Huize Holding Ltd. ADR (HUIZ): Price and Financial Metrics

HUIZ Price/Volume Stats

| Current price | $0.62 | 52-week high | $2.08 |

| Prev. close | $0.62 | 52-week low | $0.43 |

| Day low | $0.58 | Volume | 20,600 |

| Day high | $0.63 | Avg. volume | 32,794 |

| 50-day MA | $0.65 | Dividend yield | N/A |

| 200-day MA | $0.91 | Market Cap | 31.47M |

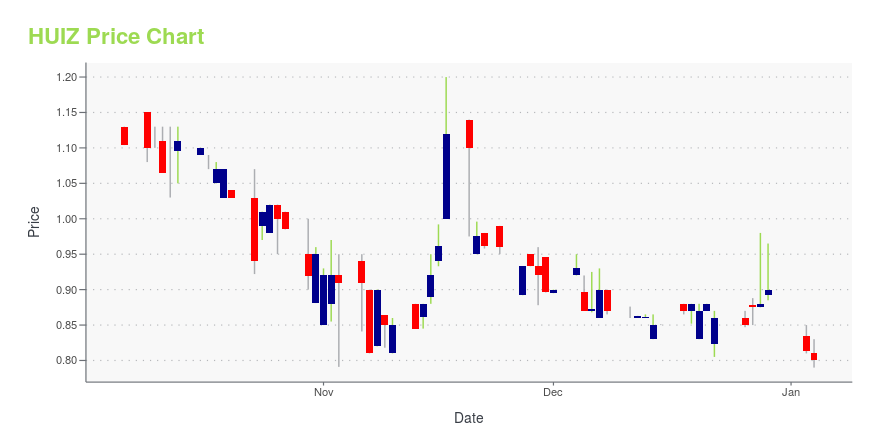

HUIZ Stock Price Chart Interactive Chart >

Huize Holding Ltd. ADR (HUIZ) Company Bio

Huize Holding Ltd. engages in the provision of insurance brokerage services through online platform. It distributes insurance products underwritten by insurer partners, and help them to reach a large number of insurance clients. The company was founded by Cunjun Ma in 2006 and is headquartered in Shenzhen, China.

Latest HUIZ News From Around the Web

Below are the latest news stories about HUIZE HOLDING LTD that investors may wish to consider to help them evaluate HUIZ as an investment opportunity.

Huize Partners with PICC Life Insurance to Launch “Darwin Critical Care No.8 – Advanced” – A Customized Critical Illness Insurance ProductSHENZHEN, China, Dec. 15, 2023 (GLOBE NEWSWIRE) -- Huize Holding Limited, (“Huize”, the “Company” or “we”) (NASDAQ: HUIZ), a leading digital insurance product and service platform for new generation consumers in China, today announced that it has partnered with PICC Life Insurance Company Limited (“PICC Life”) to launch “Darwin Critical Care No.8 – Advanced”, the latest customized critical illness insurance product in the “Darwin Critical Care” series, first launched in 2018. “Darwin Critical Ca |

Huize Holding Limited (NASDAQ:HUIZ) Q3 2023 Earnings Call TranscriptHuize Holding Limited (NASDAQ:HUIZ) Q3 2023 Earnings Call Transcript November 17, 2023 Operator: Ladies and gentlemen, thank you for standing by and welcome to the Huize Holding Limited Third Quarter 2023 Earnings Conference Call. At this time, all participants are in a listen-only mode. After the management’s prepared remarks, we will have a question-and-answer session. […] |

Q3 2023 Huize Holding Ltd Earnings CallQ3 2023 Huize Holding Ltd Earnings Call |

Huize Reports Third Quarter 2023 Unaudited Financial ResultsSHENZHEN, China, Nov. 17, 2023 (GLOBE NEWSWIRE) -- Huize Holding Limited, (“Huize”, the “Company” or “we”) (NASDAQ: HUIZ), a leading digital insurance product and service platform for new generation consumers in China, today announced its unaudited financial results for the third quarter ended September 30, 2023. Third Quarter 2023 Financial and Operational Highlights Driving high-quality growth: Gross Written Premiums (“GWP”) facilitated year to date on our platform were RMB4,555.5 million, inc |

Huize Partners with Dajia Annuity Insurance to Launch “Dajia Hui Xuan” – A Customized Retirement Annuity Insurance ProductSHENZHEN, China, Nov. 15, 2023 (GLOBE NEWSWIRE) -- Huize Holding Limited, (“Huize”, the “Company” or “we”) (NASDAQ: HUIZ), a leading digital insurance product and service platform for new generation consumers in China, today announced that it has partnered with Dajia Annuity Insurance Co., Ltd. (“Dajia Annuity Insurance”) to launch “Dajia Hui Xuan”, a customized retirement annuity insurance product. “Dajia Hui Xuan” is distinguished by three key product highlights: i) high flexibility: customers |

HUIZ Price Returns

| 1-mo | N/A |

| 3-mo | -6.13% |

| 6-mo | -34.73% |

| 1-year | -50.40% |

| 3-year | -91.28% |

| 5-year | N/A |

| YTD | -31.11% |

| 2023 | -34.79% |

| 2022 | -3.49% |

| 2021 | -79.57% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...