GEE Group Inc. (JOB): Price and Financial Metrics

JOB Price/Volume Stats

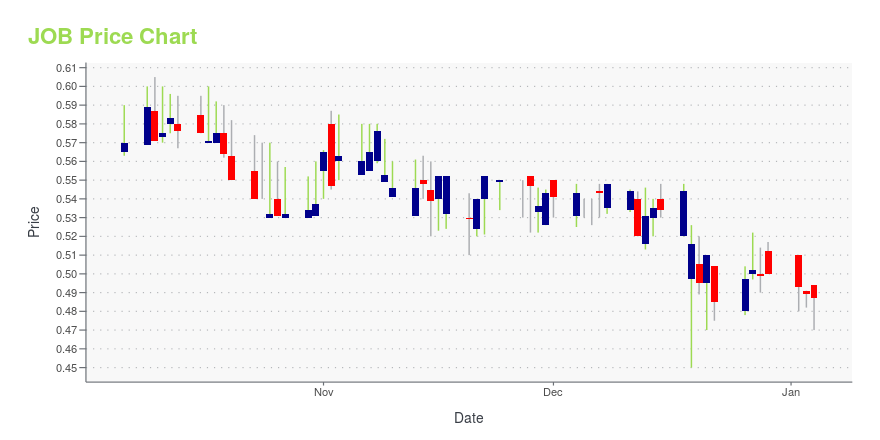

| Current price | $0.31 | 52-week high | $0.63 |

| Prev. close | $0.31 | 52-week low | $0.24 |

| Day low | $0.30 | Volume | 259,200 |

| Day high | $0.32 | Avg. volume | 262,445 |

| 50-day MA | $0.32 | Dividend yield | N/A |

| 200-day MA | $0.42 | Market Cap | 33.83M |

JOB Stock Price Chart Interactive Chart >

GEE Group Inc. (JOB) Company Bio

GEE Group, Inc. provides permanent and temporary professional, industrial, and physician assistant staffing and placement services in the United States. It operates in two segments, Industrial Staffing Services and Professional Staffing Services. The company offers professional placement services comprising placement of information technology, engineering, medical, and accounting professionals on regular placement basis or a temporary contract basis; and temporary staffing services for light industrial clients. The company provides medical data entry assistants, who offer electronic medical record services for emergency departments, specialty physician practices, and clinics. It offers professional and commercial staffing services under the names of Access Data Consulting, Agile Resources, Ashley Ellis, General Employment, Omni-One, Paladin Consulting, and Triad; medical staffing services under the Scribe Solutions brand; and contract and direct hire professional staffing services under the Accounting Now, SNI Technology, Legal Now, SNI Financial, Staffing Now, SNI Energy, and SNI Certes brands. The company was formerly known as General Employment Enterprises, Inc. and changed its name to GEE Group, Inc. in July 2016. GEE Group, Inc. was founded in 1893 and is headquartered in Jacksonville, Florida.

Latest JOB News From Around the Web

Below are the latest news stories about GEE GROUP INC that investors may wish to consider to help them evaluate JOB as an investment opportunity.

11 Popular Penny Stocks on RobinhoodIn this article, we discuss the 11 popular penny stocks on Robinhood. If you want to skip our detailed analysis of these stocks, go directly to 5 Popular Penny Stocks on Robinhood. Even though the United States economy has battled recession fears in the past few months, there are many reasons to be optimistic about […] |

GEE Group, Inc. (AMEX:JOB) Q4 2023 Earnings Call TranscriptGEE Group, Inc. (AMEX:JOB) Q4 2023 Earnings Call Transcript December 19, 2023 JOB isn’t one of the 30 most popular stocks among hedge funds at the end of the third quarter (see the details here). Derek Dewan: Hello, and welcome to the GEE Group Fiscal Fourth Quarter and Year End September 30, 2023 Earnings and […] |

Q4 2023 GEE Group Inc Earnings CallQ4 2023 GEE Group Inc Earnings Call |

JOB Stock Earnings: GEE Group Misses Revenue for Q4 2023JOB stock results show that GEE Group missed on revenue for the fourth quarter of 2023. |

GEE Group Announces Results for the Fiscal 2023 Full Year and Fourth QuarterJACKSONVILLE, FL / ACCESSWIRE / December 18, 2023 / GEE Group Inc. (NYSE American:JOB) together with its subsidiaries (collectively referred to as the "Company," "GEE Group," "our" or "we"), a provider of professional staffing services and human resource ... |

JOB Price Returns

| 1-mo | -1.52% |

| 3-mo | -3.19% |

| 6-mo | -35.24% |

| 1-year | -34.74% |

| 3-year | -34.35% |

| 5-year | -49.18% |

| YTD | -38.02% |

| 2023 | 2.08% |

| 2022 | -14.04% |

| 2021 | -42.74% |

| 2020 | 155.26% |

| 2019 | -44.52% |

Continue Researching JOB

Want to do more research on GEE Group Inc's stock and its price? Try the links below:GEE Group Inc (JOB) Stock Price | Nasdaq

GEE Group Inc (JOB) Stock Quote, History and News - Yahoo Finance

GEE Group Inc (JOB) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...