Laureate Education, Inc. - (LAUR): Price and Financial Metrics

LAUR Price/Volume Stats

| Current price | $14.48 | 52-week high | $16.60 |

| Prev. close | $15.47 | 52-week low | $12.32 |

| Day low | $14.41 | Volume | 1,296,760 |

| Day high | $15.05 | Avg. volume | 748,248 |

| 50-day MA | $15.06 | Dividend yield | N/A |

| 200-day MA | $14.08 | Market Cap | 2.28B |

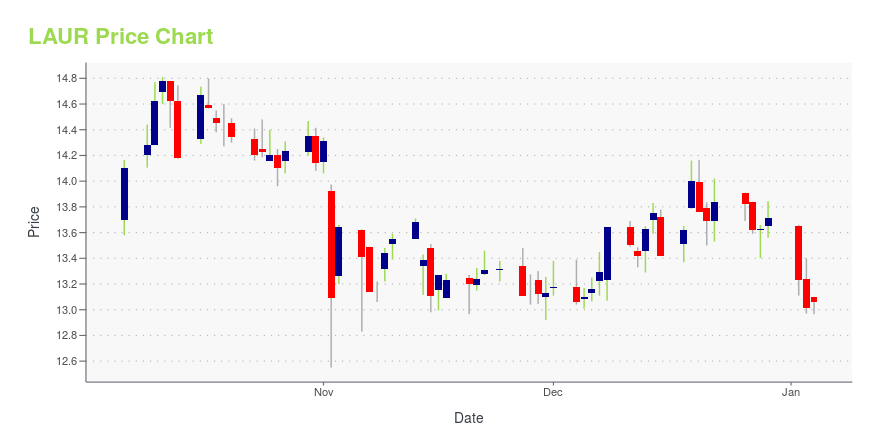

LAUR Stock Price Chart Interactive Chart >

Laureate Education, Inc. - (LAUR) Company Bio

Laureate Education, Inc. provides undergraduate, master’s, and doctoral degree programs in North America, Latin America, Europe, the Asia Pacific, Africa, and the Middle East. The company was founded in 1998 and is based in Baltimore, Maryland

Latest LAUR News From Around the Web

Below are the latest news stories about LAUREATE EDUCATION INC that investors may wish to consider to help them evaluate LAUR as an investment opportunity.

Should You Be Adding Laureate Education (NASDAQ:LAUR) To Your Watchlist Today?Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks... |

Laureate Education, Inc. (NASDAQ:LAUR) Q3 2023 Earnings Call TranscriptLaureate Education, Inc. (NASDAQ:LAUR) Q3 2023 Earnings Call Transcript November 5, 2023 Operator: Good day, and thank you for standing by. Welcome to the Third Quarter 2023 Laureate Education Inc., Earnings Conference Call. At this time, all participants are in a listen-only mode. After the speaker’s presentation, there will be a question-and-answer session. [Operator Instructions]. […] |

Q3 2023 Laureate Education Inc Earnings CallQ3 2023 Laureate Education Inc Earnings Call |

Laureate Education Inc (LAUR) Reports 20% Revenue Increase in Q3 2023Company declares special cash dividend of $0.70 per common share |

Laureate Education Reports Financial Results for the Third Quarter and Nine Months Ended September 30, 2023Company announces a special cash dividend of $0.70 per common share declared by its Board of DirectorsMIAMI, Nov. 02, 2023 (GLOBE NEWSWIRE) -- Laureate Education, Inc. (NASDAQ: LAUR), which operates five higher education institutions across Mexico and Peru, today announced financial results for the third quarter and nine months ended September 30, 2023. It also announced that its Board of Directors has declared a special cash dividend of $0.70 per common share. Third Quarter 2023 Highlights (com |

LAUR Price Returns

| 1-mo | 1.90% |

| 3-mo | -2.16% |

| 6-mo | 10.70% |

| 1-year | 15.38% |

| 3-year | 0.28% |

| 5-year | -12.19% |

| YTD | 5.62% |

| 2023 | 42.52% |

| 2022 | -21.41% |

| 2021 | -15.93% |

| 2020 | -17.32% |

| 2019 | 15.55% |

Continue Researching LAUR

Want to do more research on Laureate Education Inc's stock and its price? Try the links below:Laureate Education Inc (LAUR) Stock Price | Nasdaq

Laureate Education Inc (LAUR) Stock Quote, History and News - Yahoo Finance

Laureate Education Inc (LAUR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...