Intrepid Potash, Inc (IPI): Price and Financial Metrics

IPI Price/Volume Stats

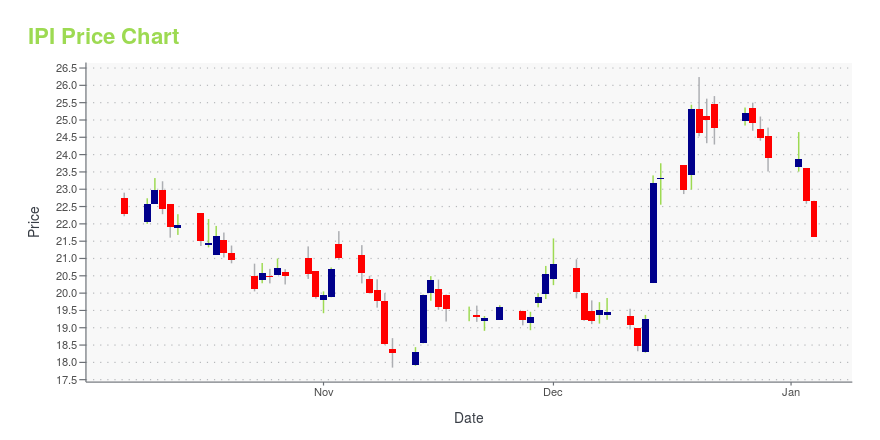

| Current price | $26.93 | 52-week high | $28.30 |

| Prev. close | $26.53 | 52-week low | $17.52 |

| Day low | $26.21 | Volume | 59,929 |

| Day high | $27.09 | Avg. volume | 104,269 |

| 50-day MA | $24.87 | Dividend yield | N/A |

| 200-day MA | $21.63 | Market Cap | 357.33M |

IPI Stock Price Chart Interactive Chart >

Intrepid Potash, Inc (IPI) Company Bio

Intrepid Potash is the main U.S. producer of potash and supplies, used for crop development, industrial applications and as an ingredient in animal feed. The company is based in Denver, Colorado.

Latest IPI News From Around the Web

Below are the latest news stories about INTREPID POTASH INC that investors may wish to consider to help them evaluate IPI as an investment opportunity.

Why Intrepid Potash Stock Is Popping This WeekThe fertilizer miner just told investors: We're really a lithium company, too. |

Intrepid Engages Pickering Energy Partners as Lithium AdvisorDenver, CO, Dec. 12, 2023 (GLOBE NEWSWIRE) -- Intrepid Potash, Inc. ("Intrepid," "we," or "our") (NYSE:IPI) today announced it engaged Pickering Energy Partners LP (“Pickering” or “PEP”) to advise on maximizing the value of the lithium resource at its mine in Wendover, Utah. Management Commentary Bob Jornayvaz, Intrepid's Executive Chairman and CEO commented: “I am excited to announce our engagement with Pickering to help us evaluate our options to capitalize on the value of the lithium that we |

Intrepid Potash, Inc. (NYSE:IPI) is largely controlled by institutional shareholders who own 53% of the companyKey Insights Significantly high institutional ownership implies Intrepid Potash's stock price is sensitive to their... |

Intrepid Potash (IPI) Q3 Earnings Lag Estimates, Sales Down Y/YIntrepid Potash (IPI) sees lower average net realized sales price for potash and Trio in the third quarter. |

Intrepid Potash, Inc. (NYSE:IPI) Q3 2023 Earnings Call TranscriptIntrepid Potash, Inc. (NYSE:IPI) Q3 2023 Earnings Call Transcript November 9, 2023 Operator: Thank you for standing by. This is the conference operator. Welcome to the Intrepid Potash, Inc. Third Quarter 2023 Results Conference Call. As a reminder, all participants are in a listen-only mode and the conference is being recorded. [Operator Instructions] I would […] |

IPI Price Returns

| 1-mo | 14.26% |

| 3-mo | 37.89% |

| 6-mo | 35.19% |

| 1-year | -1.86% |

| 3-year | -10.35% |

| 5-year | -23.71% |

| YTD | 12.72% |

| 2023 | -17.25% |

| 2022 | -32.44% |

| 2021 | 76.94% |

| 2020 | -10.89% |

| 2019 | 4.23% |

Continue Researching IPI

Here are a few links from around the web to help you further your research on Intrepid Potash Inc's stock as an investment opportunity:Intrepid Potash Inc (IPI) Stock Price | Nasdaq

Intrepid Potash Inc (IPI) Stock Quote, History and News - Yahoo Finance

Intrepid Potash Inc (IPI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...