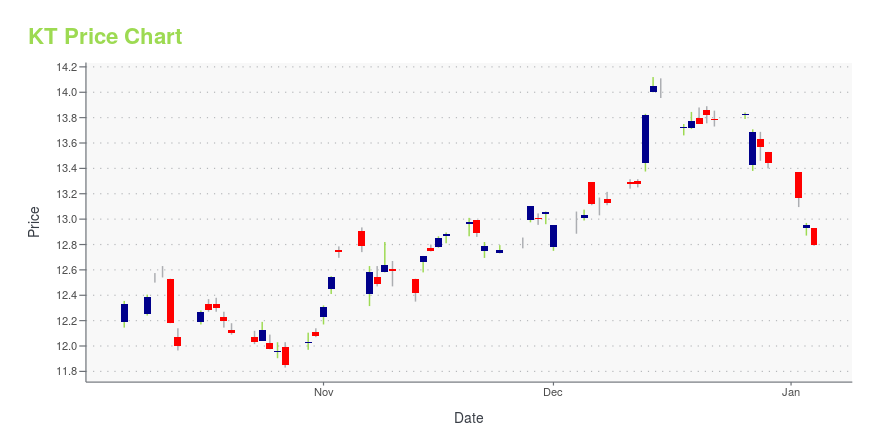

KT Corporation (KT): Price and Financial Metrics

KT Price/Volume Stats

| Current price | $14.10 | 52-week high | $15.35 |

| Prev. close | $13.85 | 52-week low | $11.63 |

| Day low | $13.94 | Volume | 353,900 |

| Day high | $14.12 | Avg. volume | 791,806 |

| 50-day MA | $13.46 | Dividend yield | 5.47% |

| 200-day MA | $13.30 | Market Cap | 7.27B |

KT Stock Price Chart Interactive Chart >

KT Corporation (KT) Company Bio

KT Corporation offers mobile voice and data telecommunication services in Korea, including fixed-line telephone services, local, domestic long-distance and international long-distance fixed-line, and voice over Internet protocol telephone services. The company was founded in 1981 and is based in Seongnam, South Korea.

Latest KT News From Around the Web

Below are the latest news stories about KT CORP that investors may wish to consider to help them evaluate KT as an investment opportunity.

Epsilon Awarded Global Company of the Year Award by Frost & Sullivan for Its Market-leading Connectivity SolutionsFrost & Sullivan has awarded Epsilon Telecommunications the 2023 Global Company of the Year Award in the global data center connectivity industry. The company's cutting-edge Network as a Service (NaaS) platform Infiny distinguishes itself by offering customers private interconnectivity to an extensive and diverse ecosystem of cloud, Software as a Service (SaaS) and Internet exchange (IX) partners globally, as well as a suite of international networking and voice solutions. Epsilon is one of the |

KT Corporation (NYSE:KT) Q3 2023 Earnings Call TranscriptKT Corporation (NYSE:KT) Q3 2023 Earnings Call Transcript November 8, 2023 Young-Jin Kim: [Call starts abruptly] Our salary negotiations were reflected in Q4 last year, while we were able to smooth our content sourcing cost this year. In this regard, operating income has increased Y-o-Y in both consolidated and stand-alone basis to continue solid growth. […] |

South Korea Had High Hopes for 5G. What Happened?Things didn’t work out as expected, thanks in part to technical problems and a lack of consumer demand |

KT Corp (KT): A Comprehensive Analysis of Its Market ValueDelving into the intrinsic value of South Korea's largest fixed-line telecom operator |

KT Corporation (NYSE:KT) Q2 2023 Earnings Call TranscriptKT Corporation (NYSE:KT) Q2 2023 Earnings Call Transcript August 7, 2023 Operator: [Foreign Language] Good morning and good evening. Thank you all for joining this conference call. And now we will begin the conference of our 2023 Second Quarter Earnings Results by KT. We would like to have welcoming remarks from Mr. Seung-Hoon Chi, KT […] |

KT Price Returns

| 1-mo | 4.75% |

| 3-mo | 11.99% |

| 6-mo | 9.02% |

| 1-year | 22.09% |

| 3-year | -0.29% |

| 5-year | 19.63% |

| YTD | 6.01% |

| 2023 | -0.44% |

| 2022 | 7.40% |

| 2021 | 14.17% |

| 2020 | -5.09% |

| 2019 | -18.42% |

KT Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching KT

Want to do more research on Kt Corp's stock and its price? Try the links below:Kt Corp (KT) Stock Price | Nasdaq

Kt Corp (KT) Stock Quote, History and News - Yahoo Finance

Kt Corp (KT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...