Imax Corporation (IMAX): Price and Financial Metrics

IMAX Price/Volume Stats

| Current price | $20.09 | 52-week high | $20.70 |

| Prev. close | $19.40 | 52-week low | $13.20 |

| Day low | $19.39 | Volume | 2,156,700 |

| Day high | $20.49 | Avg. volume | 809,727 |

| 50-day MA | $16.78 | Dividend yield | N/A |

| 200-day MA | $16.32 | Market Cap | 1.06B |

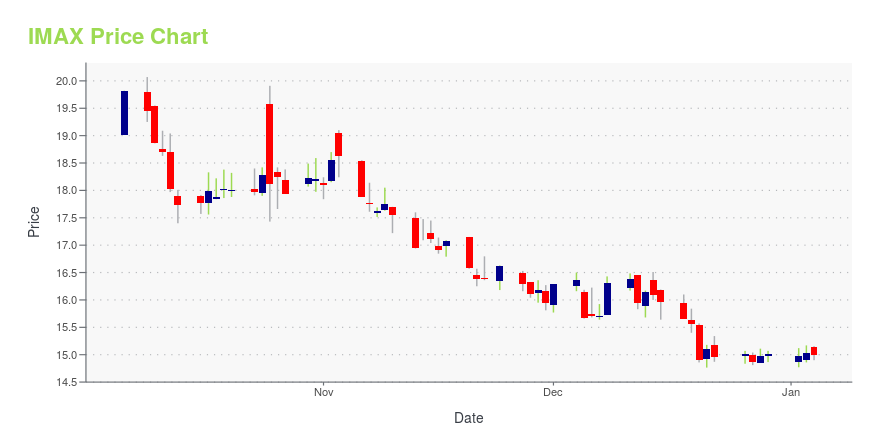

IMAX Stock Price Chart Interactive Chart >

Imax Corporation (IMAX) Company Bio

IMAX Corporation operates as an entertainment technology company specializing in motion picture technologies and presentations worldwide. The company operates in seven segments: IMAX Systems, Theater System Maintenance, Joint Revenue Sharing Arrangements, Film Production and IMAX Digital Re-Mastering, Film Distribution, Film Post-Production, and Other. The company was founded in 1967 and is based in Mississauga, Canada.

Latest IMAX News From Around the Web

Below are the latest news stories about IMAX CORP that investors may wish to consider to help them evaluate IMAX as an investment opportunity.

7 Growth Stocks Poised to Thrive in a Post-Fed Pivot WorldWith the Federal Reserve previously engaged in a bitter – and seemingly, at times desperate – struggle against blisteringly hot inflation, the narrative for growth stocks to buy now frankly didn’t resonate very well with many investors. |

Zacks Industry Outlook Highlights Warner Music, News, Lions Gate Entertainment and IMAXWarner Music, News, Lions Gate Entertainment and IMAX are part of the Zacks Industry Outlook article. |

4 Film & Television Production Stocks to Watch on Solid Industry TrendsFilm and television production and distribution companies like WMG, NWSA, LGF.A and IMAX are benefiting from higher consumption of digital entertainment and a recovering ad spending environment. |

IMAX Corporation's (NYSE:IMAX) Business Is Trailing The Industry But Its Shares Aren'tWhen close to half the companies in the Entertainment industry in the United States have price-to-sales ratios (or... |

Sidoti Events, LLC's Virtual December Small-Cap ConferenceNEW YORK, NY / ACCESSWIRE / December 5, 2023 / Sidoti Events, LLC, an affiliate of Sidoti & Company, LLC, has released the presentation schedule and weblinks for its two-day December Small-Cap Conference taking place Wednesday and Thursday, December ... |

IMAX Price Returns

| 1-mo | 18.60% |

| 3-mo | 17.14% |

| 6-mo | 42.08% |

| 1-year | 6.58% |

| 3-year | 19.23% |

| 5-year | -6.34% |

| YTD | 33.75% |

| 2023 | 2.46% |

| 2022 | -17.83% |

| 2021 | -1.00% |

| 2020 | -11.80% |

| 2019 | 8.61% |

Continue Researching IMAX

Here are a few links from around the web to help you further your research on Imax Corp's stock as an investment opportunity:Imax Corp (IMAX) Stock Price | Nasdaq

Imax Corp (IMAX) Stock Quote, History and News - Yahoo Finance

Imax Corp (IMAX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...