Centrus Energy Corp. (LEU): Price and Financial Metrics

LEU Price/Volume Stats

| Current price | $42.69 | 52-week high | $61.35 |

| Prev. close | $41.80 | 52-week low | $33.95 |

| Day low | $41.49 | Volume | 112,000 |

| Day high | $42.85 | Avg. volume | 226,444 |

| 50-day MA | $44.65 | Dividend yield | N/A |

| 200-day MA | $46.92 | Market Cap | 669.21M |

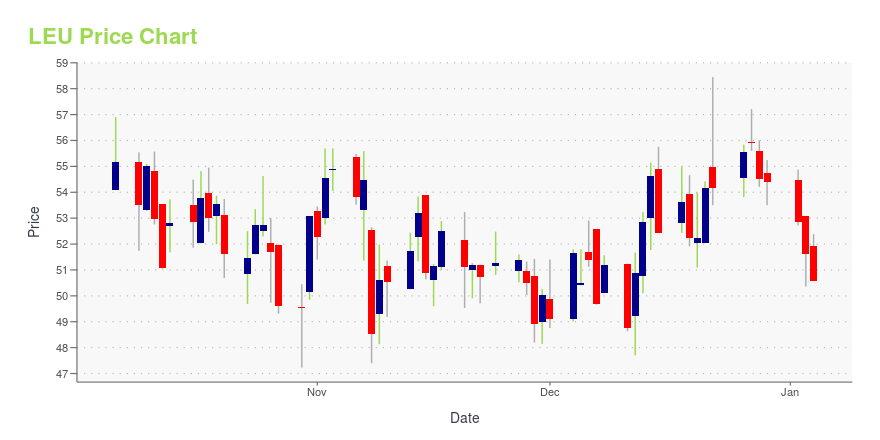

LEU Stock Price Chart Interactive Chart >

Centrus Energy Corp. (LEU) Company Bio

Centrus Energy Corp. is a global energy company that supplies low enriched uranium ("LEU") for commercial nuclear power plants. The Company, through its subsidiary, operates a uranium enrichment facility in Kentucky, United States.

Latest LEU News From Around the Web

Below are the latest news stories about CENTRUS ENERGY CORP that investors may wish to consider to help them evaluate LEU as an investment opportunity.

Recent Price Trend in Centrus Energy Corp. (LEU) is Your Friend, Here's WhyCentrus Energy Corp. (LEU) made it through our "Recent Price Strength" screen and could be a great choice for investors looking to make a profit from stocks that are currently on the move. |

Centrus Energy Announces Departure from Board of DirectorsCentrus Energy Corp (NYSE American: LEU) announced today that Neil S. Subin has decided to leave the company's Board of Directors effective December 31, 2023. Mr. Subin has served on the Board since 2017 and remains a major investor in the company. |

Don't Overlook These Basic Materials Stocks it's Time to BuyAdded to the Zacks Rank #1 (Strong Buy) list this week here are three basic materials stocks that investors should consider right now. |

New Strong Buy Stocks for December 12thPAY, BROS, SAIC, BRSP and FMX have been added to the Zacks Rank #1 (Strong Buy) List on December 12, 2023. |

Earnings Estimates Moving Higher for Centrus Energy Corp. (LEU): Time to Buy?Centrus Energy Corp. (LEU) shares have started gaining and might continue moving higher in the near term, as indicated by solid earnings estimate revisions. |

LEU Price Returns

| 1-mo | 0.40% |

| 3-mo | 2.69% |

| 6-mo | -17.48% |

| 1-year | 20.59% |

| 3-year | 68.67% |

| 5-year | 1,268.27% |

| YTD | -21.54% |

| 2023 | 67.52% |

| 2022 | -34.92% |

| 2021 | 115.78% |

| 2020 | 236.19% |

| 2019 | 307.10% |

Continue Researching LEU

Here are a few links from around the web to help you further your research on Centrus Energy Corp's stock as an investment opportunity:Centrus Energy Corp (LEU) Stock Price | Nasdaq

Centrus Energy Corp (LEU) Stock Quote, History and News - Yahoo Finance

Centrus Energy Corp (LEU) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...