JOANN Inc. (JOAN): Price and Financial Metrics

JOAN Price/Volume Stats

| Current price | $0.10 | 52-week high | $2.19 |

| Prev. close | $0.11 | 52-week low | $0.08 |

| Day low | $0.08 | Volume | 4,427,700 |

| Day high | $0.10 | Avg. volume | 1,225,765 |

| 50-day MA | $0.39 | Dividend yield | N/A |

| 200-day MA | $0.71 | Market Cap | 4.06M |

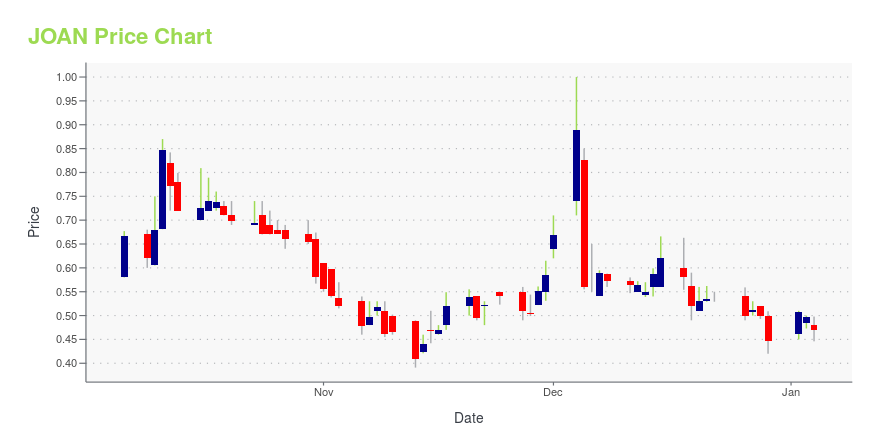

JOAN Stock Price Chart Interactive Chart >

JOANN Inc. (JOAN) Company Bio

JOANN Inc. operates as a specialty retailer of sewing, and arts and crafts category products in the United States. Its products in sewing category include cotton fabrics; warm fabrics, such as fleece and flannel fabrics; home decorating and utility fabrics and accessories; fashion and sportswear fabrics; special occasion fabrics; seasonally themed and licensed fabric designs; and sewing supplies, including cutting implements, threads, zippers, trims, tapes, pins, elastic, and buttons, as well as patterns for sewing projects. The company's products in arts and crafts, home décor, and other category comprise yarn and yarn accessories, and needlecraft kits and supplies; paper crafting components; craft materials; fine art materials; sewing machines, craft technology, lighting, irons, organizers, and other products; artificial floral products; seasonal décor and entertaining products; home décor accessories; ready-made frames; related books and magazines; and non-merchandise products. JOANN Inc. offers products through retail stores, as well as online. As of February 1, 2020, it operated 867 retail stores in 49 states. The company was formerly known as Jo-Ann Stores Holdings Inc. and changed its name to JOANN Inc. in February 2021. JOANN Inc. was founded in 1943 and is based in Hudson, Ohio.

Latest JOAN News From Around the Web

Below are the latest news stories about JOANN INC that investors may wish to consider to help them evaluate JOAN as an investment opportunity.

JOANN Inc. (NASDAQ:JOAN) Q3 2024 Earnings Call TranscriptJOANN Inc. (NASDAQ:JOAN) Q3 2024 Earnings Call Transcript December 4, 2023 JOANN Inc. misses on earnings expectations. Reported EPS is $-0.21 EPS, expectations were $-0.19. Operator: Hello, and welcome to the JOANN Third Quarter Fiscal 2024 Earnings Conference Call. [Operator Instructions]. Please note this event is being recorded. I’d like to remind everyone that comments […] |

JOANN Inc. (JOAN) Q3 2024 Earnings Call TranscriptJOANN Inc. (JOAN) Q3 2024 Earnings Conference Call December 4, 2023 5:00 PM ET Company Participants Christopher DiTullio - Executive Vice President and Chief Customer Officer Scott Sekella - Executive Vice President and Chief Financial Officer Rob Will - Executive Vice President and Merchandising Officer Conference Call Participants Laura Champine - Loop Capital Markets Peter Keith - Piper Sandler Cristina Fernández - Telsey Advisory Group David Lantz - Wells Fargo Steven Forbes - Guggenheim Securities Presentation Operator Hello, and welcome to the JOANN Third Quarter Fiscal 2024 Earnings Conference Call. [Operator Instr... |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on TuesdayIt's time to dive into the biggest pre-market stock movers as we check out all of the hottest trading news for Tuesday morning! |

JOANN (JOAN) Q3 Loss Wider Than Expected, Sales Decline Y/YJOANN (JOAN) navigates a complex consumer landscape in Q3 with a focus on e-commerce growth, strategic cost management and targeted marketing initiatives, positioning itself for sustained success. |

JOANN Announces Third Quarter Fiscal 2024 Results And Increases Top-Line Full Year OutlookNet sales totaled $539.8 million; eCommerce sales up 11.5% to last yearGross profit of $282.1 million increased 0.4% compared to the third quarter of last year52.3% gross margin, a 240-basis point year-over-year improvementLine of sight to now deliver $225 million in targeted annual cost reductions under Focus, Simplify and Grow initiative HUDSON, Ohio, Dec. 04, 2023 (GLOBE NEWSWIRE) -- JOANN Inc. (NASDAQ: JOAN) (“JOANN”), the nation’s category leader in fabric and sewing with one of the largest |

JOAN Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | -76.99% |

| 1-year | -90.91% |

| 3-year | -99.32% |

| 5-year | N/A |

| YTD | -77.58% |

| 2023 | -84.35% |

| 2022 | -71.56% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...