JanOne Inc. (JAN): Price and Financial Metrics

JAN Price/Volume Stats

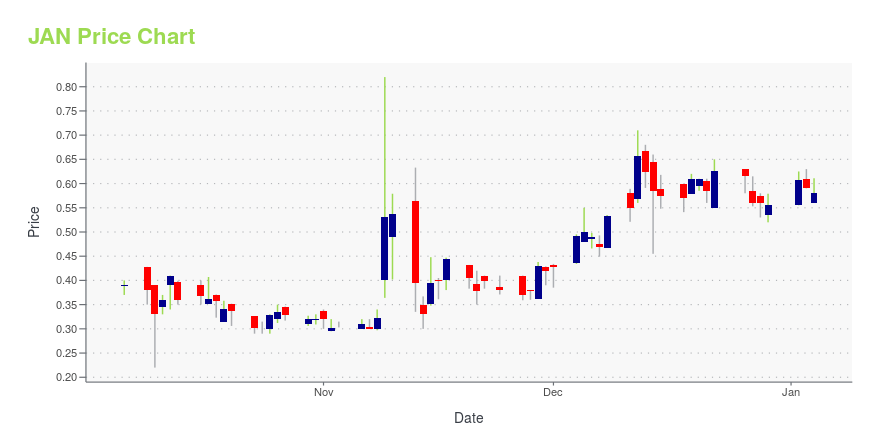

| Current price | $2.23 | 52-week high | $5.26 |

| Prev. close | $2.14 | 52-week low | $0.22 |

| Day low | $2.14 | Volume | 139,500 |

| Day high | $2.37 | Avg. volume | 229,417 |

| 50-day MA | $2.88 | Dividend yield | N/A |

| 200-day MA | $1.64 | Market Cap | 20.02M |

JAN Stock Price Chart Interactive Chart >

JanOne Inc. (JAN) Company Bio

JanOne Inc. develops treatments for conditions that cause severe pain. The company, through its non-addictive pain-relieving drugs, focuses on reduction for need of opioid prescriptions to treat disease associated pain that can lead to opioid abuse. Its lead candidate JAN101 provides slow-release formulation of sodium nitrite therapeutic for treatment of peripheral artery disease (PAD). The company was formerly known as Appliance Recycling Centers of America, Inc. and changed its name to JanOne Inc. in September 2019. JanOne Inc. was founded in 1976 and is headquartered in Las Vegas, Nevada.

JAN Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 337.25% |

| 3-year | -19.49% |

| 5-year | -33.83% |

| YTD | N/A |

| 2024 | 0.00% |

| 2023 | -59.49% |

| 2022 | -66.50% |

| 2021 | -16.36% |

| 2020 | 65.20% |

Loading social stream, please wait...