iSun Inc. (ISUN): Price and Financial Metrics

ISUN Price/Volume Stats

| Current price | $0.05 | 52-week high | $0.64 |

| Prev. close | $0.07 | 52-week low | $0.03 |

| Day low | $0.03 | Volume | 2,732,600 |

| Day high | $0.07 | Avg. volume | 2,658,435 |

| 50-day MA | $0.16 | Dividend yield | N/A |

| 200-day MA | $0.21 | Market Cap | 2.25M |

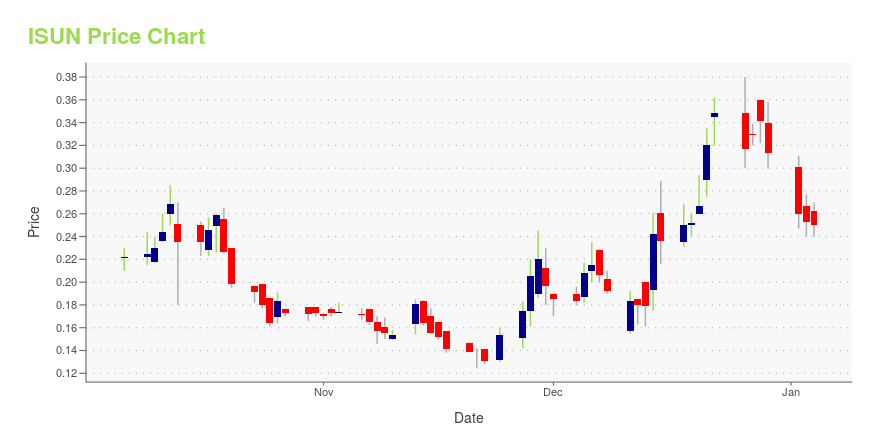

ISUN Stock Price Chart Interactive Chart >

iSun Inc. (ISUN) Company Bio

iSun, Inc. operates as a solar engineering, construction, and procurement contractor for commercial and industrial customers in the Northeastern United States. It also provides electrical contracting services; and data and communication services. The company was formerly known as The Peck Company Holdings, Inc. and changed its name to iSun, Inc. in January 2021. iSun, Inc. was founded in 1972 and is headquartered in South Burlington, Vermont.

Latest ISUN News From Around the Web

Below are the latest news stories about ISUN INC that investors may wish to consider to help them evaluate ISUN as an investment opportunity.

Next2Sun and iSun Build First Vertical Agrivoltaics System in the USADILLINGEN, Germany, December 21, 2023--The US solar company iSun, Inc. (NASDAQ: ISUN) ("iSun") and the German agrivoltaics pioneer Next2Sun Mounting Systems GmbH ("Next2Sun") have been cooperating since the beginning of 2023 to jointly establish Next2Sun's vertical agrivoltaics system in the USA. Construction of the first agrivoltaics plant with Next2Sun system will begin in Vermont in early 2024. |

iSun Inc. Secures $8.0 million Term LoanWILLISTON, Vt., December 14, 2023--iSun, Inc. (NASDAQ: ISUN) (the "Company," or "iSun"), a leading solar energy and clean mobility infrastructure company with 50-years of experience accelerating the adoption of innovative electrical technologies, today announced the closing of an $8.0 million senior secured loan with Decathlon Capital Partners, the country’s largest revenue-based funding investor, to refinance in full the prior senior secured convertible facility which had become overly dilutive |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on MondayIt's time to start the trading week with a look at the biggest pre-market stock movers worth watching for Monday morning! |

iSun files for $50M common stock shelfMore on iSun |

iSun, Inc. (NASDAQ:ISUN) Q3 2023 Earnings Call TranscriptiSun, Inc. (NASDAQ:ISUN) Q3 2023 Earnings Call Transcript November 14, 2023 Operator: Greetings. Welcome to the iSun Energy Third Quarter 2023 Earnings Conference Call. At this time, all participants are in a listen-only mode. A question-and-answer session will follow the formal presentation. [Operator Instructions]. Please note, this conference is being recorded. I will now turn […] |

ISUN Price Returns

| 1-mo | N/A |

| 3-mo | -70.24% |

| 6-mo | -77.97% |

| 1-year | -88.64% |

| 3-year | -99.43% |

| 5-year | N/A |

| YTD | -84.04% |

| 2023 | -76.63% |

| 2022 | -77.52% |

| 2021 | 0.17% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...