Johnson Controls International PLC (JCI): Price and Financial Metrics

JCI Price/Volume Stats

| Current price | $68.77 | 52-week high | $74.23 |

| Prev. close | $66.72 | 52-week low | $47.90 |

| Day low | $67.71 | Volume | 4,794,459 |

| Day high | $69.23 | Avg. volume | 5,324,303 |

| 50-day MA | $69.48 | Dividend yield | 2.14% |

| 200-day MA | $60.44 | Market Cap | 46.33B |

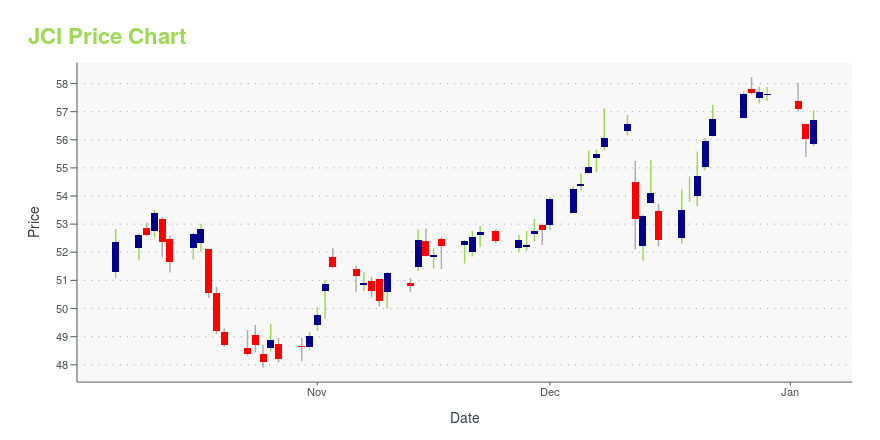

JCI Stock Price Chart Interactive Chart >

Johnson Controls International PLC (JCI) Company Bio

Johnson Controls International is an American Irish-domiciled multinational conglomerate headquartered in Cork, Ireland, that produces fire, HVAC, and security equipment for buildings. As of mid-2019, it employed 105,000 people in around 2,000 locations across six continents. As of 2017, it was listed as 389th in the Fortune Global 500; in 2017, it became ineligible for the Fortune 500, as it was headquartered outside the U.S. (Source:Wikipedia)

Latest JCI News From Around the Web

Below are the latest news stories about JOHNSON CONTROLS INTERNATIONAL PLC that investors may wish to consider to help them evaluate JCI as an investment opportunity.

Reasons Why You Should Avoid Betting on Johnson Controls (JCI)Weakness in the Global Products segment, increasing costs and unfavorable foreign-currency movement are weighing on Johnson Controls' (JCI) operations. |

Johnson Controls International plc (JCI) was Impacted by a Cyber AttackDiamond Hill Capital, an investment management company, released its “Long-Short Fund” third-quarter 2023 investor letter. A copy of the same can be downloaded here. The positive returns of the portfolio outperformed the Russell 1000 Index and the blended benchmark (60% Russell 1000 Index/40% Bloomberg US Treasury Bills 1-3 Month Index), both of which were negative in […] |

2 Stocks Down 17% and 18% to Buy for 2024The market rally has left these two stocks behind, offering a great opportunity for forward-looking investors. |

Time to Buy This Dividend Stock on a Dip?Investors need to take a pragmatic approach to the investment proposition at this industrial company. |

Decoding Johnson Controls International PLC (JCI): A Strategic SWOT InsightUnveiling the Strengths and Challenges: A Deep Dive into Johnson Controls International PLC (JCI) SWOT Analysis |

JCI Price Returns

| 1-mo | 4.34% |

| 3-mo | 6.20% |

| 6-mo | 22.89% |

| 1-year | 1.69% |

| 3-year | 4.17% |

| 5-year | 87.86% |

| YTD | 20.65% |

| 2023 | -7.63% |

| 2022 | -19.29% |

| 2021 | 77.42% |

| 2020 | 17.70% |

| 2019 | 40.91% |

JCI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching JCI

Want to see what other sources are saying about Johnson Controls International plc's financials and stock price? Try the links below:Johnson Controls International plc (JCI) Stock Price | Nasdaq

Johnson Controls International plc (JCI) Stock Quote, History and News - Yahoo Finance

Johnson Controls International plc (JCI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...