Livent Corporation (LTHM): Price and Financial Metrics

LTHM Price/Volume Stats

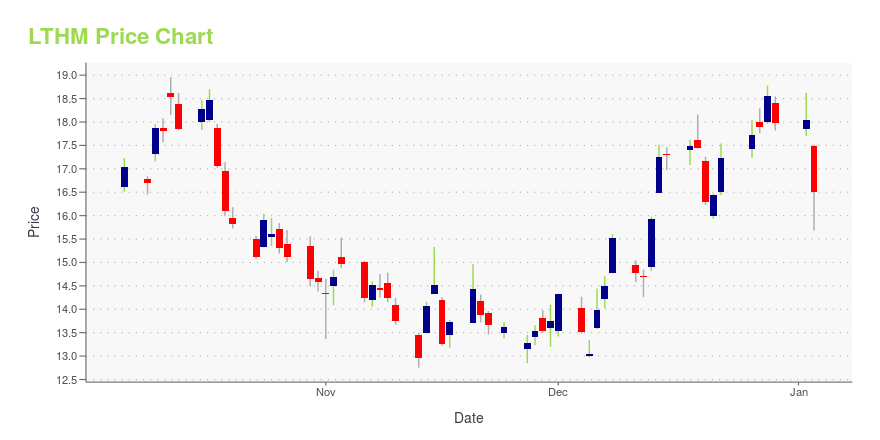

| Current price | $16.51 | 52-week high | $29.17 |

| Prev. close | $18.05 | 52-week low | $12.76 |

| Day low | $15.68 | Volume | 52,566,500 |

| Day high | $17.51 | Avg. volume | 29,534,803 |

| 50-day MA | $15.12 | Dividend yield | N/A |

| 200-day MA | $20.77 | Market Cap | 2.97B |

LTHM Stock Price Chart Interactive Chart >

Livent Corporation (LTHM) Company Bio

Livent is a lithium compound producer being spun out of FMC. The company was founded in 1883 and is based in Philadelphia, Pennsylvania.

Latest LTHM News From Around the Web

Below are the latest news stories about LIVENT CORP that investors may wish to consider to help them evaluate LTHM as an investment opportunity.

Here is What to Know Beyond Why Livent Corporation (LTHM) is a Trending StockZacks.com users have recently been watching Livent (LTHM) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects. |

Best Lithium Stocks 2024: 7 to Add to Your Must-Buy ListInvestors may want to use recent weakness as an opportunity with these seven beaten-down lithium stocks heading into 2024. |

Electrify Your Portfolio With These 2 Lithium StocksAs batteries are the cornerstone of EV performance and lithium is the most important metal in EV batteries, demand for the same is set to grow. Watch stocks like LTHM and LAC for potential gains. |

11 Most Profitable Lithium Stocks NowIn this article, we will take a look at 11 of the most profitable lithium stocks to buy now. To skip our analysis of the lithium industry and its impacts on the battery and EV sectors, go directly to the 5 Most Profitable Lithium Stocks Now. The worldwide demand for lithium batteries has been on […] |

11 Most Promising EV Battery Stocks According to AnalystsIn this article, we discuss the 11 most promising EV battery stocks according to analysts. To skip the detailed analysis of the EV battery industry, go directly to the 5 Most Promising EV Battery Stocks According to Analysts. The global push toward clean energy has been mainly due to climate concerns. From a financial perspective, […] |

LTHM Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -33.37% |

| 3-year | -10.47% |

| 5-year | 146.42% |

| YTD | -8.18% |

| 2023 | -9.51% |

| 2022 | -18.50% |

| 2021 | 29.41% |

| 2020 | 120.35% |

| 2019 | -38.04% |

Continue Researching LTHM

Want to do more research on Livent Corp's stock and its price? Try the links below:Livent Corp (LTHM) Stock Price | Nasdaq

Livent Corp (LTHM) Stock Quote, History and News - Yahoo Finance

Livent Corp (LTHM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...