The Intergroup Corporation (INTG): Price and Financial Metrics

INTG Price/Volume Stats

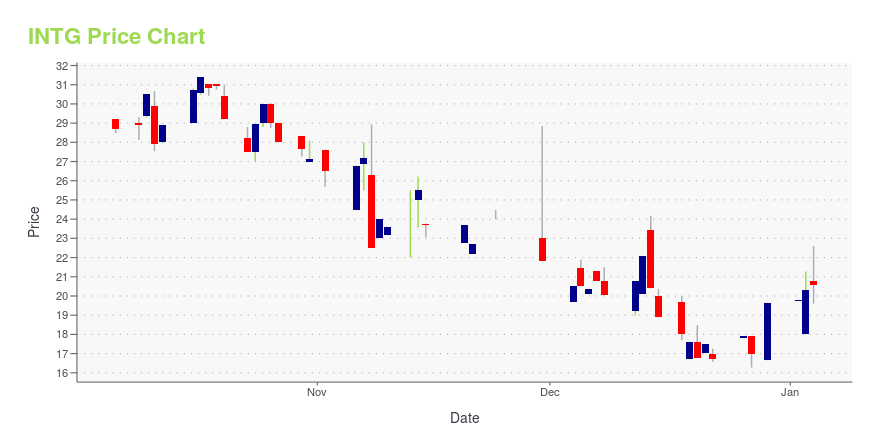

| Current price | $20.75 | 52-week high | $36.67 |

| Prev. close | $21.00 | 52-week low | $16.27 |

| Day low | $20.67 | Volume | 6,568 |

| Day high | $21.20 | Avg. volume | 6,858 |

| 50-day MA | $21.88 | Dividend yield | N/A |

| 200-day MA | $23.95 | Market Cap | 45.38M |

INTG Stock Price Chart Interactive Chart >

Latest INTG News From Around the Web

Below are the latest news stories about INTERGROUP CORP that investors may wish to consider to help them evaluate INTG as an investment opportunity.

InterGroup (NASDAQ:INTG) shareholders have earned a 10% CAGR over the last three yearsThe InterGroup Corporation ( NASDAQ:INTG ) shareholders might be concerned after seeing the share price drop 22% in the... |

InterGroup Third Quarter 2023 Earnings: US$0.16 loss per share (vs US$0.21 loss in 3Q 2022)InterGroup ( NASDAQ:INTG ) Third Quarter 2023 Results Key Financial Results Revenue: US$14.4m (up 37% from 3Q 2022... |

The InterGroup Corporation (NASDAQ:INTG) insiders have significant skin in the game with 70% ownershipKey Insights Significant insider control over InterGroup implies vested interests in company growth John Winfield owns... |

InterGroup's (NASDAQ:INTG) investors will be pleased with their splendid 101% return over the last five yearsThe most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, if... |

INTG Price Returns

| 1-mo | -3.40% |

| 3-mo | -5.42% |

| 6-mo | N/A |

| 1-year | -43.37% |

| 3-year | -54.08% |

| 5-year | N/A |

| YTD | 5.60% |

| 2023 | -58.31% |

| 2022 | -7.59% |

| 2021 | 61.29% |

| 2020 | -15.56% |

| 2019 | 16.37% |

Continue Researching INTG

Want to see what other sources are saying about Intergroup Corp's financials and stock price? Try the links below:Intergroup Corp (INTG) Stock Price | Nasdaq

Intergroup Corp (INTG) Stock Quote, History and News - Yahoo Finance

Intergroup Corp (INTG) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...