Informatica Inc. (INFA): Price and Financial Metrics

INFA Price/Volume Stats

| Current price | $24.27 | 52-week high | $39.80 |

| Prev. close | $23.99 | 52-week low | $18.18 |

| Day low | $23.70 | Volume | 1,467,000 |

| Day high | $24.42 | Avg. volume | 1,702,549 |

| 50-day MA | $28.71 | Dividend yield | N/A |

| 200-day MA | $29.04 | Market Cap | 7.16B |

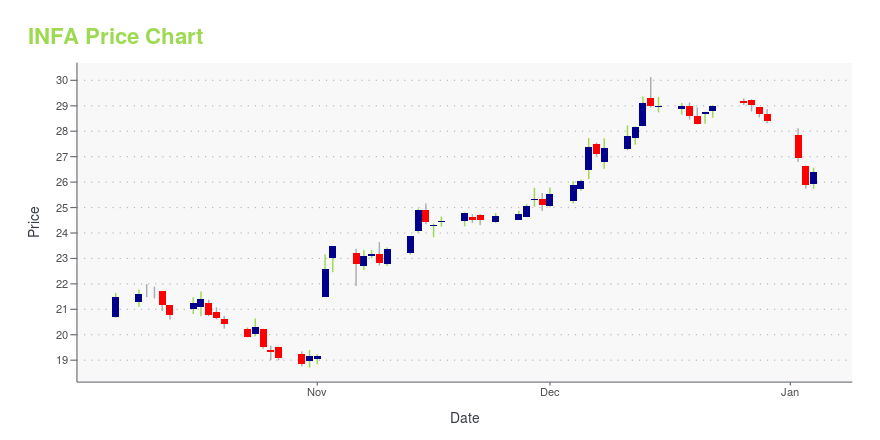

INFA Stock Price Chart Interactive Chart >

Informatica Inc. (INFA) Company Bio

Informatica, Inc. (California) engages in the development of intelligent data management cloud platform. Its software connects, manages, and unifies data across any multi-cloud hybrid system. The company was founded on June 4, 2021 and is headquartered in Redwood City, CA.

Latest INFA News From Around the Web

Below are the latest news stories about INFORMATICA INC that investors may wish to consider to help them evaluate INFA as an investment opportunity.

Is Informatica Inc. (NYSE:INFA) Trading At A 33% Discount?Key Insights The projected fair value for Informatica is US$43.59 based on 2 Stage Free Cash Flow to Equity Current... |

La Caixa Foundation Embarks on Digital Transformation with Informatica’s AI-Powered Cloud Data Management PlatformREDWOOD CITY, Calif., December 19, 2023--Informatica (NYSE: INFA), an enterprise cloud data management leader, today announced La Caixa Foundation, one of the most prominent foundations in the world by volume of social investment, has chosen Informatica’s AI-powered Intelligent Data Management CloudTM platform as one of the core components of its digital cloud transformation. This strategic collaboration aims to propel La Caixa Foundation into a new era of efficiency and agility by instilling a |

CLVT vs. INFA: Which Stock Is the Better Value Option?CLVT vs. INFA: Which Stock Is the Better Value Option? |

Jeff de Bruges Selects Informatica for AI-Powered Cloud Data Modernization ProjectREDWOOD CITY, Calif., December 13, 2023--Informatica (NYSE: INFA), an enterprise cloud data management leader, today announced that Jeff de Bruges, a fast-growing chocolate manufacturer in France, has selected Informatica’s AI-powered Intelligent Data Management CloudTM (IDMC) platform as a key component of its data modernization project. The combined solution from Informatica, KPMG, and Microsoft will help build a data-driven culture that will significantly improve the overall quality and use o |

EVP & Chief Customer Officer Ansa Sekharan Sells Over 150,000 Shares of Informatica IncIn a notable insider transaction, Ansa Sekharan, the Executive Vice President & Chief Customer Officer of Informatica Inc (NYSE:INFA), sold 150,841 shares of the company on December 7, 2023. |

INFA Price Returns

| 1-mo | -21.71% |

| 3-mo | -23.92% |

| 6-mo | -21.07% |

| 1-year | 30.41% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | -14.51% |

| 2023 | 74.28% |

| 2022 | -55.95% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...