Gartner Inc. (IT): Price and Financial Metrics

IT Price/Volume Stats

| Current price | $470.92 | 52-week high | $486.54 |

| Prev. close | $461.99 | 52-week low | $323.61 |

| Day low | $460.19 | Volume | 424,650 |

| Day high | $472.14 | Avg. volume | 401,628 |

| 50-day MA | $446.03 | Dividend yield | N/A |

| 200-day MA | $439.20 | Market Cap | 36.56B |

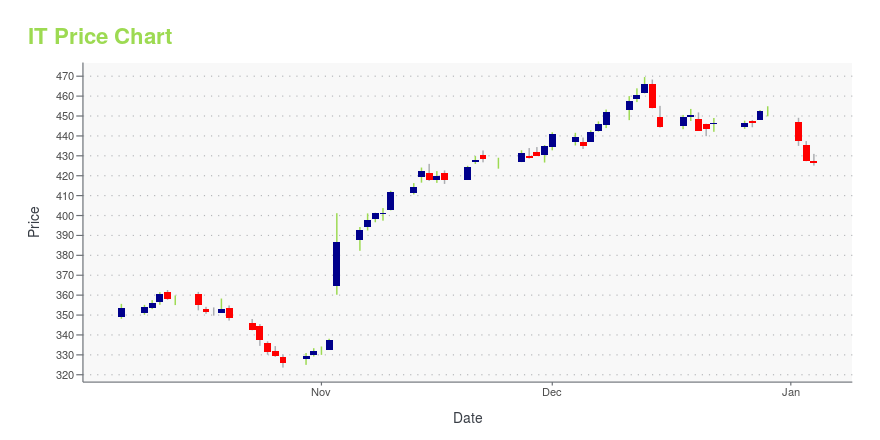

IT Stock Price Chart Interactive Chart >

Gartner Inc. (IT) Company Bio

Gartner, Inc is a technological research and consulting firm based in Stamford, Connecticut that conducts research on technology and shares this research both through private consulting as well as executive programs and conferences. Its clients include large corporations, government agencies, technology companies, and investment firms. (Source:Wikipedia)

Latest IT News From Around the Web

Below are the latest news stories about GARTNER INC that investors may wish to consider to help them evaluate IT as an investment opportunity.

Insider Sell Alert: EVP & CHRO Robin Kranich Sells 1,444 Shares of Gartner Inc (IT)Robin Kranich, the Executive Vice President and Chief Human Resources Officer (CHRO) of Gartner Inc, has recently sold 1,444 shares of the company's stock. |

Subdued Growth No Barrier To Gartner, Inc.'s (NYSE:IT) PriceWith a price-to-earnings (or "P/E") ratio of 37.2x Gartner, Inc. ( NYSE:IT ) may be sending very bearish signals at the... |

Best Momentum Stocks to Buy for December 18thPLAB, DFH and IT made it to the Zacks Rank #1 (Strong Buy) momentum stocks list on December 18, 2023. |

How Fast-Growing SASE Market Will Impact Cybersecurity StocksSecure Access Service Edge, or SASE, took off as businesses scrambled to maintain their corporate networks after the sudden shift to remote work during pandemic lockdowns. The lockdown era is over, but remote work and SASE are still going strong. What Is SASE? |

Cybersecurity Growth Prospects Remain AttractiveThis has been another eventful year on the cybersecurity front. Investors need not look any further than the Las Vegas Strip for confirmation of that. Ransomware attacks were carried out earlier this year on Caesars Entertainment (NASDAQ: CZR) and MGM Resorts International (NYSE: MGM), among other well-known corporations. Those are among the reasons the WisdomTree [...] |

IT Price Returns

| 1-mo | 5.47% |

| 3-mo | 4.93% |

| 6-mo | 2.19% |

| 1-year | 33.12% |

| 3-year | 77.88% |

| 5-year | 175.33% |

| YTD | 4.39% |

| 2023 | 34.20% |

| 2022 | 0.54% |

| 2021 | 108.70% |

| 2020 | 3.95% |

| 2019 | 20.54% |

Continue Researching IT

Want to do more research on Gartner Inc's stock and its price? Try the links below:Gartner Inc (IT) Stock Price | Nasdaq

Gartner Inc (IT) Stock Quote, History and News - Yahoo Finance

Gartner Inc (IT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...