Lincoln National Corp. (LNC): Price and Financial Metrics

LNC Price/Volume Stats

| Current price | $32.95 | 52-week high | $33.33 |

| Prev. close | $32.48 | 52-week low | $20.85 |

| Day low | $32.66 | Volume | 781,382 |

| Day high | $33.02 | Avg. volume | 1,709,221 |

| 50-day MA | $31.76 | Dividend yield | 5.51% |

| 200-day MA | $27.86 | Market Cap | 5.60B |

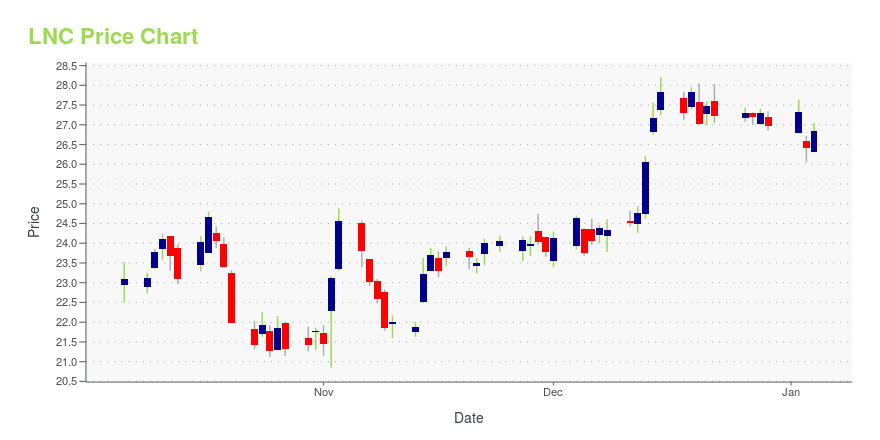

LNC Stock Price Chart Interactive Chart >

Lincoln National Corp. (LNC) Company Bio

Lincoln National Corporation is a Fortune 200 American holding company, which operates multiple insurance and investment management businesses through subsidiary companies. Lincoln Financial Group is the marketing name for LNC and its subsidiary companies. (Source:Wikipedia)

Latest LNC News From Around the Web

Below are the latest news stories about LINCOLN NATIONAL CORP that investors may wish to consider to help them evaluate LNC as an investment opportunity.

As Americans Look Ahead to a New Year, Lincoln Financial Group Shares Recommendations for Turning Financial Resolutions Into RealityRADNOR, Pa., December 28, 2023--With the new year approaching, people are setting resolutions with goals for exercising, reading, saving money and more. |

13 Cash-Rich Small Cap Stocks To Invest InIn this piece, we will take a look at the 13 cash rich small cap stocks to invest in. If you want to skip our introduction to small cap investing and the latest stock market news, then you can take a look at the 5 Cash-Rich Small Cap Stocks To Invest In. Small cap stocks […] |

Lincoln National (LNC) Inks Deal to Sell Wealth Management UnitLincoln National (LNC) inks a deal with Osaic to divest LFA and LFS and plans to increase its RBC ratio with the transaction proceeds. It also aims to focus more on growing its core businesses. |

Insurer Lincoln National to Sell Wealth Management Unit to OsaicLincoln’s sale of its wealth management business, which has approximately 1,450 advisors, is the latest instance of consolidation in the broker-dealer sector. |

Lincoln Financial Group Enters Agreement to Sell Wealth Management Business to Osaic, Inc.RADNOR, Pa., December 14, 2023--Lincoln Financial Group (NYSE: LNC) today announced that it has signed a stock purchase agreement with Osaic, Inc. (Osaic), one of the nation’s largest providers of wealth management solutions, which will acquire Lincoln’s wealth management business, including all ownership interests in the Lincoln subsidiary entities comprising that business. The transaction is expected to provide approximately $700 million of capital benefit to Lincoln upon closing, which is ant |

LNC Price Returns

| 1-mo | 6.36% |

| 3-mo | 20.24% |

| 6-mo | 19.52% |

| 1-year | 27.75% |

| 3-year | -36.81% |

| 5-year | -37.95% |

| YTD | 27.83% |

| 2023 | -5.55% |

| 2022 | -53.53% |

| 2021 | 39.49% |

| 2020 | -11.08% |

| 2019 | 17.95% |

LNC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching LNC

Want to see what other sources are saying about Lincoln National Corp's financials and stock price? Try the links below:Lincoln National Corp (LNC) Stock Price | Nasdaq

Lincoln National Corp (LNC) Stock Quote, History and News - Yahoo Finance

Lincoln National Corp (LNC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...