India Globalization Capital Inc. (IGC): Price and Financial Metrics

IGC Price/Volume Stats

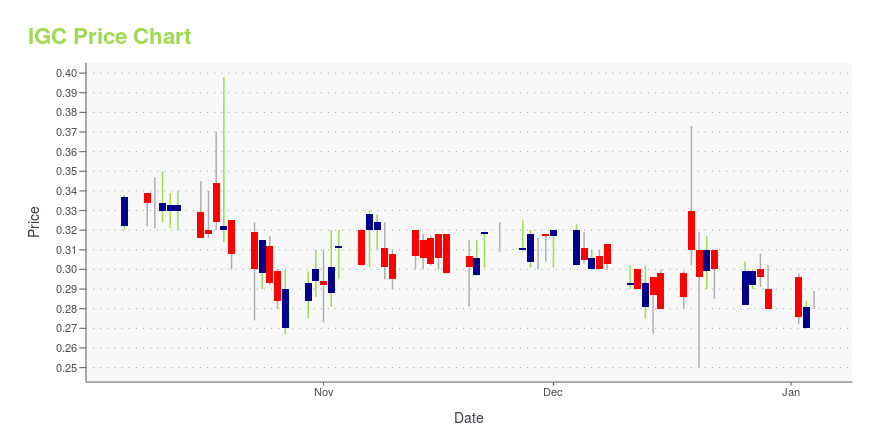

| Current price | $0.45 | 52-week high | $0.91 |

| Prev. close | $0.45 | 52-week low | $0.25 |

| Day low | $0.44 | Volume | 90,354 |

| Day high | $0.46 | Avg. volume | 590,037 |

| 50-day MA | $0.46 | Dividend yield | N/A |

| 200-day MA | $0.38 | Market Cap | 33.96M |

IGC Stock Price Chart Interactive Chart >

India Globalization Capital Inc. (IGC) Company Bio

India Globalization Capital, Inc. purchases and resells physical infrastructure commodities. The company operates through two segments, Infrastructure Business, and Life Sciences. It buys and sells infrastructure commodities, such as steel, wooden doors, marble, and tiles; rents heavy construction equipment, including motor grader, transit mixers and rollers; and undertakes highway construction contracts. The company also develops cannabinoid-based products and therapies, such as Hyalolex for the treatment of patients from anxiety, agitation, dementia, depression, and sleep disorder diseases; and Serosapse for the treatment of Parkinson's disease. In addition, it offers offer extraction, distillation, tolling, and white labeling services under the Holi Hemp brand; and hemp crude extracts, hemp isolates, and hemp distillates. The company operates in the United States, India, and Hong Kong. India Globalization Capital, Inc. was founded in 2005 and is based in Potomac, Maryland.

Latest IGC News From Around the Web

Below are the latest news stories about IGC PHARMA INC that investors may wish to consider to help them evaluate IGC as an investment opportunity.

Patent Granted to IGC Pharma for Groundbreaking Drug Formulation to Treat Agitation in Alzheimer’sPOTOMAC, Md., December 19, 2023--Patent Granted to IGC Pharma for Groundbreaking Drug Formulation to Treat Agitation in Alzheimer’s |

IGC Pharma Announces Participation in Biotech Showcase and BioPartnering @ JPM Alongside the J.P. Morgan 41st Annual Healthcare Conference 2024POTOMAC, Md., December 13, 2023--IGC Pharma Announces Participation in Biotech Showcase and BioPartnering @ JPM Alongside the J.P. Morgan 41st Annual Healthcare Conference 2024 |

IGC Pharma Announces Collaboration to Integrate AI into Clinical TrialsPOTOMAC, Md., December 06, 2023--IGC Pharma, Inc. ("IGC" or the "Company") (NYSE American: IGC) today announced an Artificial Intelligence (AI) collaboration with Los Andes University’s Center for Research and Training in Artificial Intelligence ("CINFONIA"). The partnership aims to leverage Generative AI (AI) to analyze variations in disease signatures among patients, enabling IGC Pharma to identify individuals more likely to respond to treatment and subsequently accelerate the delivery of trea |

IGC Pharma Announces Master Agreement with Leading South American University to Advance AI InitiativesPOTOMAC, Md., November 21, 2023--IGC Pharma Announces Master Agreement with Leading South American University to Advance AI Initiatives |

IGC Pharma Reports Second Quarter Fiscal 2024 ResultsPOTOMAC, Md., November 13, 2023--IGC Pharma Reports Second Quarter Fiscal 2024 Results. |

IGC Price Returns

| 1-mo | 6.89% |

| 3-mo | -1.75% |

| 6-mo | 57.89% |

| 1-year | 40.10% |

| 3-year | -74.58% |

| 5-year | -63.41% |

| YTD | 60.66% |

| 2023 | -11.95% |

| 2022 | -67.42% |

| 2021 | -37.40% |

| 2020 | 147.62% |

| 2019 | 125.00% |

Continue Researching IGC

Want to see what other sources are saying about India Globalization Capital Inc's financials and stock price? Try the links below:India Globalization Capital Inc (IGC) Stock Price | Nasdaq

India Globalization Capital Inc (IGC) Stock Quote, History and News - Yahoo Finance

India Globalization Capital Inc (IGC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...