Comstock Mining, Inc. (LODE): Price and Financial Metrics

LODE Price/Volume Stats

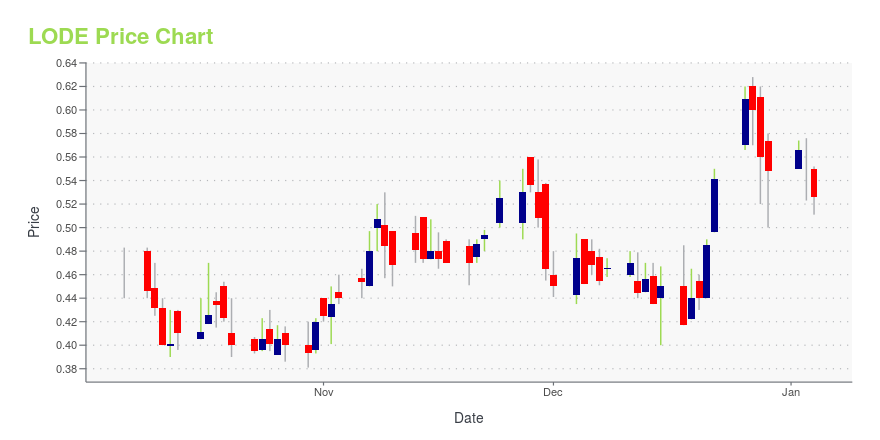

| Current price | $0.16 | 52-week high | $0.63 |

| Prev. close | $0.16 | 52-week low | $0.14 |

| Day low | $0.15 | Volume | 1,955,394 |

| Day high | $0.16 | Avg. volume | 1,282,366 |

| 50-day MA | $0.20 | Dividend yield | N/A |

| 200-day MA | $0.37 | Market Cap | 21.90M |

LODE Stock Price Chart Interactive Chart >

Latest LODE News From Around the Web

Below are the latest news stories about COMSTOCK INC that investors may wish to consider to help them evaluate LODE as an investment opportunity.

Comstock Executes First Biorefinery Commercial AgreementPreliminary Engineering Complete for 100,000 TPY Biointermediate Production at Pulp and Paper FacilityVIRGINIA CITY, Nev., Dec. 28, 2023 (GLOBE NEWSWIRE) -- Comstock Inc. (NYSE: LODE) (“Comstock” and the “Company”) today announced execution of agreements with RenFuel K2B AB (“RenFuel”) to advance Comstock’s first commercial biorefinery, including an option to acquire a subsidiary of RenFuel (“JV”). The JV has previously completed extensive preliminary engineering for a new biorefinery using RenF |

Comstock Metals Executes Orders for End-of-Life Solar Panel RecyclingVIRGINIA CITY, Nev., Dec. 21, 2023 (GLOBE NEWSWIRE) -- Comstock Inc. (NYSE: LODE) (“Comstock” and the “Company”), an innovator of technologies that enables systemic decarbonization by efficiently converting under-utilized natural resources into renewable energy products, announced today that it has secured sufficient supplier commitments to begin commissioning the Company’s first photovoltaic recycling facility upon receipt of the necessary permits. The world remains focused on the production of |

Comstock Fuels Targets More Sustainable Aviation FuelTechnology Partner RenFuel Awarded Grant to Demonstrate Increased Sustainable Aviation Fuel YieldsVIRGINIA CITY, Nev., Dec. 19, 2023 (GLOBE NEWSWIRE) -- Comstock Inc. (NYSE: LODE) (“Comstock” or the “Company”) and its wholly owned subsidiary, Comstock Fuels Corporation (“Comstock Fuels”), today announced that Comstock Fuels’ biointermediate refining technology partner, RenFuel K2B AB (“RenFuel”), was awarded a Swedish Energy Agency grant of SEK 4.9 million (nearly US$480,000) to demonstrate an e |

Comstock Receives Early Payments on Mineral Exploration LeaseLeasing Receipts Exceed $2 million for 2023VIRGINIA CITY, Nev., Dec. 06, 2023 (GLOBE NEWSWIRE) -- Comstock Inc. (NYSE: LODE) (“Comstock” and the “Company,”) an innovator of decarbonizing technologies that is leveraging physics-based artificial intelligence (AI) and sensing technologies to transform mineral exploration, announced today that its wholly-owned subsidiary, Comstock Northern Exploration, LLC, has received early all payments totaling over $2 million this year from Mackay Precious Metal |

GenMat Launches Pioneering, Space-Based Geophysics Modeling InitiativeTransforming Mineral Exploration Via Physics-based AI and new Cutting-Edge Hyperspectral SensingVIRGINIA CITY, Nev., Nov. 14, 2023 (GLOBE NEWSWIRE) -- Comstock Inc. (NYSE: LODE) (“Comstock” and the “Company”) today announced a new, historic era of breakthrough mineral exploration with the successful launch of GENMAT-1, Quantum Generative Materials’ (GenMat) Hyperspectral Remote Sensing Imaging (HRSI) system to explore optimizing future mineral exploration for the Comstock mineral estate (“Comsto |

LODE Price Returns

| 1-mo | -10.86% |

| 3-mo | -48.65% |

| 6-mo | -66.34% |

| 1-year | -69.98% |

| 3-year | -94.75% |

| 5-year | -80.42% |

| YTD | -70.80% |

| 2023 | 99.27% |

| 2022 | -78.68% |

| 2021 | 24.04% |

| 2020 | 135.61% |

| 2019 | -33.62% |

Continue Researching LODE

Want to do more research on Comstock Mining Inc's stock and its price? Try the links below:Comstock Mining Inc (LODE) Stock Price | Nasdaq

Comstock Mining Inc (LODE) Stock Quote, History and News - Yahoo Finance

Comstock Mining Inc (LODE) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...