Lindblad Expeditions Holdings Inc. (LIND): Price and Financial Metrics

LIND Price/Volume Stats

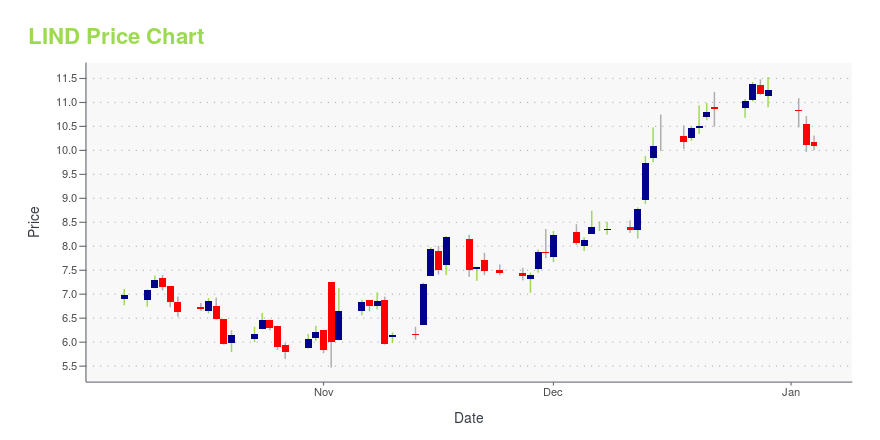

| Current price | $12.44 | 52-week high | $14.34 |

| Prev. close | $12.88 | 52-week low | $6.76 |

| Day low | $12.42 | Volume | 183,419 |

| Day high | $12.98 | Avg. volume | 318,511 |

| 50-day MA | $11.11 | Dividend yield | N/A |

| 200-day MA | $10.99 | Market Cap | 680.57M |

LIND Stock Price Chart Interactive Chart >

Lindblad Expeditions Holdings Inc. (LIND) Company Bio

Lindblad Expeditions Holdings, Inc. provides expedition cruising and adventure travel services. The company provides itineraries that feature up-close encounters with wildlife and nature. The company has a strategic alliance with The National Geographic Society. The company is based in New York City, New York.

LIND Price Returns

| 1-mo | 17.36% |

| 3-mo | 57.07% |

| 6-mo | 7.99% |

| 1-year | 19.16% |

| 3-year | 77.97% |

| 5-year | 52.45% |

| YTD | 4.89% |

| 2024 | 5.24% |

| 2023 | 46.36% |

| 2022 | -50.64% |

| 2021 | -8.88% |

| 2020 | 4.71% |

Continue Researching LIND

Here are a few links from around the web to help you further your research on Lindblad Expeditions Holdings Inc's stock as an investment opportunity:Lindblad Expeditions Holdings Inc (LIND) Stock Price | Nasdaq

Lindblad Expeditions Holdings Inc (LIND) Stock Quote, History and News - Yahoo Finance

Lindblad Expeditions Holdings Inc (LIND) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...