE NEWSWIRE) -- Hudson RPO, a leading global total talent solutions company owned by Hudson Global, Inc. (the “Company”) (NASDAQ: HSON), announced today that it has received the prestigious SEEK Annual Recruitment Awards (“SEEK SARA”) RPO of the Year award for 2023. The SEEK SARA are a set of industry awards that recognize excellence, dedication, and innovation in the recruitment sector across Australia. Winners are hand-selected by an esteemed panel of in |

Hudson RPO Appoints Jake Zabkowicz as Global CEOPrioritizes Global Accounts & Aggressive GrowthOLD GREENWICH, Conn., Nov. 15, 2023 (GLOBE NEWSWIRE) -- Hudson RPO, a leading global total talent solutions company owned by Hudson Global, Inc. (the “Company”) (NASDAQ: HSON), announced today the appointment of Jacob “Jake” Zabkowicz as Global Chief Executive Officer, effective November 15, 2023. As Global CEO for Hudson RPO, Mr. Zabkowicz will lead the vision, strategy, and execution of Hudson RPO’s growth plan. Jeff Eberwein will remain Chief Exe |

One Hudson Global, Inc. (NASDAQ:HSON) Analyst Just Made A Major Cut To Next Year's EstimatesThe latest analyst coverage could presage a bad day for Hudson Global, Inc. ( NASDAQ:HSON ), with the covering analyst... |

Hudson Global, Inc. (NASDAQ:HSON) Q3 2023 Earnings Call TranscriptHudson Global, Inc. (NASDAQ:HSON) Q3 2023 Earnings Call Transcript November 10, 2023 Operator: Good morning, and welcome to the Hudson Global Conference Call for the Third Quarter of 2023. Our call today will be led by Chief Executive Officer, Jeff Eberwein; and Chief Financial Officer, Matt Diamond. Please be advised that the statements made during […] |

HSON Price Returns

| 1-mo | 15.45% |

| 3-mo | 3.98% |

| 6-mo | 21.69% |

| 1-year | N/A |

| 3-year | -5.11% |

| 5-year | 70.71% |

| YTD | 16.27% |

| 2023 | -31.55% |

| 2022 | -21.97% |

| 2021 | 176.19% |

| 2020 | -12.13% |

| 2019 | -11.48% |

Continue Researching HSON

Here are a few links from around the web to help you further your research on Hudson Global Inc's stock as an investment opportunity:Hudson Global Inc (HSON) Stock Price | Nasdaq

Hudson Global Inc (HSON) Stock Quote, History and News - Yahoo Finance

Hudson Global Inc (HSON) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...