Host Hotels & Resorts Inc. (HST): Price and Financial Metrics

HST Price/Volume Stats

| Current price | $17.45 | 52-week high | $21.31 |

| Prev. close | $17.19 | 52-week low | $14.92 |

| Day low | $17.26 | Volume | 6,411,758 |

| Day high | $17.69 | Avg. volume | 6,060,884 |

| 50-day MA | $18.01 | Dividend yield | 4.46% |

| 200-day MA | $18.65 | Market Cap | 12.30B |

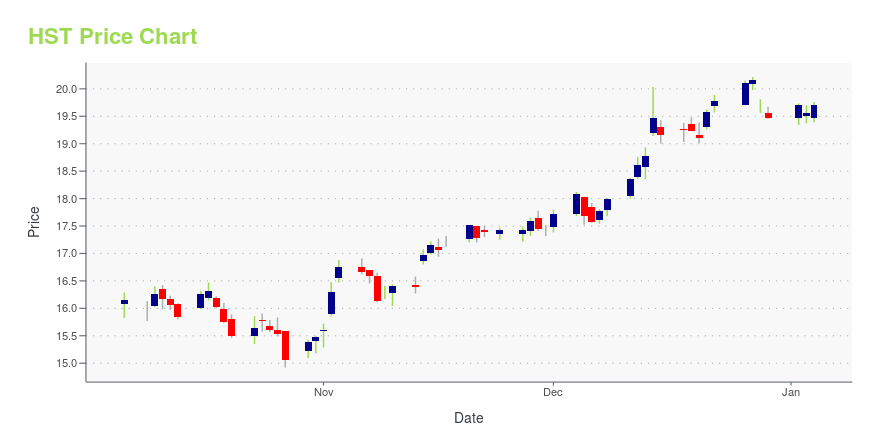

HST Stock Price Chart Interactive Chart >

Host Hotels & Resorts Inc. (HST) Company Bio

Host Hotels & Resorts, Inc. is an American real estate investment trust that invests in hotels. As of February 19, 2021, the company owned 80 upscale hotels containing approximately 46,500 rooms in the United States, Brazil, and Canada. (Source:Wikipedia)

Latest HST News From Around the Web

Below are the latest news stories about HOST HOTELS & RESORTS INC that investors may wish to consider to help them evaluate HST as an investment opportunity.

Green Giants: 7 ESG Stocks Leading the Way in Sustainable InvestingInvest in ESG stocks amidst the growing demand for corporate accountability offering strong upside potential over the long-run. |

Key Reasons to Add Host Hotels (HST) Stock to Your PortfolioRecovery in group and business transient travel demand, capital-recycling efforts and healthy balance sheet strength are likely to drive Host Hotels' (HST) performance in the quarters ahead. |

Hotel REITs 2024: Golden Opportunity Or Fool's Gold?As 2023 nears completion, investors in real estate investment trusts (REITs) are feeling more optimistic. After a prolonged slump throughout 2022 and the first 10 months of 2023, REITs have rallied over the past two months. Pauses in interest rate hikes, along with the likelihood of three interest rate cuts in 2024, have generated strong appreciation of REITs across multiple subsectors. As investors look toward 2024, they will be forced to differentiate between REITs that will likely continue ma |

Host Hotels Is Poised for an Extended Stay With BullsHost Hotels & Resorts is a lodging real estate investment trust (REIT) and one of the largest owners of luxury and upper-upscale hotels. The On-Balance-Volume (OBV) line has made a new high for the move up to confirm the price gains. The weekly OBV line has been creeping higher since August. |

Host Hotels & Resorts Inc CEO James Risoleo Sells 11,668 SharesJames Risoleo, the President and CEO of Host Hotels & Resorts Inc (NASDAQ:HST), has sold 11,668 shares of the company on December 22, 2023, according to a recent SEC filing. |

HST Price Returns

| 1-mo | -1.20% |

| 3-mo | -6.44% |

| 6-mo | -9.53% |

| 1-year | 5.16% |

| 3-year | 20.71% |

| 5-year | 14.87% |

| YTD | -8.47% |

| 2023 | 27.61% |

| 2022 | -4.62% |

| 2021 | 18.86% |

| 2020 | -19.71% |

| 2019 | 16.65% |

HST Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching HST

Here are a few links from around the web to help you further your research on Host Hotels & Resorts Inc's stock as an investment opportunity:Host Hotels & Resorts Inc (HST) Stock Price | Nasdaq

Host Hotels & Resorts Inc (HST) Stock Quote, History and News - Yahoo Finance

Host Hotels & Resorts Inc (HST) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...