Iron Mountain Inc. (IRM): Price and Financial Metrics

IRM Price/Volume Stats

| Current price | $98.50 | 52-week high | $101.38 |

| Prev. close | $96.90 | 52-week low | $56.51 |

| Day low | $97.14 | Volume | 1,193,300 |

| Day high | $99.18 | Avg. volume | 1,596,198 |

| 50-day MA | $88.87 | Dividend yield | 2.58% |

| 200-day MA | $74.70 | Market Cap | 28.87B |

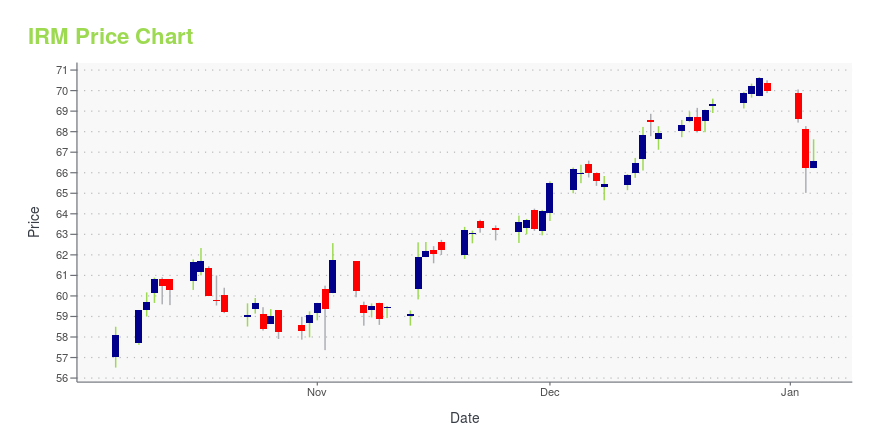

IRM Stock Price Chart Interactive Chart >

Iron Mountain Inc. (IRM) Company Bio

Iron Mountain Inc. was founded in 1951 in Livingston, New York by Herman Knaust. Iron Mountain provides records, information management services, and data management services, along with the complex storage and information management such as rising storage rental costs, and increased litigation, and disaster recovery requirements. The company’s solutions serve several different industries including the banking, energy, entertainment, fine arts, healthcare, insurance, law firms, pharmaceutical, and retail sectors. Iron Mountain operates several data centers across the United States, Europe, and Asia in highly secure and compliant colocation facilities. William Meaney serves as President and Chief Executive Officer and the company is headquartered in Boston, Massachusetts.

Latest IRM News From Around the Web

Below are the latest news stories about IRON MOUNTAIN INC that investors may wish to consider to help them evaluate IRM as an investment opportunity.

Data Center Dynamos: 3 Stocks Powering the Information AgeThese top data center stocks can reward long-term investors due to artificial intelligence and the information age. |

Is Iron Mountain (IRM) Stock Apt for Your Portfolio Now?A recurring revenue business model, expansion into the data center business and a strong balance sheet position are likely to drive Iron Mountain's (IRM) performance despite high rates and competition. |

Iron Mountain Inc CEO William Meaney Sells Over $1.3 Million in Company StockIron Mountain Inc (NYSE:IRM), a global leader in storage and information management services, has recently witnessed a significant insider sell by its President and CEO, William Meaney. |

It Might Be Time to Sell These 2 Stocks -- Here's WhyFool.com contributors Matt Frankel and Tyler Crowe generally buy stocks with the long term in mind, but they also sell stocks regularly, and for a variety of reasons. In this video, hear why Tyler recently pulled the plug on Iron Mountain (NYSE: IRM) and why Frankel is thinking of unloading Goldman Sachs (NYSE: GS). |

Insider Sell Alert: EVP Deborah Marson Sells Shares of Iron Mountain IncIron Mountain Inc (NYSE:IRM), a global leader in storage and information management services, has recently witnessed an insider sell that has caught the attention of investors and market analysts alike. |

IRM Price Returns

| 1-mo | 11.36% |

| 3-mo | 28.01% |

| 6-mo | 48.08% |

| 1-year | 67.10% |

| 3-year | 155.81% |

| 5-year | 338.71% |

| YTD | 42.96% |

| 2023 | 46.52% |

| 2022 | -0.09% |

| 2021 | 87.74% |

| 2020 | 0.97% |

| 2019 | 5.87% |

IRM Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching IRM

Want to see what other sources are saying about Iron Mountain Inc's financials and stock price? Try the links below:Iron Mountain Inc (IRM) Stock Price | Nasdaq

Iron Mountain Inc (IRM) Stock Quote, History and News - Yahoo Finance

Iron Mountain Inc (IRM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...