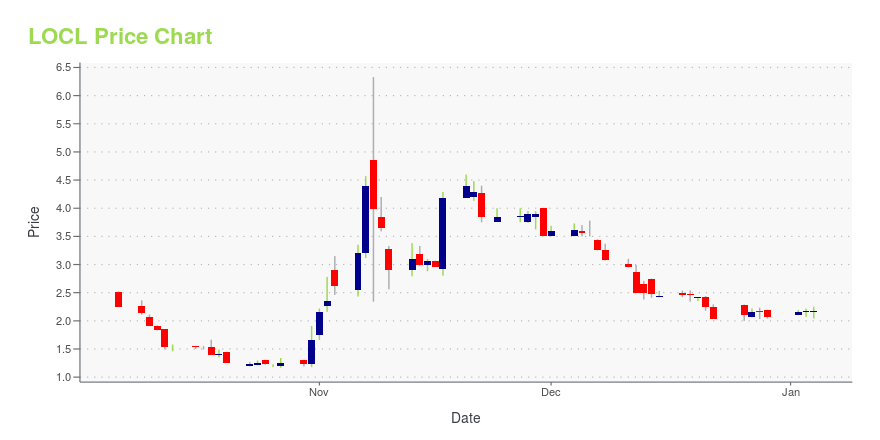

Local Bounti Corporation (LOCL): Price and Financial Metrics

LOCL Price/Volume Stats

| Current price | $2.95 | 52-week high | $6.33 |

| Prev. close | $2.85 | 52-week low | $1.17 |

| Day low | $2.64 | Volume | 2,000 |

| Day high | $2.95 | Avg. volume | 11,426 |

| 50-day MA | $2.90 | Dividend yield | N/A |

| 200-day MA | $2.63 | Market Cap | 25.04M |

LOCL Stock Price Chart Interactive Chart >

Local Bounti Corporation (LOCL) Company Bio

Local Bounti Corporation grows fresh greens and herbs. It produces lettuce, herbs, and loose-leaf lettuce. Local Bounti Corporation was founded in 2018 and is headquartered in Hamilton, Montana.

Latest LOCL News From Around the Web

Below are the latest news stories about LOCAL BOUNTI CORPORATION that investors may wish to consider to help them evaluate LOCL as an investment opportunity.

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on WednesdayWe're starting off Wednesday with a breakdown of the biggest pre-market stock movers investors will want to keep track of today! |

Local Bounti Announces Third Quarter 2023 Financial ResultsLocal Bounti Corporation (NYSE: LOCL) ("Local Bounti" or the "Company"), a breakthrough U.S. indoor agriculture company combining the best aspects of vertical and greenhouse growing technologies, today announced its financial results for the three months ended September 30, 2023. |

Local Bounti to Release Third Quarter 2023 Financial Results on Monday, October 30, 2023Local Bounti Corporation (NYSE: LOCL) ("Local Bounti" or the "Company"), a breakthrough U.S. indoor agriculture company combining the best aspects of vertical and greenhouse growing technologies, today announced it will release its financial results for the third quarter ended September 30, 2023 after the market closes on Monday, October 30, 2023. |

Local Bounti Announces Second Quarter 2023 Financial ResultsLocal Bounti Corporation (NYSE: LOCL, LOCL WS) ("Local Bounti" or the "Company"), a breakthrough U.S. indoor agriculture company combining the best aspects of vertical and greenhouse growing technologies, today announced its financial results for the three months ended June 30, 2023 and reaffirmed full year 2023 guidance. |

Local Bounti to Release Second Quarter 2023 Financial Results on Wednesday, August 9, 2023Local Bounti Corporation (NYSE: LOCL, LOCL WS) ("Local Bounti" or the "Company"), a breakthrough U.S. indoor agriculture company combining the best aspects of vertical and greenhouse growing technologies, today announced it will release its financial results for the second quarter ended June 30, 2023 before the market opens on Wednesday, August 9, 2023. |

LOCL Price Returns

| 1-mo | 9.26% |

| 3-mo | 0.00% |

| 6-mo | 37.21% |

| 1-year | -21.54% |

| 3-year | -97.70% |

| 5-year | N/A |

| YTD | 42.51% |

| 2023 | -88.54% |

| 2022 | -78.45% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...