InnSuites Hospitality Trust Shares of Beneficial Interest (IHT): Price and Financial Metrics

IHT Price/Volume Stats

| Current price | $1.56 | 52-week high | $2.33 |

| Prev. close | $1.62 | 52-week low | $0.95 |

| Day low | $1.50 | Volume | 1,300 |

| Day high | $1.57 | Avg. volume | 6,398 |

| 50-day MA | $1.60 | Dividend yield | 1.41% |

| 200-day MA | $1.42 | Market Cap | 14.08M |

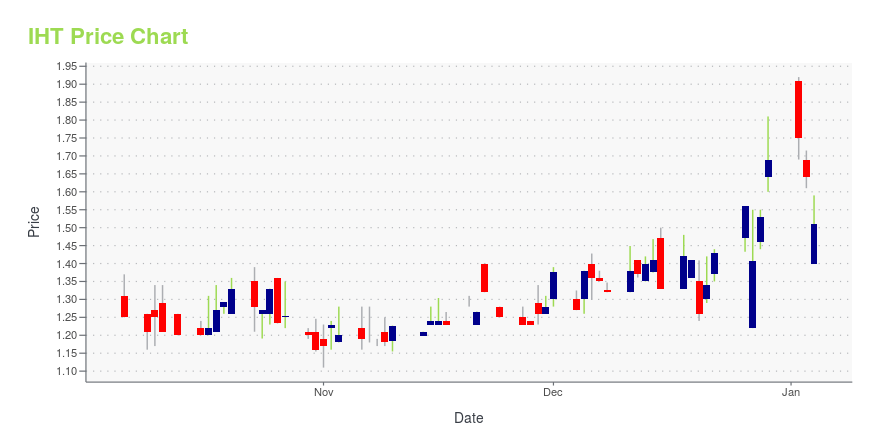

IHT Stock Price Chart Interactive Chart >

InnSuites Hospitality Trust Shares of Beneficial Interest (IHT) Company Bio

InnSuites Hospitality Trust (NYSE American symbol: IHT) first listed on the NYSE in 1971 is headquartered in Phoenix, Arizona is an unincorporated Ohio Business. Trust that owns and manages hotels under the InnSuites Hotels name. InnSuites® Hotels and Suites has owned real estate and hotels and provided hotel services including management, branding, and reservations to hotels under the brand name ÂInnSuites trademarked and owned by IHT over 40 years by being innovators for guest needs and recognizing hotel membership demands.

Latest IHT News From Around the Web

Below are the latest news stories about INNSUITES HOSPITALITY TRUST that investors may wish to consider to help them evaluate IHT as an investment opportunity.

Chairman James Wirth Acquires 2,000 Shares of InnSuites Hospitality Trust (IHT)James Wirth, Chairman of InnSuites Hospitality Trust (IHT), has increased his stake in the company by purchasing 2,000 shares on December 19, 2023, according to a recent SEC Filing. |

IHT Stock Earnings: InnSuites Hospitality Reported Results for Q3 2024InnSuites Hospitality just reported results for the third quarter of 2024. |

IHT THIRD FISCAL QUARTER REVENUES INCREASE 7%Phoenix, AZ, Dec. 07, 2023 (GLOBE NEWSWIRE) -- InnSuites Hospitality Trust (NYSE American: IHT) reported a continuation of improved results for the Third Quarter of Fiscal 2024, (August 1, 2023, to October 31, 2023), as Total Revenues increased to $1,824,499, which is an increase of 7%, compared to the prior year Fiscal Third Quarter of $1,704,612. The First Three Quarters of Fiscal 2024, (February 1, 2023, to October 31, 2023), remain strong, with Total Revenues up $211,769, at $5,751,583, up o |

Insider Buying: Chairman James Wirth Acquires Shares of InnSuites Hospitality Trust (IHT)In the realm of stock market movements, insider trading activity is often a significant indicator that garners the attention of investors. |

Insider Buying: Chairman James Wirth Acquires 2,000 Shares of InnSuites Hospitality TrustOn September 21, 2023, James Wirth, Chairman of InnSuites Hospitality Trust (IHT), purchased 2,000 shares of the company, further solidifying his investment in the hospitality trust. |

IHT Price Returns

| 1-mo | -13.32% |

| 3-mo | 9.66% |

| 6-mo | 16.21% |

| 1-year | -20.54% |

| 3-year | -69.85% |

| 5-year | 4.86% |

| YTD | -6.44% |

| 2023 | 2.33% |

| 2022 | -22.86% |

| 2021 | -0.34% |

| 2020 | 46.16% |

| 2019 | -1.33% |

IHT Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching IHT

Want to do more research on Innsuites Hospitality Trust's stock and its price? Try the links below:Innsuites Hospitality Trust (IHT) Stock Price | Nasdaq

Innsuites Hospitality Trust (IHT) Stock Quote, History and News - Yahoo Finance

Innsuites Hospitality Trust (IHT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...